Show patience in a world of instant gratification

We live in a world where we expect results right now. We want same-day package delivery, faster Internet speeds, coffee ready for pickup before we even get to the café and a hot date by tomorrow night. Instant gratification has become an obsession. It doesn’t help that our attention spans keep getting shorter.

Unsurprisingly, this short-term focus also translates to the world of investing. The individuals responsible for managing your hard-earned savings and the money that needs to last through your retirement years are often being judged on a short-term basis. You don’t rush a winemaker during the maturation process, you don’t rush an engineer building a bridge and you certainly don’t rush a surgeon performing open-heart surgery. All of these professionals need time to do their job right. Then why do people have such impatience with money managers? It’s very difficult for people to part with their money – we totally get that. While your first instinct may be to ditch those underperforming investments and replace them with recent winners, you need to come to terms with the fact that underperformance from top portfolio managers is more than normal. You should even count on it!

It happens to the best

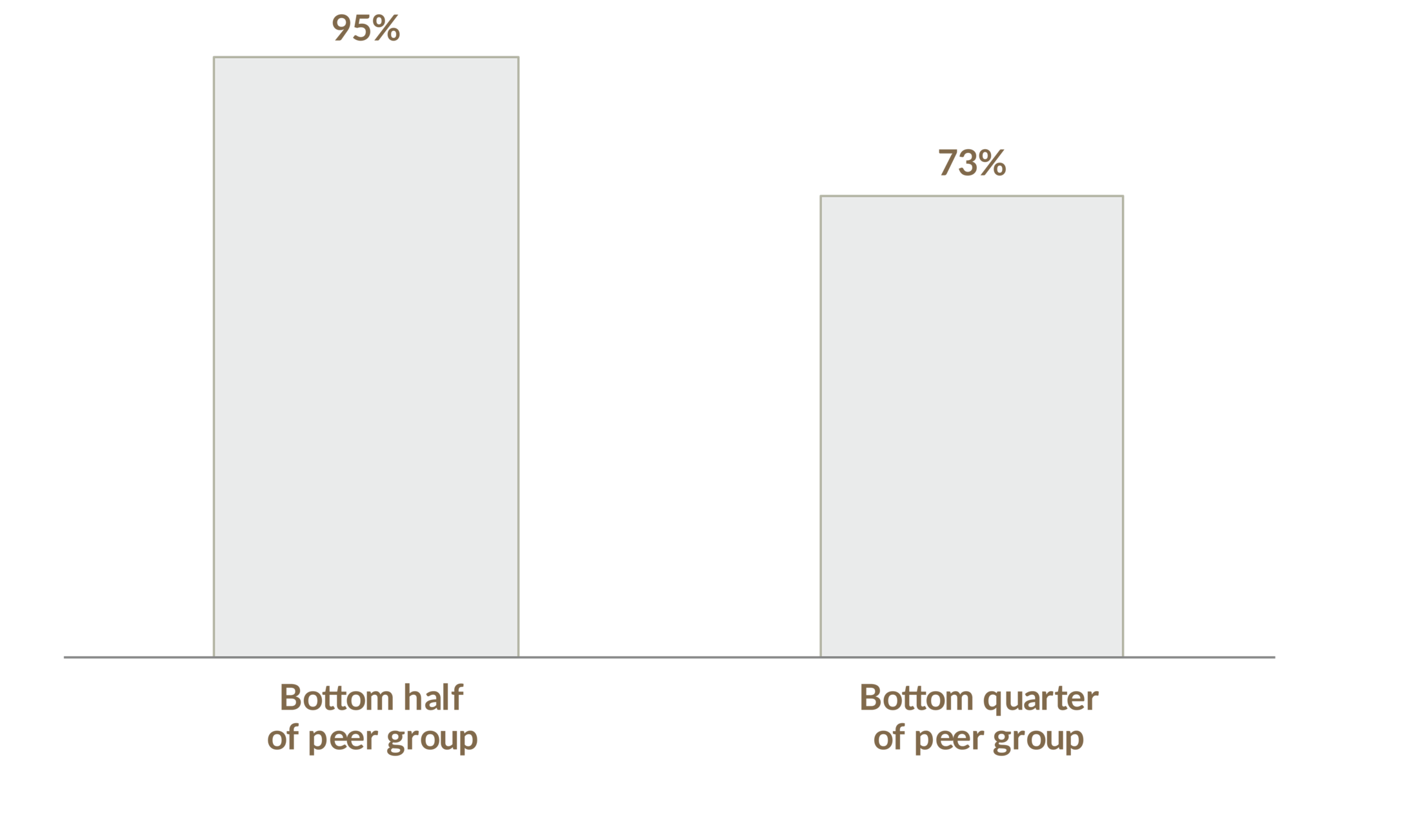

If you need empirical proof, consider the chart below. The study looked at 197 fund managers who had top-quartile performance over 10 years. Although each of the managers in this study delivered outstanding long-term returns over the 10-year period, almost all of them experienced periods of short-term underperformance.

Percent of top-quartile funds with at least one three-year period in the bottom half or quarter of the peer group

Source: Davis Funds, “The Wisdom of Great Investors”, http://davisadvisors.com/davissma/downloads/WGI.pdf. Peer group consists of 197 funds from eVestment Alliance’s large-cap equity fund universe with top-quartile annualized performance (gross of fees) over 10 years between December 31, 2003 and December 31, 2013.

What about the VERY best?

If you’re a disbeliever who insists on seeing names behind stats, let’s look at some famous investors. These are arguably the best-in-class managers who have significantly compounded investors’ wealth.

| Time Period (years) |

|---|

Would you be surprised to know that on an annual basis these managers underperformed the S&P 500 Index 30% to 40% of the time?i Let’s take a look at Sir John Templeton. During the 31 years that he managed the Templeton Growth Fund, he underperformed the S&P 500 Index 35% of the time (or 11 of the 31 years). Bill Ruane underperformed the index 40% of the time. Not such a smooth ride! The other legendary investors on our list experienced similar periods of relative underperformance.

% of years underperforming the S&P 500 Index

However, if you ignored the short-term noise and stuck with Sir John Templeton’s approach for 31 years, you would have outperformed the index by 6% on an average annualized basis. With Munger, you would have outperformed the index by 15% on an average annualized basis.

Annualized outperformance vs. the S&P 500 Index

If your head is spinning from looking at percentages, look at the cumulative outperformance in dollar terms to put the benefit of patience into perspective. If you invested $100,000 with Sir John Templeton and accepted volatility as part of the ride over the 31 years, your investment would have outperformed an investment in the index by $9 million.

| Manager (years) | Outperformance vs. the S&P 500 Index (Growth of US$100,000) |

|---|

Here’s the important lesson: Lagging an index 30% to 40% of the time is a normal part of long-term investment success and shouldn’t cause fear or panic. The bigger picture matters the most.

Name this company!

Would you invest in a company that had the following excess annual returns versus the S&P 500 Index from 1965 to 2017? For example, in 1999 this investment was down 41% more than the index. Could you stomach that sharp decline?

Relative returns vs. the S&P 500 Index

1965 to 2017

Source: Bloomberg LP. In US$.

Well, the company with bouts of short-term underperformance over its long history is none other than Berkshire Hathaway Inc. That’s right, you may have been saying “no” – perhaps even a resounding “no” – to Warren Buffett, one of the world’s most successful investors.

This is what you would have missed out on:

Berkshire Hathaway Inc. vs. the S&P 500 Index

Dec. 31, 1964 to Dec. 31, 2017 Growth of $100,000

Source: Berkshire Hathaway Inc. 2017 Annual Report. Annual percentage change in per-share market value of Berkshire Hathaway Inc.’s Class A shares versus the S&P 500 Index with dividends included. Returns in US$.

Let it grow

When you plant a tree, you give it time to grow while the sun and rain nourish it. You don’t keep digging up the sapling to check its roots, and you don’t panic in the winter when the leaves fall because it’s just part of the natural cycle.

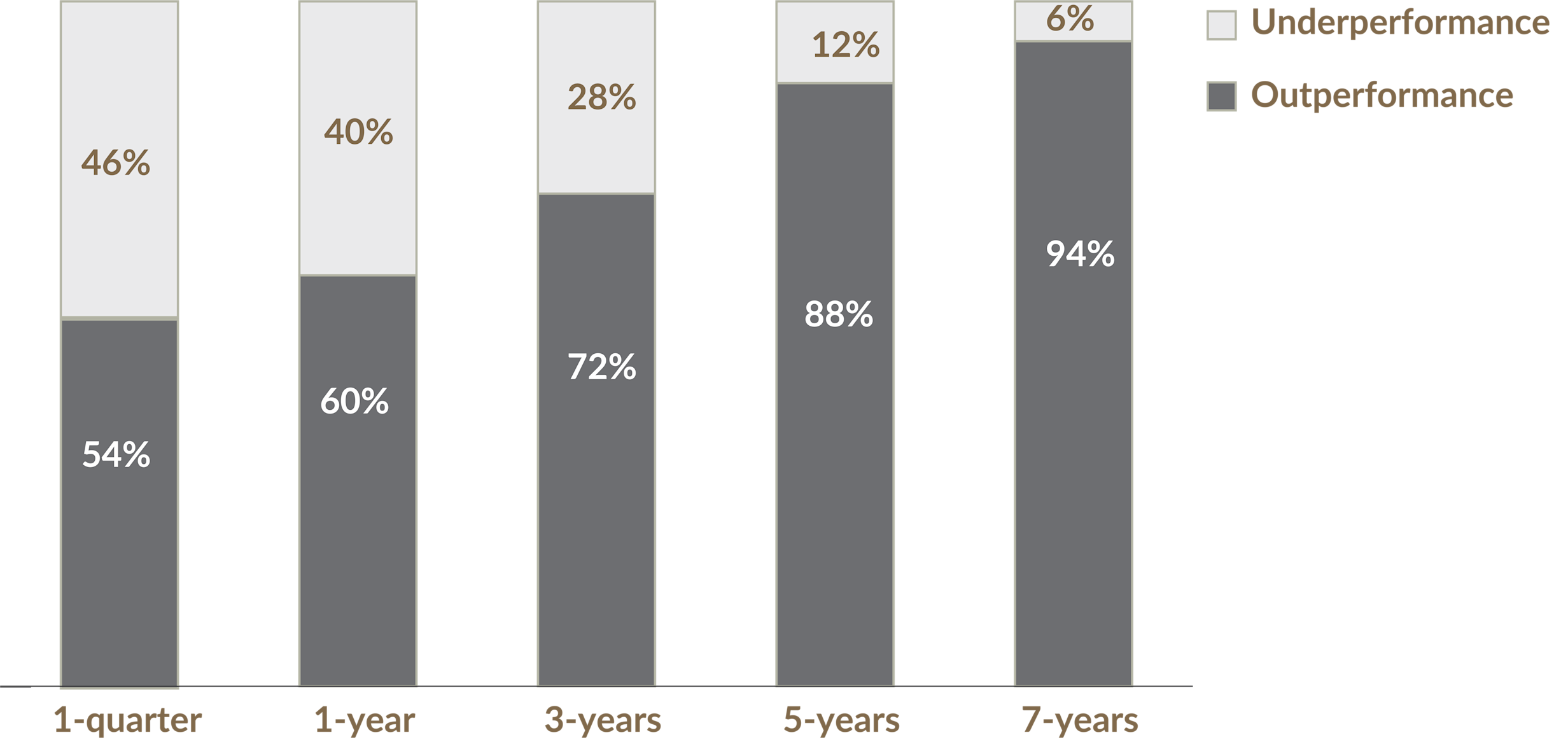

The same applies to investing. You give your portfolio the time it needs to grow and benefit you in the long-term, and you don’t panic when growth stalls temporarily versus an index. A long-term perspective brings peace of mind and enhances the power of compounding, also known as the eighth wonder of the world, but that’s reading for another day. Take a look at this chart illustrating how top manager performance improves as you extend your holding period.

It’s rare for an investment manager to outperform the benchmark index over an extended period without experiencing bouts of underperformance. If you just accept this phenomenon and keep your focus on the long term, the serenity that comes with it is priceless. And most importantly, the chances of reaching your financial goals increase dramatically.

Manager performance improves over longer holding periods

Frequency of excess returns over their benchmark by rolling period time horizon

Source: Morningstar; Baird analysis. For the 10-year period ending December 31, 2013. Number of observations: 1-quarter: 6,240; 1-year: 5,772; 3-years: 4,524; 5-years: 3,276; 7-years: 2,028.