Compounding’s magic (or how $5k can cost you $150k)

When you think about your investments no doubt how they’re performing almost immediately comes into play. The return you anticipate making on your money is, understandably, a primary focus. While there’s no disputing higher returns equate to better results, performance isn’t the end all to be all in finding success as an investor if for no other reason than it’s not something completely within your control. Month to month and year to year, the stock market fluctuates and returns are never a sure thing.

What is a guarantee is how much you can manage to save. Inasmuch as our industry might try to convince you otherwise, the path to attaining wealth is paved with your good habits and it begins with spending less than you earn then saving the difference. More empowering still, once you build a solid foundation of savings, compounding does the heavy lifting. As you’re about to see, Albert Einstein didn’t refer to it as the “eighth wonder of the world” for nothing.

The math behind the miracle

The positive long-term impact of compounding is incredible to say the least, so incredible it can be hard to believe. Yet its mechanics are actually quite simple.

Voila, the formula for compounding:

Because of the expanding base the return rate is applied to, you earn incrementally more each year. Therein lies the beauty of compounding – gains from one period create additional gains in subsequent periods. Increase the amounts and time involved and the benefits of compounding become even more pronounced.

Being an early bird catches you the worm

Time is the chief ingredient behind the so-called magic that is compounding. And there you have it – as it turns out, compounding is less magic than simply having the wherewithal to start saving and then sticking with it over an extended timeframe. This is good news for young investors who may not have very much money but do have the advantage of a long investment horizon. The more time on your side, the greater the potential that the money you earn from compounding will wind up dwarfing your initial investment, an ideal scenario.

As the rule of 72 reveals, a single $5,000 investment making 8% annually will double in value in just nine years – not bad but then again, what does $10,000 get you these days? It’s too meagre an amount to retire on. But wait 45 years and that initial $5,000 in savings will balloon to about $160,000. That’s $155,000 in profit for doing nothing really except showing patience.

Even better: Investing early AND regularly

Of course the pace of your investment’s growth only speeds up when you can save continuously. The difference between making a one-time contribution and investing regularly is enormous over the long term.

For example, if you can manage to sock away $5,000 annually while earning 8% interest, you’ll have already made $160,000 after only 16 years, something that would take you three times longer with a single $5,000 contribution. 45 years into recurring $5,000 contributions, you’d be a millionaire with an account balance of over $2 million. It would take almost double the time – some 78 years – to get to that $2-million-plus level based on a lone $5,000 investment.

Earmarking $5,000 to annual savings is by no means an easy feat, for young investors in particular. But if you can sacrifice even the small indulgences like that latte-a-day habit, cable TV or a constantly changing wardrobe, you’ll be that much closer to reaching your long-term goals. At the end of the day, investing is the act of foregoing consumption now to be able to enjoy consumption at a later time. It’s about asking yourself what would you rather: that new pair of jeans or a comfortable retirement?

The procrastination blues

Let’s say that you decide to dedicate some of your money to investing…next year. Although “better late than never” still holds, be cognizant of the penalty for deferring your savings by as little as a year. You may believe you’re simply forfeiting your first year of savings when in actual fact you’re also giving up the earnings you would’ve generated in your final year of investing, which also happens to be your biggest year earnings-wise. Get this – delaying that $5,000 annual contribution by one year would translate to an earnings loss of more than $150,000 in the 45th year of your investment assuming an 8% return. Ouch.

There’s another “what would you rather” question to inspire you to think about your financial future sooner instead of later – would you rather dedicate $5,000 toward your savings today or potentially sacrifice $154,602 in “free money” down the road?

It pays to save

Whatever your savings strategy, growing meaningful wealth is always a long-term endeavour. Time is your best ally and that means you’re not going to accomplish your savings goals overnight. Your other best ally is you. Before the exponential effects of compounding take the reins, your personal savings are the primary source of any growth.

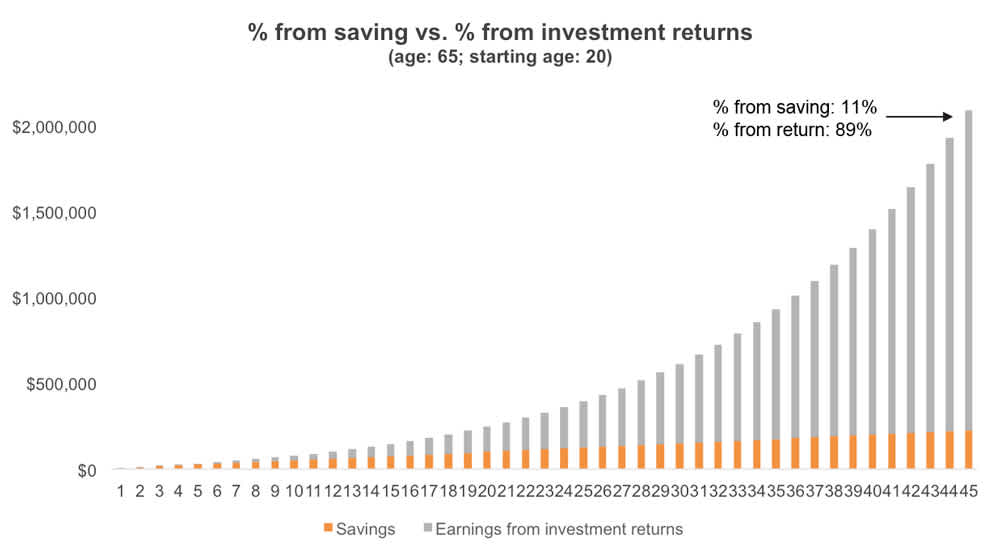

Say you start investing when you’re 20 all the way up until you retire at 65. You put away $5,000 every year and make an 8% annualized return. At the end of 45 years, you’ll have $2.2 million, some 90% of which is a result of compounded returns. So yes, in the long run it’s the compounding that causes the upsurge in your account balance and comprises the bulk of the total amount you’ve accumulated.

However, for compounding to really take off, it needs the foundation of a substantial base of savings. As a matter of fact, in your first 10 years of investing, over 60% of your account’s value would be attributed to your own savings.

Your first 15 years in, your savings would still account for about half of the value overall.

It’s not until your last decade of investing (from age 55 to 65) that the extraordinary power of compounding would suddenly take over to the point that it starts to double your balance.

Goes to show that compounding is a tremendous tool that nevertheless depends on your ability to save to truly work its wonders.

The icing on the cake

Okay, so what if you’re in the enviable position of having done what you can to save as much as you can for as long as you can? The third and final element in determining your long-term success as an investor is the rate of return you’re able to achieve. Lower rates, like those associated with cash, can offer nothing in terms of real gains and erode your purchasing power if they don’t outpace inflation. The goal is to get richer, not poorer, and as such you need to reach a return level that’s both sustainable and high enough that it allows you to build long-term wealth in a meaningful way. The higher the rate, the faster compounding will start to work for you.

The following table illustrates the huge bearing that returns can have on your investment’s value. A difference of a mere 5% can result in four times more (or less) wealth after 40 years. The greater the gap between rates of return, the more extreme the contrast in final outcomes.

| Years | 5 % | 10 % | 15 % | 20 % |

|---|

Makes sense then why you want to choose wisely about where to put your money. If you’re looking for growth, leaving your savings to linger in a chequing account is a terrible approach because interest rates can’t compete with the returns of other, less “safe” asset classes such as stocks. While investing may feel riskier because of volatility, there’s nothing safe about inflation eating away at your nest egg, which effectively works like compounding in reverse. The point is, you need to find a happy medium between your long-term financial goals and the risk you’re comfortable taking to accomplish those goals. You can think of it like this: is the risk of running out of money greater or less than the risk you’ll experience some volatility along the way? Once you figure that out, managing to both save well and invest well will bring you the greatest rewards, and that’s a guarantee.