The trouble with simple stories – 2nd quarter, 2015

The wisest person I know has played an integral role in building a number of successful companies. He’s one of the sharpest investors in the world and has the track record to prove it. His investing acumen has created large sums of wealth for tens of thousands of families who have entrusted him with their savings. He’s been awarded the Order of Canada, is one of Canada’s greatest philanthropists, and in his spare time has figured out a way to have a profound impact on medical research. He’s a private person who shuns the limelight, yet his office is a revolving door of the “who’s who” in Canada seeking insight. What this man imparts is rarely in the form of advice. Instead he walks you through an issue and through a clever line of questioning allows you to come to the appropriate conclusion on your own. He has a knack for elevating the game of all those around him. I was very fortunate to meet this man when I was young, and as such have had many years to tap his wisdom.

Not long ago, he gave me a book by Daniel Kahneman, a psychologist notable for his work on the psychology of judgment and decision making. He had never recommended a particular author before. For a person who doesn’t give advice, this was as close to it as he’ll probably ever get.

The book was one of the hardest I’ve read in my life. While the content was clear, the sheer volume of it was enormous. My brain was tired after reading just 30 pages. The overall theme revolved around thinking biases and the influence these biases have on our decision-making capabilities.

One of the central tenets of the book was humans systematically underestimate the amount of uncertainty to which we’re exposed. In a weird way, we have to underestimate uncertainty to some degree otherwise our brains would be incapable of making any decisions at all. As a coping mechanism, we create an illusion of the future that’s much more orderly than it will be. We do this by telling ourselves simple stories.

The book taught me that if you want to be a better investor, tell yourself fewer stories. By doing so, you’ll be better able to focus on the facts at hand, and more prepared for future uncertainty.

This commentary will walk through five ways we try to combat the simple stories our brains want to tell us while managing your hard-earned savings.

We can’t eliminate all the stories but these rules help with many of them:

The next few years won’t be like the past few

Our brains like to tell us that the near future will be like the recent past. Humans assume what happened yesterday will happen tomorrow. When it comes to investing, that’s rarely true. Past returns are rarely, if ever, indicative of future performance.

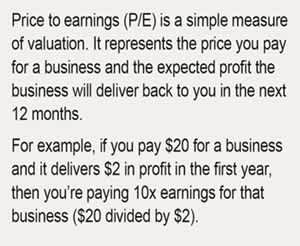

Simple math tells us that entry price dictates a stock’s return, which is a fancy way of saying the more you pay for a business, the lower your return will be.

The chart below* shows 10-year rolling average returns for the S&P 500 Index charted against valuations at the time of entry. Unlike the short-term data our brains use to create stories, this data goes all the way back to 1937. It shows the higher the valuation of the market at the time of purchase, the lower your subsequent 10-year returns will likely be.

There’s no data beyond 2004 on the chart above because it’s showing rolling 10-year averages, so if you add 10 years to 2004 it takes you to the present. However, if we go back to 2012, the P/E on the S&P 500 was around 15.5x. According to this chart, an entry valuation of about 15.5x would generate a 10-year compound annual return of between 7% and 17%. We’ll only know if this range is accurate in 2022. Interestingly, today’s P/E on the S&P 500 is closer to 20x, which would generate a return of between 2% and 12% per year over the next 10 years. This is obviously below where the range was in 2012.

At EdgePoint, we don’t own the S&P 500. Instead, we own a small collection of businesses whose combined performance we believe will beat their respective benchmarks. However, when we look at businesses today, we recognize that valuations are higher and that future returns will be lower than they’ve been in the recent past. You should be aware of that as well, and don’t let your brain tell you otherwise.

Volatility is the only constant

When someone mentions future annual returns, our brains simplify the story to make sense of it. Our brains tell us those returns will be achieved consistently through time. For example, if I were to say that I believe a business can deliver a return of 10% a year, your brain would likely imagine the returns to look something like this:

Rendement annuel composé = 10 %

If our projections are correct about future returns, there’s a much greater chance that the distribution of returns will look something like this:

Compound annual return = 10%

Our brains need order to be functional and they construct order by creating stories about the future when order is the least likely thing to happen. Being aware of this is important and the following chart highlights why.

This chart† shows you the annual returns and intra-year declines of the S&P 500 over the last 35 years:

Since 1980, the annual return of the S&P 500 has been 10.6%, while the average intra-year decline has been 14.2%. Our brains like to focus on the 10.6% annual return while dismissing the annual declines.

The issue with oversimplifying the future is when temporary declines in value challenge the simple return story we tell ourselves. This triggers confusion and causes unwanted emotions of fear and worry. These emotions are further amplified if the recent past was characterized by periods of low intra-year declines. For example, the maximum intra-year stock market decline in 2013, 2014 and year-to-date has been -6%, -7% and -4%, respectively. These are historically modest declines. Despite evidence to the contrary, our brains anticipate the trend will continue. The facts, however, indicate that on average, markets typically experience higher volatility than what we’ve seen over the last three years.

At EdgePoint, we don’t see temporary volatility in stock prices as risk. Volatility is the friend of the investor who knows the value of a business and the enemy of the investor who doesn’t. It’s our job to know the value of businesses so that we can take advantage of volatility in the market to your benefit. We’ve tried to train our brains to expect and embrace volatility, and we encourage you to do the same.

We’ve written extensively about volatility in past commentaries. If you’d like to read more about our thoughts on volatility please go to:

Be unmoved by market moves – 3rd quarter, 2013

The right choice for our families – 4th quarter, 2011

28 questions and a night with the bears – 1st quarter, 2011

What do you know that others don’t?

Our brains like to assume that if a business is popular it must be a good investment. Case in point, a friend of mine mentioned that I should look at Under Armour as an investment idea. As head creative director for one of the largest advertising firms in the country, my friend knows a thing or two about good companies. He went on to say that because Under Armour sponsors athletes like Jordan Spieth (the recent U.S. Open winner) and Stephen Curry (the recent NBA MVP), its sales should increase. I responded that I could see how its sales would increase because of Spieth and Curry, but asked him what he knew about the business that most of the market was missing. After all, anyone who watched the U.S. Open or NBA finals this year couldn’t miss Under Armour’s sponsorship of Spieth and Curry. What my friend knew about Under Armour was well known by millions of others, which typically means the value people see in the company is already reflected in the share price. Without a unique insight, how could he do better than average with his investment in it?

At EdgePoint, we believe the best way to buy a business at an attractive price is to have an idea about the business that isn't widely shared by others – what we refer to as a proprietary insight.

We strive to develop proprietary insights around businesses we understand. We focus on companies with strong competitive positions, defendable barriers to entry and long-term growth prospects that are run by competent management teams. These holdings generally reflect our views looking out more than five years.

Proprietary insights for the most part revolve around how a business can grow in the future and why we’re not being asked to pay for that growth today. In effect, they’re the exact opposite of the simple stories our brains like to create to cope with uncertainty.

We only invest where we find proprietary insights. We encourage you to train your brain to do the same if you plan on investing in individual stocks.

Moats: Increasing the probability of getting the future earnings right

Our brains like to tell us that a good business today will be a good business tomorrow but the fact is many of the competitive advantages a business has will be eroded away over time. So how do you predict if a business will continue to be successful in the long term when we’ve already established our brains’ limited forecasting abilities? As investors we try to do this by investing in businesses with moats.

What’s a business moat? In its simplest form, a moat is the ability to maintain competitive advantage over competitors. More specifically, if someone was given $100 million to build a business, could they compete with your business and win? If the answer is no, then your business probably has a moat.

If the future is less orderly than we believe, then a moat will help companies thrive under widely variable conditions.

Investing in businesses with moats has helped us build wealth for you since EdgePoint’s inception. A few examples of moats in place in your portfolio today include:

Ryanair

The average cost to move a passenger on a Ryanair flight is €29. Its closest competitor’s cost is €52. The average Ryanair fare is €47. This is its moat. It allows Ryanair to make a healthy profit while maintaining lower prices than its closest competitors. Since we’ve owned Ryanair, the world has thrown many unpredictable events its way. Namely, high unemployment levels in its markets, volcano eruptions that shut down its airspace for long periods and unpredictably high oil prices. Despite the uncertain times, Ryanair has grown its earnings per share from €-0.11 to €0.63.††

Anthem

Anthem sells health insurance in the U.S. It has close to a 50% market share in some states. This high level of market dominance allows Anthem to buy medical services from hospitals for less than its competitors can, which in turn allows it to offer lower premiums to its customers. Lower premiums help protect its market domination by ensuring it continues to attract new business. Since we’ve owned Anthem, it has experienced some unpredictable variables like new healthcare legislation designed to crimp its profits, a major U.S. recession and a U.S. president that doesn’t favour its business model. During this time Anthem has grown its earnings per share from $4.79 to $9.31.‡

Tim Hortons/Restaurant Brands International: We probably don’t need to explain Tim Hortons’ moat. If you’re Canadian, it’s what keeps you going back. While we’ve owned it, the business has had to cope with some unpredictable events like a recession, a coffee war that saw its largest competitors give away free coffee in an effort to lure customers away from Tim’s, and a takeover/change in management team at the company. Over this period Tim’s/Restaurant Brands International grew its earnings per share from $1.55 to $2.83.§

The bottom line is if the future is way more uncertain than our brains allow us to believe, having a moat around your business is critical.

It’s not supposed to be easy

This is perhaps the most puzzling simple story our brains trick us with. Most of our investors have worked very hard to save the money they’ve entrusted us with. Some have worked 60- hour weeks for years, multiple jobs or have had to retrain themselves countless times to stay relevant to their employers. At the end of the day, they have savings to show for it. Despite all this, when they invest those savings in the market, they expect making money will be easier than it was in their careers. That’s simply not the case. Investing can be brutally difficult. It can, and will, push you to your limit just like your career.

The truth is, our industry is guilty of selling your brain the same story – making money is easy. Our industry will push historical performance numbers at you hoping your brain will build a story that if you invest, then you too can achieve those returns. Confronted by an uncertain future, our industry knows your brain will seek that story. What those advertisements don’t show you is that the people who achieved those returns had to deal with uncertainty and fear. They stuck to their long-term plan and accepted that volatility will happen. They found it brutally difficult at times but saw it through. For those investors with EdgePoint for longer than three years, you know what I’m talking about. It’s not always smooth sailing. Don’t let anyone tell you any different.

End of story

The world is uncertain and will likely be more uncertain in future. You’ve given us the mandate to invest your hard-earned savings in the face of this uncertainty. As we’ve done in the past, we’ll try to create the circumstances for success through the application of our investment approach. We continue to approach investing with measured confidence, value your trust in us and look forward to working to build your wealth in an effort to be worthy of that trust.

Fixed-income comments

By Frank Mullen, portfolio manager

I’d like to expand on the theme of simple stories exploring them through the context of the fixed-income environment that we’re operating in today. One of the most common perceived truths I hear from clients and the financial media is that bonds are unquestionably a safe asset class. Although there are arguments and circumstances that reinforce this, I’d argue that the safety in any asset is determined by the price you pay for it. Buying an asset believed to be risky at a bargain price could provide a margin of safety that makes it a much better investment than overpaying for an asset perceived to be safe. I believe that the recent past provides a number of examples that support the notion that bonds aren’t inherently safe and like all investments must be analyzed on an individual basis. Blanket statements categorizing assets as risky or safe are misleading at best. Instead, investors should focus on performing due diligence for each investment.

In governments we trust

Lending money to governments is now commonplace for investors around the globe. Many view large, developed governments as low risk despite the fact that most are far more indebted than they were in previous decades. The demand for high-rated government bonds has pushed yields to low levels and their respective prices very high. Although the credit risk may be minimal, paying a high price can in fact be quite risky. The recent movement in Germany-issued bonds highlights just that.

As one of the strongest economies in Europe, Germany’s government debt has been so appealing to investors that they’ve pushed 10- and 30-year yields to as low as 0.79% and 1.59%|| respectively. Although the credit risk may be minimal, paying a high price can be quite risky as evidenced by the recent price moves in German bonds. During a three-week period in May, Germany’s 30-year government bond declined in price by almost 20%.¶ If rates remain at these levels, it will take decades to recoup the losses experienced over those 21 days. Despite the low credit risk, the price investors paid for these bonds exposed them to a great deal of risk. Overpaying for a “safe” government credit didn’t turn out to be safe after all.

The current low-interest rate environment has caused investors to reach for yield in more unconventional securities, such as buying debt of periphery European government bonds or from emerging markets. There will always be unique opportunities for those willing to invest where others are hesitant, but it must be done with extreme caution and solid investment due diligence. Many clients have asked us why we don’t own this debt as the yields are far more attractive than most alternatives. You can’t be seduced by yield alone and we weren’t comfortable with the risks inherent in the investment. Right now I’m quite happy we didn’t buy any high-yielding debt from Greece. It’s doubtful that the yield was high enough to compensate investors for the scenarios that are unfolding now.

Safety preferred?

Low interest rates around the world have forced investors to look beyond traditional bonds for higher yields. After the financial crisis, many Canadian investors turned to the preferred share market for yield as it’s perceived to be a safer, more stable choice than common shares and companies were quick to satisfy investor demand. Rate-reset preferred shares dominated the market as investors were attracted to their dividends, which adjust every five years based on a spread over government bonds. With concerns about interest rate increases, investors were attracted to the potential of a rising dividend stream. Investors were so enamoured with the potential benefits of this structure that many failed to analyze the full spectrum of possibilities.

Fast forward several years and bond yields have in fact fallen. The so-called safe and secure dividend payments on many issues have actually been cut materially because these shares are being reset at a time when rates are at unexpectedly low levels. This drives down the price of preferred shares. Not only are these securities falling short in providing the income investors had hoped but they’re now trading at up to 40% less than their issue price.** Investors believed they were buying a security that protected them from interest rate movements, and it was this so-called protection that ended up hurting them. Regardless of what you think the future may look like, it’s always prudent to analyze the merits of an investment under a broad range of scenarios, even ones that you consider unlikely. While we weren’t previously participants in these investments, we’ve now turned our attention to some of these preferred shares as their prices may provide more attractive entry points.

Liquidity premium?

Bonds are often thought to be some of the most liquid instruments to invest in. Historically most fixed-income asset classes, including corporate bonds, were fairly liquid but there have been changes to the market structure that should prompt investors to question if the future will look different than the past.

Since the 2007-08 financial crisis, bank regulations have become much more stringent. To prevent the type of bailouts that occurred during the crisis, regulators have made it more costly for large broker/dealer banks to hold inventories of securities. Their ability to play an intermediary role in the fixed-income markets has diminished, reducing liquidity in the markets.

We see this diminished liquidity every day when we try to buy and sell bonds. In the past when we wanted to sell a sizeable amount of a bond issue, we’d contact a bank and it would quickly give us a bid price. The banks’ goal was to buy from us and use their broad-based relationships to sell to others at a higher price. Our goal was to not only get the best price but to transact in a liquid market that provided the opportunity to buy and sell sizeable positions quickly and efficiently.

Transactions today are done much differently. The decrease in inventory at the banks means banks can’t buy bonds in one quick transaction. They simply don’t have the capital to put at risk and are penalized for holding inventory overnight. The new reality forces them to find a buyer every time they have a seller and vice versa. This rarely happens quickly. The new system works under normal operating conditions but I question whether it does during times of duress. If dealers and banks aren’t there to make markets, many investors may find themselves with bonds to sell and no willing buyers at prices satisfactory to the sellers.

Bond ETFs – a better choice?

Fixed-income ETFs have been growing in popularity since the financial crisis. These products appeal to investors due to their perceived liquidity. An investor can buy or sell an ETF position with the click of a button but as previously discussed it’s no longer as easy to sell the underlying bonds the ETF owns. How can a financial instrument be more liquid than the underlying assets it invests in? An event that causes investors to sell ETFs in unison will leave no choice but to sell bonds into a declining market, further exacerbating the situation. The International Monetary Fund recently calculated that it could take 50 to 60 days for a fund holding U.S. high-yield corporate bonds to liquidate its securities.‡‡ What would happen if every investor wanted their funds tomorrow? Investors must understand that the level of liquidity experienced in the past may be different in the future and incorporate this into their risk and return analysis.

Change begets opportunities

As a participant in fixed-income markets, I do worry about the above events taking place but I believe that any short-term pain could be offset by new opportunities. Our portfolios have several levers that we can use in turbulent times. They are only 30% invested in fixed-income securities with the majority of the remaining assets invested in more liquid equities and cash. The majority of the fixed-income assets we own are short-duration investment-grade securities. We remain very flexible due to our relatively small portfolio size and have the ability to shift our asset mix to a greater fixed-income weighting should the opportunity arise. The same flexibility allows us to place more emphasis on high-yield bonds when we see value.

We have a defined investment process at EdgePoint that leads us in every decision we make. We try not to fall victim to “market truths” and will question convention in our analysis. Our approach helps ensure that we consider both risk and reward potential under various scenarios and not simply anchor to the recent past. We measure success by our ability to find attractive fixed-income investment opportunities and also by our ability to avoid making mistakes by questioning the simple stories that the market likes to tell.

I know bonds aren’t everyone’s bag but if you’re one of our fixed-income enthusiasts, email me at mullen@edgepointwealth.com and make my day!

†Calendar year returns and intra-year returns based on price index only and don’t include dividends. As at March 15, 2015. Source: Standard & Poor’s, FactSet Research Systems Inc., J.P. Morgan Asset Management. Intra-year drops refers to the largest market drops from peak-to-trough during the year. For illustrative purposes only. Annualized return calculation is based on price returns for 12/31/1979 – 01/04/1988 from Yahoo Finance and total returns for 01/05/1988 – 03/31/2015 from Bloomberg LP.

††Source: Bloomberg LP. Earnings per share 12/31/2008 and 12/31/2014, in EUR.

‡Source: Bloomberg LP. Earnings per share 12/31/2008 and 12/31/2014, in US$.

§Source: Bloomberg LP. Earnings per share 12/31/2008 and 12/31/2014, in C$

||Source: Bloomberg LP. June 29, 2015.

¶Source: Bloomberg LP. “German-bond investors just lost 25 years of yield in 14 days”, May 6, 2015.

**Source: Bloomberg LP.

‡‡Source: The Economist, “Frozen”, April 18th, 2015