Most of our working life, we have plenty of expenses to cover – from buying a car and home to starting a family, paying for the kids’ education and maybe sneaking in a vacation here and there. Whatever money is left over, we try to save.

After decades of saving, it’s time to start spending once you enter retirement. But how much can you safely withdraw each year without needing to worry about running out of money? The answer is critical in determining how long your savings will last you.

In your accumulation phase, your savings rate is the make-or-break number: Save too little or too late and you’ll be hard-pressed to make up your savings shortfall. When you retire, your withdrawal rate is the equivalent make-or-break figure. Withdraw too much from your portfolio and you’ll run the risk of running out of money prematurely.

What’s a sustainable withdrawal rate?

It’s the amount of money you can withdraw from your portfolio of stocks and bonds in retirement with an acceptable risk of running out of money. It’s expressed as a percentage of your portfolio, such as the popular “4% rule”.i This particular guideline suggests that if you start withdrawing 4% of your assets in the first year of retirement and then index these withdrawals to inflation in the following years, the risk that you would run out of money before your 30-year retirement ends is reasonably low.

Let’s go back to Anna, our diligent saver from the previous articles, who retires at 65 with $773,435 in savings. According to this rule, she should withdraw 4% (or $30,937) in the first year of retirement. Each subsequent year, the amount withdrawn increases by the rate of inflation so she can maintain her purchasing power. The chart shows what these withdrawals would grow to, assuming a 2.5% inflation rate, 15 and 30 years later.

Anna’s annual withdrawals, 4% withdrawal rate, inflation indexed

Vast amount of research has been done on this topic using historical data on stock and bond returns over long-term periods that cover various market cycles. Many of these studies found that 4% per year was a sustainable withdrawal rate because it didn’t exhaust a balanced portfolio of stocks and bonds despite the annual withdrawals during retirement. Keep in mind that these studies were based on the historical market returns in the U.S., and that they generally apply to 30-year retirement periods. Changing some of these important assumptions impacts the recommended withdrawal rates.

The magic number

Although 4% is a reasonable starting point, there isn’t a magic number that’s right for everyone. Actual inflation rates, portfolio returns and individual-specific issues will likely alter the equation.

Depending on factors like portfolio size, lifestyle and spending requirements, age and health, the right withdrawal rate for a retiree could be anywhere from 3% to 10%.

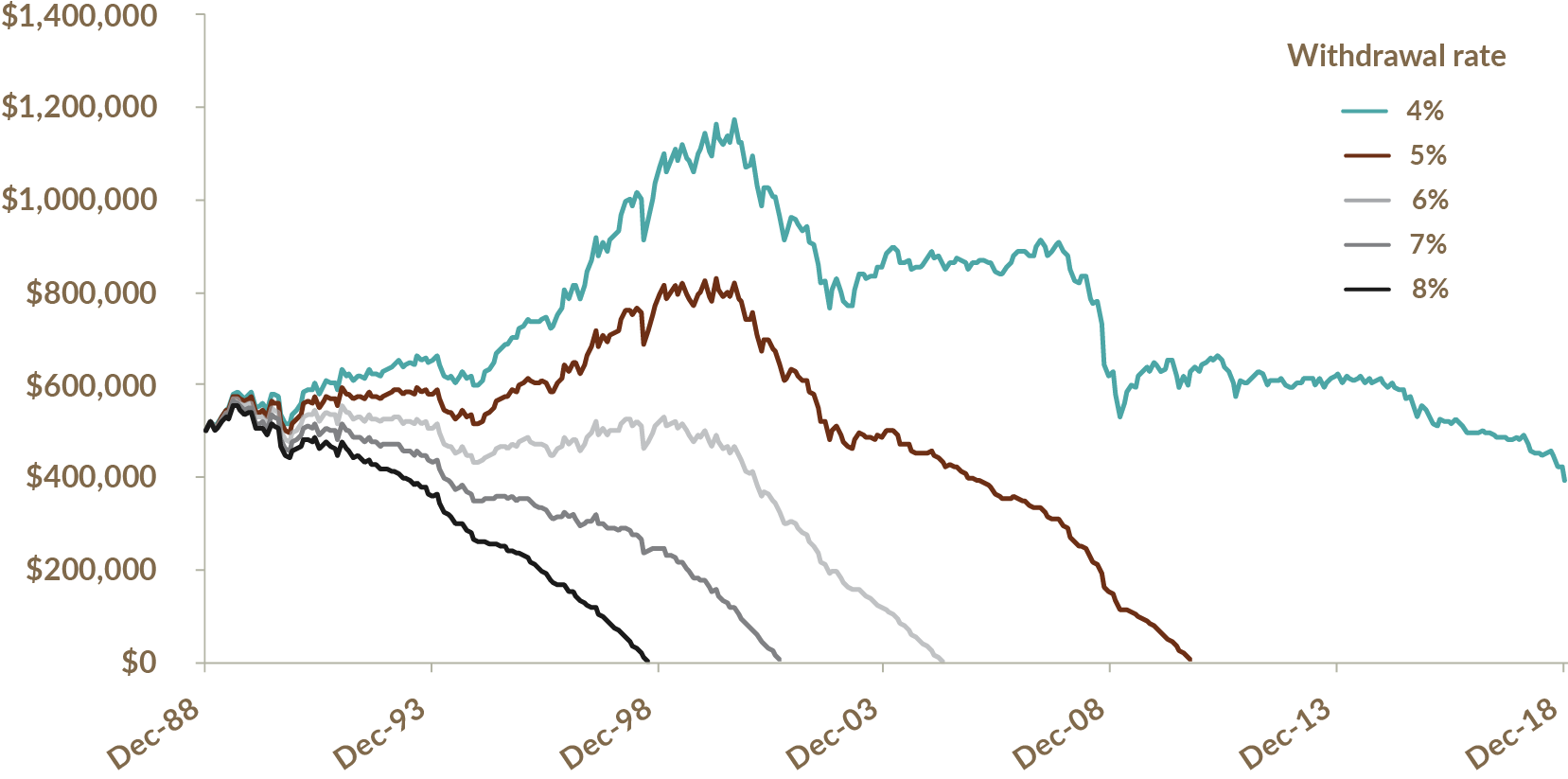

Although it’s impossible to say precisely what a retiree’s optimal withdrawal rate would be ahead of time (because that requires the magical ability to predict the retiree’s life expectancy, investment returns, inflation rates and unexpected spending needs), careful planning is critical because your withdrawal rate can be the make-or-break figure in retirement. Consider the chart below, which shows how long a $500,000 portfolio of equities and bonds would have lasted at various withdrawal rates over 30 years.

Portfolio values over a 30-year period at different withdrawal rates

65% S&P 500 Index (equities)/35% Bloomberg Barclays US Treasury Total Return Unhedged Index (bonds) Dec. 31, 1988 to Dec. 31, 2018

Source: Bloomberg. Returns are total returns and in US$. The S&P 500 index is a broad-based, market-capitalization-weighted index of 500 of the largest and most widely held U.S. stocks. The Bloomberg Barclays US Treasury Total Return Unhedged Index is a benchmark that measures US$-denominated, fixed-rate nominal debt issued by the United States Treasury.

Just a 1% change in the withdrawal rate can make a drastic difference in the longevity of your portfolio. If you started withdrawing 6% of your portfolio in 1988, you would have run out of money at the age of 83, only about 18 years into your retirement.

As a guiding principle, it’s wise to be conservative. Most people would probably rather make withdrawals that are too modest and end up with money left over, than taking the risk of running out of money.

Inflation can be higher than expected

In our piece called “The big day has arrived,” we discussed the impact of inflation on your income needs. How much you withdraw in your first year of retirement is relevant, but how much you’ll be spending by year 15 or 30 is just as important.

In that same piece, recall that our diligent saver Anna withdrew $40,000 from her portfolio of $773,435 (about 5% withdrawal rate) indexed to a 2.5% inflation rate, and her portfolio was invested in a mix of equities and fixed income that yielded a 6.6% return annually. Anna’s money lasted her throughout retirement and she was even left with more than $670,000 at the end. This chart shows what happens if she faces a high inflation period of 4% per year in the first 10 years of her retirement.

The 10-year period of high inflation at the beginning would exhaust her portfolio much faster (the yellow line). With higher inflation rates and everything else being equal, Anna would need to lower her withdrawal rate to ensure she doesn’t run out of money prematurely.

Investment returns – the opposite of erosion

Your investment choices and returns greatly impact the withdrawal rates that your portfolio will be able to sustain. Needless to say, higher portfolio returns can provide more comfortable withdrawal rates and weather unexpected expenses in retirement much better.

This chart shows Anna’s outcome assuming different allocations to equities and, therefore, different investment returns.

Assuming the same withdrawal rate in each case, with a 4% annual return she runs out of money at age 88, while with a 7.2% return she is able to leave an estate of over $1 million at age 95.

Assuming a 5% withdrawal rate indexed to inflation, and 2.5% annual inflation. Safe investments are securities that are generally considreed to be safe - government bonds, money market funds, other bonds or cash considered low risk. The above scenarios are hypothetical investors used to illustrate the effect of investing in different vehicles. The results don’t represent actual returns of an investible portfolio.

You can’t predict, but you can prepare

For retirees, success means, in part, not outliving their money. Determining the appropriate withdrawal rate from a portfolio to cover a retiree’s living expenses (the amount needed in addition to what he or she receives in government and company pensions, Old Age Security or other benefit payments) is an important but challenging exercise. Your advisor can help you develop a comprehensive financial plan that can account for all your spending needs and the projected income from your investments.

But since no one can forecast their spending accurately for the next 30 years, not to mention all the other variables that impact withdrawal rates, a margin of safety must be built in. That’s why safe withdrawal rate guidelines, like the 4% rule discussed earlier, are common.

It’s also important to create a portfolio that can weather the unexpected. Choose an appropriate mix of investments that can generate enough growth so you can cover your expenses throughout retirement and make your money last.

The key is to plan conservatively, manage withdrawals in the context of the portfolio that needs to sustain them, and track the inflationary pressure on your expenses. Your advisor can help you prepare effectively and invest wisely so you can enjoy the retirement you want.

Is a SWP right for you?

Once you’ve left the workforce and are ready to enjoy retirement, you’ll need a regular source of income while staying invested to continue growing your savings. A systematic withdrawal plan (SWP) can meet both of these important objectives. Your personal financial circumstances, age and risk tolerance will help determine if a SWP makes sense for you. Consult with your advisor.