In “Are your retirement savings on track?” we explored the idea of saving and investing wisely in your accumulation phase. Let’s shift gears and discuss what happens when you actually retire.

In retirement, the financial reality people need to face is changing direction from working and putting money away, to not working and taking money out. This is often a stressful subject. Fortunately, you can alleviate some of the stress by putting your financial plan in good order. Creating a financial plan for retirement is an in-depth process that needs careful thought and guidance.

The most important question

As people prepare to enjoy retirement, their most common worry revolves around this question:

Will my retirement income be enough to sustain my lifestyle or is there a chance that I may run out of money during retirement?

In other words, will you outlive your money or will your money outlive you. Although nobody can give you a definite answer, you can take action today to improve your chance of success.

Pieces of the retirement puzzle

As you start working on a financial plan for your golden years, there are a few variables you need to consider: (1) how much you’ve saved; (2) your life expectancy; (3) your expected income needs (and your plan for those unexpected needs); plus (4) what kind of investments will protect your income needs in retirement. That’s a lot to consider, so let’s go through these variables one by one.

Your savings (The “money”)

Obviously, the bigger your retirement nest egg, the better. To learn about ways to maximize your nest egg by the time you reach retirement, refer to our piece entitled, “Are your retirement savings on track?”Life expectancy (“How long will I need that money?”)

The good news is that we have witnessed a steady increase in life expectancy, but the bad news is that this is often not properly taken into account when planning for retirement. Your life expectancy is what truly determines your investment horizon and how long your income will need to last in retirement.

The probability of living to a certain age for 65-year olds

How long does your income need to last? A 65-year old couple has a 90% chance of living to 80 or beyond, nearly a 50% chance of reaching 90 and a 20% chance of turning 95 or older. This means that if you’re in good health at 65, your retirement plan should probably account for about 30 years of living expenses. So even if you are already retired, you still likely should be planning for a long investment horizon: three decades!

3. Income needs (“How much money will I actually need each year?”)

Retirement presents an income challenge: how much money will you actually need to meet your living expenses? This depends on your circumstances (lifestyle, health, home ownership, family obligations, etc.). Your financial advisor can help you estimate what your expenses may look like in retirement.

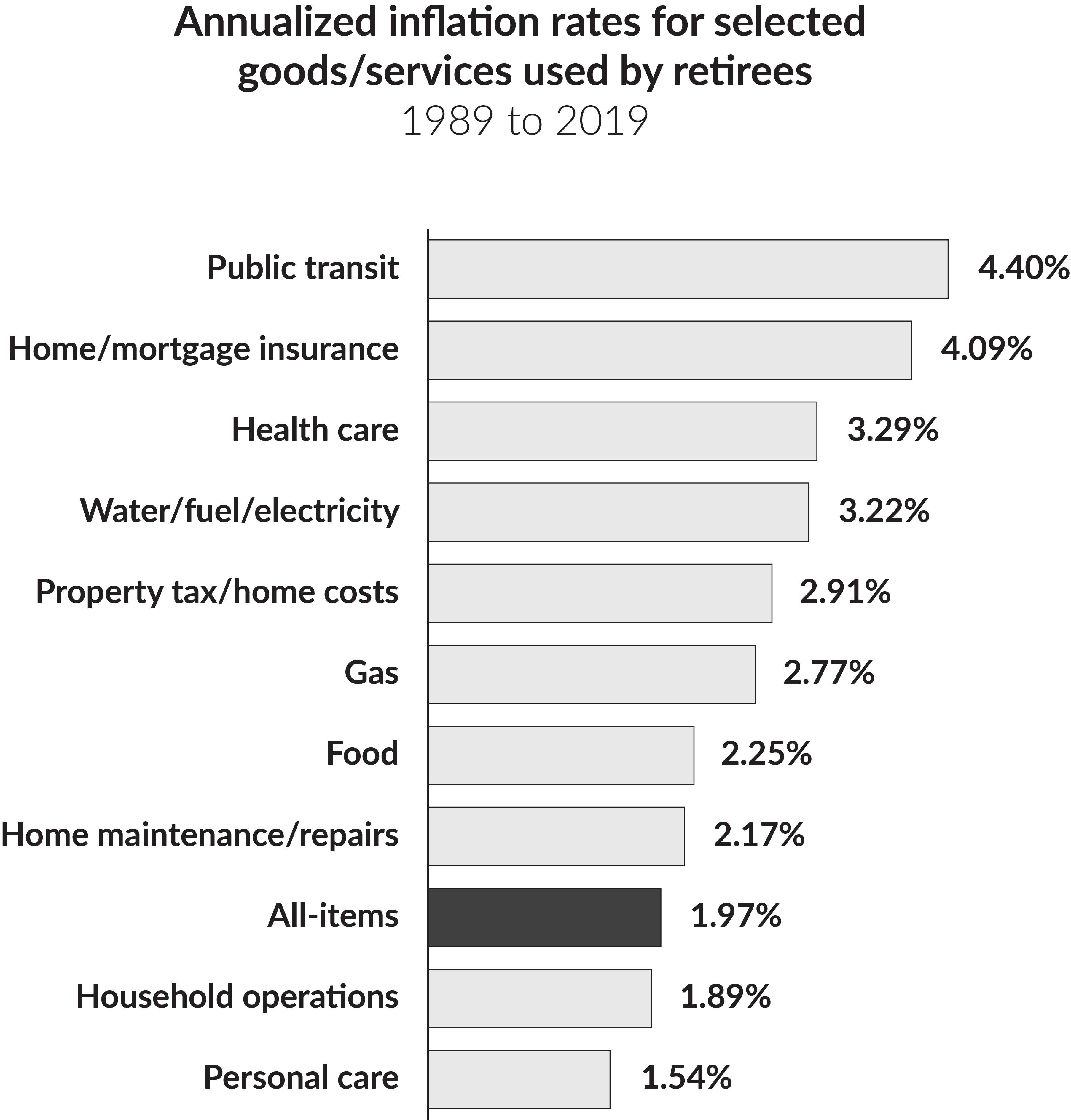

An important thing to consider is inflation, or that prices rise over time. This means a dollar will buy less and less as the years go by. As you’re calculating how much retirement income you’ll need, that amount should increase each year to combat inflation, so you can maintain the same level of purchasing power throughout retirement.

The chart to the right shows the annualized inflation rates for some of the goods and services used by retirees over the last 30 years.

If you need $40,000 in income in your first year of retirement, what will you need after 30 years of inflation?

Income needed today and 30 years later at various rates of inflation

You see how easily inflation can eat into your purchasing power and your savings. The most important thing your retirement income can do is provide you with dignity and independence in your retirement. For this to happen, your retirement income will need to last at least the balance of your life AND grow at least at the rate of inflation to match your cost of living increases.

There are quick rules of thumb for setting broad, general expectations on how much you’ll need to spend in retirement and how much you’ll need to have saved up:

70% of working income*: This rule estimates that you will need at least 70% of your pre-retirement income in retirement.

Example: if you earn $58,000 per year before retiring, you will need approximately $40,000 (or 70%) in annual income to maintain your pre-retirement lifestyle.

4% withdrawal rate**: This rule suggests that the maximum you should withdraw is 4% of your portfolio, on an inflation-adjusted basis, to ensure you don’t run out of money.

Example: if you need $40,000 in income annually from your portfolio. Using a 4% withdrawal rate and a 30-year retirement, you should have $40,000/4% = $1,000,000 saved up before you retire.

Of course, these are just quick rules of thumb. Retirement planning isn’t a one-size-fits-all exercise. There’s no cookie-cutter approach to determine how much money you’ll need to sustain you throughout your retirement.

*This rule estimates that you’ll need at least 70% of your pre-retirement income in retirement if you don’t have a mortgage, and more if you have one or other atypical expenses. Retirement estimates often assume lower expenses: no more mortgage payments, saving for retirement, supporting kids, etc.

** This guideline suggests that if you start withdrawing 4% of your assets in the first year of retirement and then index these withdrawals to inflation in the following years, the risk that you would run out of money before your 30-year retirement ends is reasonably low. Many studies found that 4% was a sustainable withdrawal rate as it did not exhaust a balanced portfolio of stocks and bonds despite the annual withdrawals during retirement. These studies were based on the historical market returns in the U.S., and that they generally apply to 30-year retirement periods.

4. Build an effective retirement portfolio (“What investments will protect my income needs?”)

Just because you stopped working, doesn’t mean your savings need to. How do you get your retirement income to keep pace with rising costs throughout your retired life?

Let’s bring back Anna, one of the twins and the diligent saver from “Are your retirement savings on track?” Anna is now 65 and looking at two potential retirement portfolios with different investment options:

How do the two options fare?

The above scenarios are hypothetical investors used to illustrate the effect of investing in different vehicles. The results don’t represent actual returns of an investible portfolio.

With “safe” investments, Anna runs out of money after 23 years, but the option with equities provides her with income throughout her 30-year retirement and also leaves her with a portfolio value of more than $670,000 at 95. Even with a generous growth assumption, the “safe” investments just don’t provide enough growth to sustain Anna’s growing income needs, while the additional growth provided by equities in the second option ensures that she has enough to cover her expenses and even grows beyond her income needs.

Although investments like government bonds are perceived to be “safe”, eventually they eat away at your savings (no pun intended) because they don’t generate the growth necessary to keep up with your increasing costs. They’re considered conservative investments because they protect the principal value, but the purchasing power of that principal is constantly eroding. Not to mention that very few retirees have enough money to live off the interest in their portfolio, especially at today’s ultra-low interest rates.

Assume that a Big Mac currently costs $6.85. Let’s say a retired 65-year-old today has an option to either buy that burger or invest the money in a 20-year Canadian government bond yielding 0.9%iii. Bonds are often viewed as a source of income in retirement portfolios, so let’s say that this retiree uses the income generated by the bond to pay for some expenses rather than reinvesting it. How many Big Macs could the retiree buy with that $6.85 in 20 years, assuming an inflation rate of 2.5%?

The number of Big Mac you can purchase after 20 years (when the bond matures) is…

Productive assets are your safety net

What you need in your portfolio are “productive assets” that can generate the growth and the rising income you need in retirement. You might be wondering what these are? A great business is a productive asset; a farm or real estate can also be productive assets.

An investment in productive assets will allow your savings to grow faster than inflation. Great businesses can raise their prices as their input costs increase over time, and they can also grow faster than inflation by moving into new markets, launching new products, taking market share from competitors or expanding their profit margins. If you own the stock of a great business, the rising income to you will come in the form of appreciation in value of the share price over time and from rising dividend payments.

Won’t my portfolio be too “risky”?

Great businesses that increase their free cash flow and grow in value can be perceived as “risky” investments if their stock prices are volatile. Conventional wisdom says to avoid risk as you approach retirement, which would mean switching out of stocks and into bonds for “income and preservation of capital.” But if true safety is preserving your purchasing power in retirement as you face a longer life expectancy and the eroding effect of inflation, your biggest risk isn’t market or economic volatility, but running out of money before you die.

This belief that stocks are too risky usually comes from two sources: seeking safety in terms of principal preservation and investors’ short-term views on market volatility. A short-term perspective leads investors to obsess over current market conditions and makes them forget their long-term goals. It leads people to equate risk with volatility.

Since 1945, the S&P 500 Index went through 10 bear markets (i.e., periods of significant decline). They occurred approximately once every seven years, but the index recovered every single time. A dollar invested in the S&P 500 Index in 1945 would have grown to $2,433 by the end of 2019. Stocks have proven through history to be excellent at protecting purchasing power. That’s why most retirees need to continue to have a significant exposure to equities to ensure their income keeps up with their expenses.

S&P 500 Index: Growth of $1

Jan.1, 1946 to Dec. 31, 2019

Source: Bloomberg LP. As at December 31, 2019. Total returns in US$. Bear markets occur when the stock market declines by at least 20% from peak to trough. The S&P 500 Index is a broad-based market-capitalization weighted index of 500 of the largest and most widely held U.S. stocks.

What’s the magic formula for building a great retirement portfolio?

There isn’t one.

That’s why we at EdgePoint strongly support professional financial advice and the many benefits this advice can bring you. Your advisor will analyze all your sources of retirement income, create a financial plan for you and invest your savings to help protect your living expenses throughout your retirement.

During your retirement, you’ll likely encounter bear markets. Market dips are inevitable and what matters most is how you react during these tough times. Your advisor will help you stick with your plan through short-term market “noise”. This financial plan will be the driver of your portfolio. It’s this plan, rather than any momentary market activity, that should dictate what you own in your portfolio.

iiSource: Bloomberg LP. Government of Canada 20-year Treasury Bond yield. As at March 12. 2020.

iiiIbid