For people who are approaching retirement, it’s not that hard to focus on their savings because the end goal is in sight. But what if you’re many years from retiring? Saving for such a distant goal may seem like something that doesn’t require your immediate attention.

The fact is, saving and investing your money wisely is important for anyone in the “accumulation” phase (i.e., still building your wealth for retirement). As life expectancies increase, one of the toughest problems retirees face today is making sure their money lasts as long as they do.

A recent study showed than many 65-year olds have a good chance of seeing 80 or 90, but most aren’t financially ready for that long of a retirement. Around the world, retirement savings are expected to fall short by between eight to almost 20 years on average.

Retirement Savings Gap

Estimated years of life expectancy past retirement savings, by country

Source: Wood, Johnny, "Retirees will outlive savings by a decade", World Economic Forum (blog), June 13, 2019. https://www.weforum.org/agenda/2019/06/retirees-will-outlive-their-savings-by-a-decade/

So, how do you avoid running out of money in retirement? The rest of this article will go over four key concepts for successful retirement savings:

Start to save and invest early

Build a foundation in savings and compounding will do the heavy lifting

Maintain a long-term focus when investing and understand your investments

Manage your behavioural tendencies for the best chance at success

The best time to start saving for retirement was yesterday, but today works almost as well

One of the keys to enjoying a successful retirement is to save as much as possible during your working years. Yeah, we know that’s easier said than done. Many people wait too long to start saving because retirement seems so far away and the constant financial demands when you’re younger (living expenses, mortgage, car payments, raising kids, etc.) mean that money is often in short supply.

The good news is that you have more control than you think regarding how much you save. It starts with good habits, spending less than you earn and saving the difference. We live in a world where the temptations to spend your money are endless, but it pays to forgo some consumption today and put those savings to work for you. The sooner you start, the faster your money grows and the more time you have for compounding to work its magic.

Earn more without doing more: The wonders of compounding

Compounding is a saver’s best friend. If you save (and invest) early and often, you can let compounding make the most of your savings.

To show you how, let’s walk through a quick example of two twins who are turning 18 today:

Anna saves $4,000 a year for 10 years but then never saves a dime again

Kris doesn’t save anything for the first 10 years, but then saves $4,000 a year until he reaches 65. Said differently, Kris saves $4,000 a year for 38 years

They both earn the same annual return on their savings (let’s say 7%)

Which twin will retire with more money?

The rate of return is used only to illustrate the effects of the compounding growth rates and is not intended to reflect future values of the mutual fund or returns on investment in the mutual fund.

Surprised by the answer? The chart above shows that after saving $4,000 a year for only 10 years, Anna retires with $773,435 in the bank, while Kris has $738,561 after saving for 38 years. Anna retires with about $34,874 more, even though Kris saved and invested almost four times as long as Anna, and also almost four times as much.

Time and investment returns are the fuel of the compounding engine. The higher the annual return and the longer the holding period, the more pleasing the investment result will be.

To learn more about compounding, see “Compounding's Magic”.

Think long term, sleep better

You have a long-term investment horizon during your accumulation phase, so it’s wise to make the most of your time by aligning your investment strategy with your goals.

What does “long term” actually mean? Today, the average holding period for an S&P 500 Index stock is six months.i Not exactly long term, is it? According to a DALBAR study, the average investor tends to hold a mutual fund for only four years.ii Once again, not long term. Sure, this is better than six months, but if your long-term goal is retirement, then your investment horizon should have the same timeline.

A portfolio's investment return varies from year to year. There’s always something to worry about in the financial markets – interest rate fluctuations, trade tensions, possible recession, etc. Whatever is happening in the world right now may cause your investment’s daily value to fluctuate, but it’s unlikely to impact your long-term plan. That is, unless you decide to try to time the market and stay on the sidelines until whatever is happening passes and the market settles down. This kind of short-term thinking usually happens when investors let greed and fear dictate when they buy and sell. It usually results in locking in losses by panic selling during downturns and missing out on gains when the markets eventually recover.

Volatility is the price for pleasing long-term returns

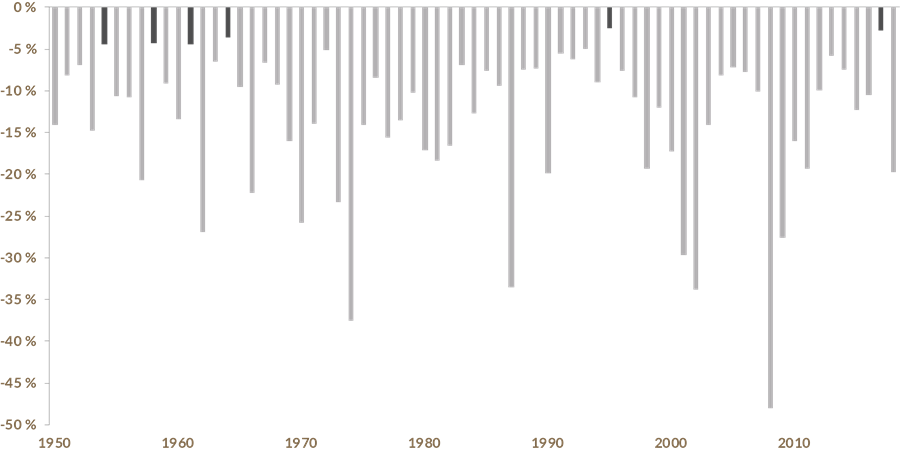

What do you think would have happened if you were able to avoid being invested in equities in all the years in which the markets had a loss of 5% or more at some point during the year and invested this money in bonds instead (5-year U.S. Treasuries)? How would you have done versus another investor who held onto their equity investments, bumpy ride and all? It would have cost you dearly. The chart below shows how this would have played out from 1950 to 2018.

The benefit of a long term focus

Buy and hold vs. avoiding years with drawdowns of 5% or more

Source: Bloomberg LP. The teal line illustrates the growth of $1 invested in the S&P 500 Index from December 31, 1949 to December 31, 2018. The dark grey line illustrates the growth of 1$ invested in the S&P 500 Index only in years in which the Index did not go through a drawdown of 5% or more at any point during the year. The rest of the time it’s invested in a 5-year U.S. Treasury bond. The S&P 500 index is a broad-based, market-capitalization-weighted index of 500 of the largest and most widely held U.S. stocks.

If you were able to avoid all the years in which the market fell by at least 5%, and invested in bonds during those years, by 2018 you would have accumulated 90% less in your account than a buy-and-hold strategy. The reason? You would have been invested in equities in only six years!

S&P 500 Index

Maximum Intrayear Drawdown by Year

The truth is, volatility is the price you need to pay for pleasing long-term returns. There will always be bumps along the way, but it’s impossible to know when they will occur. What matters is that you focus on your ultimate goal and align your investment strategy with your goal to make it count.

Understand your investments

When you invest in stocks or purchase units of a mutual fund, you’re not just buying pieces of paper – you’re buying shares of public companies. Doing so makes you a business owner.

Rational business owners don’t buy a business and try to flip it six months later (which, as you recall, is currently the average holding period for a stock). They focus on the long-term prospects for the business. Rational business owners don’t sell a business because other people’s perception of what the business is worth changes. They understand the business and that what others think about it may be irrelevant. In order to be a successful investor in the long term, you also need to understand your investments and think like a rational business owner.

We’ve shown you how important it is to start saving and investing early; how compounding does the heavy lifting once you build a foundation in savings; and how maintaining a long-term focus and understanding your investments is the only way to ensure success over the long haul. There’s one other key aspect that can act as an invaluable backbone in keeping you on track throughout the accumulation phase – working with a good financial advisor.

iiSource: “Quantitative Analysis of Investor Behavior, 2019”, DALBAR, Inc.