Playing my first round of golf of the 2021 season, I couldn’t help but reminisce on life without COVID safety protocols (while also noting that, honestly, I wouldn’t mind if some of them stayed even as we return to a virus-free world).

If you haven’t been to the golf course in the past 18 months, experts were quick to recognize ball washers as a lurking superspreader, so those are gone. I do look forward to playing with a clean golf ball again.

And taking the flag out of the hole is a no-go, which might not sound like a major detractor, but I’ve rapped my putt off the flagstick enough to hold a grudge.

A few courses have even removed the colour-coded blocks from the tee box, citing “touch points.” I don’t know who’s licking the tee before firing a drive, so that one is weird.

On the other hand, having each player drive their own golf cart is an absolute luxury. Nobody likes making their playing partner chase a ball 100 yards in the wrong direction while the other’s drive sits comfortably in the fairway. And spacing tee-off times 10 minutes apart means you spend a lot less time twiddling your thumbs waiting for the group ahead to get off the green. Not sure how it prevents COVID, but it keeps the round moving.

In case you aren’t a golfer, there are similar aspects to everyday life that you might find more relatable. I’m sure a lot of you look forward to attending your next concert or family gathering, but other aspects of “stopping-the-spread” are kind of enjoyable. In my opinion, fist bumps instead of handshakes and no more cramming the elevator with 18 people can both become permanent fixtures. We have a “no taking the subway” rule at the office that’s a blessing. In fact, let’s vote to keep the six-feet-of-personal-space a common courtesy altogether.

Similar to pros-and-cons of protocols meant to keep the pandemic at bay, there are pretty obvious pros-and-cons to whatever it is central banks are trying to do to keep volatility at bay. Filling the banks to the gills in deposits I assume makes the COVID-plagued economy feel pretty good but it’s hard to imagine the consequences will be very pleasant on the other side.

A recent WSJ article described one peculiar side effect of the policy of central banks buying up as many Treasury and mortgage bonds as they can get their hands on.i With newly printed cash flooding the system, banks today are hesitant to accept incremental dollars as they lack conviction that lending the money out would be a profitable endeavour on the other side.

Source: Nina Trentmann and David Benoit, “Banks to Companies: No More Deposits, Please.” WSJ.com, The Wall Street Journal, June 9, 2021. https://www.wsj.com/articles/banks-to-companies-no-more-deposits-please-11623238200.

When the Federal Reserve – or similar central banks – conjure up digital dollars to buy government bonds, those dollars inevitably find their way into the banking system. The latest US$1.9 trillion dollars worth of giveaways included US$1,400 cheques (or thereabouts) that were helicoptered through the economy.ii The Federal Reserve printed the dollars, and consumers were sent the cheques. Whether those cheques were deposited directly, or spent on groceries, toys or McDonald’s along the way, unless they were withdrawn as cash, those dollars instantly became a deposit at a bank.

U.S. commercial bank total deposits

Jan. 1, 1973 to Jun. 30, 2021

Source: Federal Reserve Bank of St. Louis, Board of Governors of the Federal Reserve System (US). “Deposits, All commercial Banks.” https://fred.stlouisfed.org/series/DPSACBW027SBOG#0.

There’s a cost to taking on deposits and, combined with post-2008/09 regulation meant to shore up big bank balance sheets, there’s a real incentive for the largest U.S. banks – JPMorgan and Bank of America in particular – not to grow. Once a deposit has been made at a bank, the choices that bank has to do with the cash are limited. Ideally they’d lend it to businesses and consumers, and there was a time 10 years ago where very nearly 100% of deposits went to such borrowers. Not today – the more the Fed prints, the more the gap between deposits and loans will rise. And the difference largely bids up asset prices.

U.S. commercial bank total deposits vs. loans

Jan. 1, 1973 to Jun. 30, 2021

Sources: Federal Reserve Bank of St. Louis, Board of Governors of the Federal Reserve System (US). “Deposits, All commercial Banks.” https://fred.stlouisfed.org/series/DPSACBW027SBOG#0; “Loans and Leases in Bank Credit, All Commercial Banks.” https://fred.stlouisfed.org/series/TOTLL.

So, as mentioned, in the spirit of being an equal opportunist, just like finding the good and the bad in COVID safety protocols, let’s cover the good and bad of crazy central bank policy. The good, no doubt is how incredibly strong the economy feels. Across our Portfolios, business earnings have been phenomenal. There’s no telling what happens as stimulus wanes, but COVID resurgence aside, if I had to guess (judging by the hour-long line outside every Winners I see), the consumer is just getting started.

The flip side, however, is finding a way to make money as a fixed income investor.

If there’s one thing we can say for certain, it’s that making money over the next 30 years is going to be a whole lot harder than the past 30 years. The age of the near-universal, double-digit investment return track records is over. And it’s hard not to look with envy at the bountiful return environment available to investors of the 1980s and 1990s. Today, single-digit price-to-earnings ratios on great businesses and double-digit interest rates on government bonds might as well be the Easter Bunny.

We’ve said in the past that the mind isn’t wired to understand compound interest, and while the difference between 10% and 2% – the yield available on 30-year government bonds then and now – might not sound insurmountable. Today’s interest rates turn the next generation’s investment goals from a mole hill into a mountain.

| June 30, 1991 | June 30, 2021 |

|---|

Long-term bonds today are no way to build wealth. They might do well in the short term, but from now until they mature, 30-year government bonds yielding 2% are going to deliver a 2% return for 30 years. If an asset class cannot accomplish the simple task of maintaining the purchasing power of your savings relative to anything you might want to buy in the future, it’s not an asset class that you want to be in.

Inflation (total change in price)

Dec. 31, 1999 to Apr. 30, 2021

*October 1999 to October 2020.

As at April 30, 2021. Source, tuition, healthcare, food, public transportation, electricity, childcare, textbooks: Statistics Canada, The Consumer Price Index. http://www.statcan.gc.ca/tables-tableaux/sum-som/l01/cst01/econ46a-eng.htm. Source, home price: Teranet Inc., National Bank of Canada, House Price Index. https://housepriceindex.ca/#maps=c11. Source, rent: Canada Mortgage and Housing Corp., Housing Market Information Portal. https://www03.cmhc-schl.gc.ca/hmip-pimh/en#Profile/1/1/Canada.

At this year’s Cymbria Day, we talked about the flexibility of our investment approach. It’s this flexibility to adapt to different markets, to look across asset classes without boxing ourselves into a specific geography, size, industry or rating that allows us to look at the next 30 years through a lens of optimism rather than a haze of pessimism. It’s the flexibility to do what a businessperson would do.

In our balanced Portfolios, when government bonds are positioned to deliver next-to-nothing, the last thing we want to do is lock in those interest rates. Being a long-term lender today is all risk and no reward.

But the tailwinds of Federal Reserve policy trying to immunize the population from reality have at the same time meant solidly improving fundamentals across our Portfolio companies. Still, opportunities remain. While many businesses initially impacted (or perceived to be impacted) by the early onset of the pandemic have recovered, others continue to struggle and find themselves out of favor. Casinos, cinemas, restaurants and events are only starting to recover. Automotive and aerospace supply chains are in disarray, and people have a bad taste in their mouth from recent experience in the oil patch.

Outside these industries, with improving cash flows and easy access to financing, accelerating debt paydowns have meant high yield issuers are giving us our money back. Combined with opportunistic selling at frothy prices, our high yield allocation has come down a lot from the depths of March 2020.

EdgePoint Canadian Growth & Income Portfolio fixed income allocation

Investment grade bonds are debt rated BBB or higher, while high yield bonds are debt rated lower than BBB.

Aware as always that part of the role our balanced Portfolios play is buffering downside in times of volatility, the proceeds from high yield bond sales and maturities have been allocated to our “dry powder” investment grade sleeve where it salivates for another hiccup in markets. Even with our defensive positioning, the fixed income component of our balanced Portfolios can achieve a higher yield to maturity than anything resembling the ICE BofA Canada Broad Market Index (tracked by most other balanced portfolios) all while maintaining a significantly shorter average duration.

| As at June 30, 2021 | Yield-to-Maturity | Duration (years) |

|---|

Source: Bloomberg LP. All yield-to-maturity and duration figures as at June 31, 2021. Duration is a measure of a debt instrument’s price sensitivity to a change in interest rates. The higher the duration, the more sensitive a bond’s price is to changes in interest rates. Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return. The ICE BofA Canada Broad Market Index tracks the performance of investment-grade debt publicly issued in the Canadian domestic market. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed-income comparability from the index.

This short duration is important, as it gives us enormous flexibility to take advantage of the next opportunity, whether it comes from higher overall interest rates or wider credit spreads. If the economy does roll over as central banks remove the proverbial punchbowl of free money, our investors should consider ensuing volatility a gift to future returns.

EdgePoint fixed income returns vs. the ICE BofA Canada Broad Market Index

Dec. 31, 2019 to Jun. 30, 2021

Portfolio performance as at June 30, 2021. Annualized total returns, net of fees, in C$.

EdgePoint Global Growth & Income Portfolio, Series A: YTD 10.35%; 1-year: 23.39%; 3-year: 4.67%; 5-year: 8.66%; 10-year: 9.99%; Since inception (Nov. 17, 2008): 11.43%. ICE BofAML Canada Broad Market Index: YTD -3.63%; 1-year: -2.62%; 3-year: 4.06%; 5-year: 2.56%; 10-year: 3.92%; Since inception (Nov. 17, 2008): 4.54%.

Source: FactSet Research Systems Inc. As at June 30, 2021. ICE BofA Canada Broad Market Index returns in C$ and EdgePoint returns in local currency. Both returns are total returns. The ICE BofA Canada Broad Market Index hit its lowest point following the COVID-19-related decline on March 26, 2020. EdgePoint Global Growth & Income Portfolio fixed ncome performance figures shown for illustrative purposes only and aren’t indicative of future performance. They aren’t intended to represent returns of an actual fixed income fund as they weren’t investible. EdgePoint Global Growth & Income Portfolio fixed income performance figures are gross of fees, in local currency and approximations calculated based on end-of-day holdings data (actual trading prices not captured). The ICE BofA Canada Broad Market Index tracks the performance of investment-grade debt publicly issued in the Canadian domestic market. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed income comparability from the index.

The cost to managing money this way is that we have no idea when the next bout of volatility could come, and if we are several years from the next great opportunity, we’re going to be leaving a lot of money on the table. That said, with interest rates in the doldrums, this “opportunity cost” is lower than ever.

EdgePoint Variable Income Portfolioiii

If there’s one lesson reinforced by the experience of the past 18 months, it’s how well high yield bonds perform through market cycles. In our view, the best way to generate pleasing fixed income returns over the next 30 years is our EdgePoint Variable Income Portfolio, a portfolio that can continuously pursue the absolute best opportunities, even if it means it might experience a greater short-term decline than a lower-yielding fund the next time markets are walloped by a pandemic.

As always with high yield bonds, these bouts of volatility are much less severe than with a pure equity portfolio and are a gift to both new and existing investors, as interest coupons and principal maturities are reinvested at increasingly attractive prices.

We’re as excited as ever about the prospects for the high yield bonds we own, and the fundamentals of the businesses we lend to continue to surprise to the upside. To the extent we venture away from high yield bonds, it will be to improve the characteristics of the overall Portfolio. But we also aren’t confined to investing in this asset class. And as good as business fundamentals have been, and as much as central banks keep spraying money around, our high yield bond coupon payments cannot grow.

This is why one of the most fruitful hunting grounds for our Portfolio this year has been a growing allocation to convertible bonds, an asset class with almost laughable value given where the most popular high yield bonds are trading. These unique securities behave just like a bond and have the typical characteristics of protecting downside, while coming with the added optionality of being able to “convert” into a company’s equity if the stock rises above a certain level.

With convertible bonds today, not only are we receiving an attractive yield in a world where short-term interest rates are at zero, but if the economy remains as hot as it seems and this vibrance filters through to our businesses, we have a very real shot of making significantly more. Our allocation to convertible debt in EdgePoint Variable Income Portfolio has increased from 11% to 19% over the past 18 months, and we have a number of attractive transactions in the hopper that could well increase our investment weight in the near term.

EdgePoint Variable Income Portfolio fixed income allocation

One example held in both our balanced Portfolios and in EdgePoint Variable Income Portfolio is Mullen Group 5.75% bonds due November 2026. This company operates one of the largest last-mile trucking and logistics & warehousing networks in Western Canada and Ontario. They also run an oil & gas services division that several years ago would have generated two-thirds of company income, but has since struggled through the downturn. Lending money to Mullen was a straightforward decision; the company owns real estate across the country estimated to be worth more than the value of its debt.

Beyond having an excellent credit profile, Mullen Group has also built a great business – one any rational business person would want to own. The company comes with a great management team with strong insider ownership (the founder and CEO owns ~$60 million worth of stockiv) that has taken advantage of downturns time and again to enhance shareholder value. The company’s dominant last-mile trucking business has been a beneficiary of growth in eCommerce and just-in-time inventory, and has the added torque of increasing profitability in an eventual oil & gas recovery.

Having made our Mullen investment at new issue in June 2019, we saw the option value in the convertible bonds from the start. What we didn’t see was a pandemic. Still, this bumpy ride was a blessing in disguise, as both the company and our Portfolios took advantage of the malaise. Mullen’s management team went to work acquiring four different companies all while repurchasing stock and reducing shares outstanding by close to 8%.

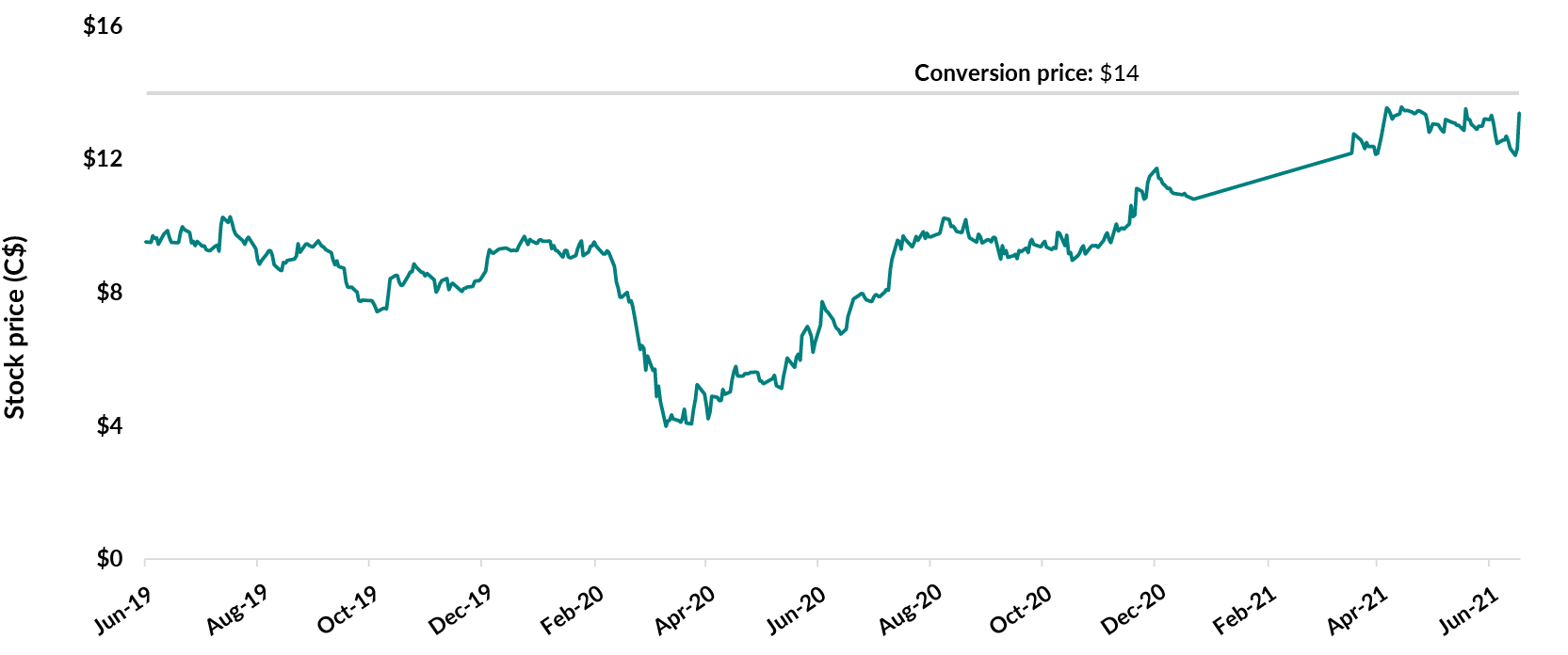

Mullen Group Ltd. share price

Jun. 14, 2019 to Jun. 30, 2021

Source: Bloomberg LP. In C$. June 14, 2019 was selected as the start of the period since that is the launch date of Mullen Group Ltd., 5.75%, due 2026/11/30.

We went to work by more than tripling the amount of bonds we owned in EdgePoint Variable Income Portfolio, ramping the portfolio weight from 2.2%v to 5.1%vi last spring at a yield near 10.0%.

Mullen Group Ltd., 5.75%, due 2026/11/30 price vs. bonds held in EdgePoint Variable Income Portfolio

Jun. 14, 2019 to Jun. 30, 2021

Source: Bloomberg LP. June 14, 2019 was selected as the start of the period since that is the launch date of Mullen Group Ltd., 5.75%, due 2026/11/30.

Mullen Group Ltd., 5.75%, due 2026/11/30 yield-to-maturity vs. bonds held in EdgePoint Variable Income Portfolio

Du 14 juin 2019 au 30 juin 2021

Source: Bloomberg LP. June 14, 2019 was selected as the start of the period since that is the launch date of Mullen Group Ltd., 5.75%, due 2026/11/30.

After already generating a holding period return of 33.4%, our excitement for the position has only grown. Combining the value we saw in the short-haul logistics business in June 2019, the enhancements to value made over the past 18 months, and the real possibility for resurgent activity in the oil patch, prospects for Mullen are bright. The bonds today yield 2.8% to maturity – among the lowest in the Portfolio – but the stock sits at $13.36,vii just 4.8% away from the $14 threshold we need for equity upside. With five years remaining to maturity, there’s plenty of time to get there.

Concluding remarks

It’s been a strange 18 months. Combining a pandemic, a wild ride in markets and the funny stuff that came with them, you’re not alone if you have a love-hate relationship with the environment. Aspects have been frustrating, others invigorating. As ever, we believe our Portfolios are ready to thrive through inevitable future turmoil, but at the same time are positioned to participate if the good times persist. Accepting the good along with the bad, we’ll do our best to ensure the investors’ experience is on par with the past, as much as the future will be anything but.

ii Source: Niall McCarthy, “What’s In The $1.9 Trillion Stimulus Package?” Forbes.com, Forbes, March 11, 2021. https://www.forbes.com/sites/niallmccarthy/2021/03/11/whats-in-the-19-trillion-stimulus-package-infographic/?sh=28ab78c87e07.

iii The Portfolio is sold via OM and pursuant to exemption from prospectus requirements. As such, the Portfolio is not available to the general public and is only available to, for example, accredited investors, within the meaning of National Instrument 45-106 — Prospectus Exemptions.

Common exemptions for accredited investor include: Individuals who have at least $1 million in financial assets (excludes real estate) on their own or combined with their spouse; individuals with net assets of at least $5 million (includes real estate) on their own or combined with their spouse; individuals whose annual net income before taxes exceeds $200,000 in the last two years ($300,000 when combined with spouse’s net income) and expected to exceed $200,000 in the current year; current or former individuals registered as a representative of a Securities Advisor or Dealer (in Canada); a company with net assets of at least $5 million on most recent financial statements; or a company whose owners are accredited investors. A minimum amount investment exemption is available corporations or other entities (but not individual investors) with a minimum purchase of $150,000.

The Fund is subject to various risk factors. An investment in the Fund may be deemed speculative and is not intended as a complete investment program. A subscription for Units should be considered only by persons financially able to maintain their investment and who can bear the risk of loss associated with an investment in the Fund.

iv Source: Bloomberg LP. In C$ as at July 6, 2021.

v January 31, 2020.

vi July 31, 2020.

vii As at June 30, 2021.