Mistakes were made but not by me – 1st quarter, 2017

If dreams were lightning, thunder was desire

This old house would have burnt down a long time ago.

John Prine, Angel from Montgomery

Everybody has a story. Certainly some personal stories seem more significant than others, whether they be of courage or tragedy. When we think about our own story, I believe it’s true that we generally identify ourselves with things that are more heroic or courageous than tragic. If you don’t believe that, pick up a copy of the book “Mistakes Were Made (but not by me)” to see if it might be true of you.

As someone who works in the investment business, I can tell you that while 75% of investment managers underperform their benchmark over time, when asked, 75% of investment managers still believe they are above average.i Go figure.

When I talk investments with people I know, they generally focus on their big successes rather than their big losers. From a human perspective this makes sense as losses feel twice as bad as gains feel good and it’s the human condition to avoid pain, be it mental or physical, as much as we can. Often when people make mistakes they pull the wool over their eyes to avoid the mental pain and blow to their self-worth, instead rationalizing an outcome that absolves them of responsibility. While humility is a characteristic we often admire in people, it doesn’t always shine through.

Our core beliefs at EdgePoint include partnering with a select group of financial advisors who, along with us, help you avoid some potential pain by putting you first in everything we do. While one of our goals is to achieve superior investment performance (helped by having some of the lowest fees in the mutual fund industry) over a ten-year period there no doubt will be short-term periods where we don’t outperform. We believe it’s during these times that it’s even more critical that you work with your financial advisor to stay the course in your effort to achieve your financial goals.

Why do we believe that? Because the human compulsion to avoid pain means that most investors substitute long-term investment success with short-term activity. The result is investors moving out of an investment when it doesn’t perform well in the short term into one that is performing well in the short term. As with most things in life, decisions made during emotional times are harmful to your investment well-being. It’s always important to never mistake activity with smart choices.

All of humanity’s problems stem from man’s inability to sit quietly in a room alone. − Blaise Pascal

You might suggest it’s in our own self-interest to say that. If you mean by putting you first in everything we do, then yes. If you mean by keeping you invested in our funds so we can collect the fees, then no. Why do I say that? Because history shows that when investors put short-term activity ahead of long-term investment success they do themselves a great deal of harm and suffer a great deal of pain.

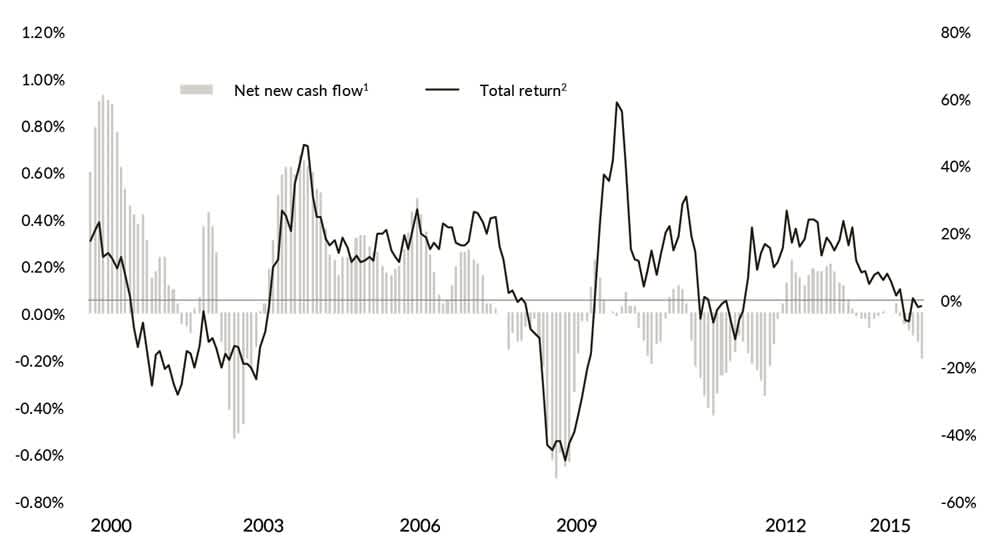

The chart below illustrates this perfectly. The bars represent cash flows into equity funds in relation to the performance of the MSCI World Index – the line graph. When returns are positive, investors pour into funds. Conversely when returns are down, they sell. Meaning they chase performance when the market is on the rise and start selling when it’s lagging. Proof of the proverbial buy high and sell low scenario that plagues many investors.

New cash flow to equity funds is related to world equity returns

1Net new cash flows is the percentage of previous month-end equity fund assets, plotted as a six-month moving average.

2The total return on equities is measured as the year-over-year percent change in the MSCI All Country World Daily Gross Total Return Index.

Sources: Investment Company Institute, Morgan Stanley Capital International and Bloomberg LP.

What’s the #1 cause of poor investment results for the average investor? According to DALBAR, Inc.: “Voluntary investor behaviour underperformance” including panic selling, excessively exuberant buying and attempts at market timing.

A couple of years ago, I wrote a commentary about my dad (Things my dad taught me) who was given the nickname Pogo by his friends and classmates at the Royal Military College because of his overly curious, adventurous and fearless nature. His nickname came from the line often associated with the Pogo comic strip: “we have met the enemy and he is us.” Though my dad’s nickname didn’t come from his investment behaviour (namely because he didn’t have any money), given the average investor’s performance, it might be apt to start referring to them as Pogo since it’s evident that the average investors' worst enemy are themselves.

By comparison, how has the average investor (you) done in the EdgePoint portfolios over time? As you can see in the chart below, very well. By following the guidance of your financial advisor, you’ve stayed the course during market downturns and periods where we have underperformed our peers. As a result, your returns have been very similar to the portfolios. While this may seem like common sense, as I pointed out above, this common sense doesn’t seem to apply to the average investor.

December 31, 2011 to December 31, 2016

Annualized total returns, net of fees, in C$ as at March 31, 2017

EdgePoint Global Portfolio, Series F

YTD: 3.88%; 1-year: 20.15%; 3-year: 14.70%; 5-year: 18.53%; since inception: 18.77%

EdgePoint Global Growth & Income Portfolio, Series F

YTD: 3.20%; 1-year: 16.20%; 3-year: 11.66%; 5-year: 14.61%; since inception: 15.35%

EdgePoint Canadian Portfolio, Series F

YTD: 3.07%; 1-year: 24.69%; 3-year: 9.42%; 5-year: 11.60%: since inception: 15.74%

EdgePoint Canadian Growth & Income Portfolio, Series F

YTD: 2.78%; 1-year: 19.29%; 3-year: 8.49%; 5-year: 10.30%: since inception: 13.49%

Source: Average EdgePoint investor returns: CIBC Mellon, average EdgePoint investor returns are the average dollar-weighted returns net of fees across investors who held EdgePoint Portfolios from December 31, 2011 to December 31, 2016. Dollar-weighted returns represent the client's personal rate of return taking into account the client's decisions regarding the timing and magnitude of cash flows in and out of the portfolio. Series F is available to investors in a fee-based/advisory fee arrangement which do not require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. As a result, the management fee for Series F is lower than Series A.

We believe we’ve been successful in our goal of partnering with a select group of financial advisors, working together to put you first in all our investment decisions. When we see results like these for our average investor it makes our investment success much more satisfying then if we had done well and you hadn’t. You’ve done well, held on to your investments during times of stock market stress and in the process are on the road to long-term investment success. At the heart of our company values is a very simple belief, if you don’t succeed, we won’t either.

Arista Networks

One of your recent investment successes is Arista Networks, which was held in EdgePoint Global and EdgePoint Global Growth & Income Portfolios. We first came across Arista when we were doing research on software-defined networking. Simply put, software-defined networking is the transition of network switches (switches being the things that guide electronic information to the appropriate recipient in an office or data centre environment) from primarily hardware to software. The transition to software allows the switches to move information around the network faster and makes provisioning a new switch in the network easier for an IT professional to deploy. It also makes them much cheaper than legacy hardware switches predominantly made by Cisco Systems, Inc.

At the time, Arista was growing very quickly because they had the fastest and easiest method to deploy switches. Because of these benefits, Arista was expanding rapidly with the “cloud” titans, companies that provide most of their services over the internet – like Netflix, Amazon.com, Facebook, Inc., Google and Microsoft Corp. When we bought Arista in September 2015, we believed they would continue that brisk growth because we knew that companies like Microsoft (owned in the EdgePoint Global Portfolio in September 2015 at the same time as the Arista purchase) expected their cloud business to triple between September 2015 and 2018. Microsoft was Arista’s biggest customer so if it was going to triple its cloud business over three years it was going to have to buy lots of Arista switches. We also believed that companies like Facebook, Amazon, Google and many other cloud-based companies were going to experience continued growth leading to more business for Arista.

We were fortunate to buy Arista when it had a cloud (nerd alert, pun intended!) over its head because it was in intellectual property litigation with Cisco who had accused Arista of stealing software code to build the switches. The team that founded Arista had all worked at Cisco for a number of years after the company they previously worked for, Granite Systems Inc., was acquired by Cisco. Basically we believed Arista had the best software networking team in the world and though they certainly represented an existential threat to Cisco’s business given their long and successful history in networking software, there was a very low probability that they’d stolen anything from Cisco. The threat to Cisco from Arista was very real though. Enough to invoke litigation because it had already taken 8% market share from Cisco and its revenue was still growing at an annual rate of 35%, while Cisco was growing at 1%. We believed this meant share gains were likely to continue. While it had taken significant market share it still only had $700 million of a $9 billion market. And based on our analysis, we felt the market share opportunity could grow to $20 billion if it introduced other products to its customers like routers. In fact, we learned that Netflix was already trialling Arista routers in its data centres so this new large market opportunity seemed highly realistic.

While we initiated the position in September 2015, we managed to take advantage of market volatility in the market swoon of late 2015 through January 2016 to increase our position at lower prices. As I mentioned earlier, we believe it’s critical for you to stay the course during market swoons – better yet, if you have money available, add to your positions during periods of market stress. But even if you don’t have money available, we’re able to add to your investments (they are yours, we only manage them) by increasing investment positions at lower prices as we did with Arista.

Our business thesis in Arista played out as we thought. The stock price reflected this which led us to sell it recently.

Take me out to the ball game

By Frank Mullen, portfolio manager

Spring isn’t only a time to say goodbye to winter, it’s a time to welcome the start of the new Blue Jays season. As a lifelong fan, I start each spring with the hopes that we can relive the glory days and make it back to a World Series. We’ve been close two years in a row but couldn’t quite make it.

The EdgePoint office is full of opinions on the topic, inevitably leading to a discussion about the batting lineup. The Blue Jays’ offense was devastating over the last two seasons. When they’re hitting, there isn’t a more exciting team to watch in baseball. The whole country loved seeing Edwin Encarnacion carry his parrot around the bases after hitting a home run and watching the bat flip seen ‘round the world’. But when they aren’t hitting, there’s nothing more frustrating. The unfortunate fact is although they led the league in home runs in 2015 while being efficient hitters, last year’s team kept their power but traded it for more strikeouts and a lower average. Many games felt binary – the 2016 Jays were either racking up a big lead or unable to put a man on base.

Many successful teams in the past decade have won the World Series not by hitting home runs, but by manufacturing runs. Instead of swinging for the fences, they had success simply hitting singles and moving players around the bases. A strategy of consistency and hitting for average has been very successful in Major League Baseball. Home runs dominate the highlight reel but consistency wins championships. The Kansas City Royals are the perfect example, with World Series rings to prove it.

I think there are many similarities between baseball and investing. Both are activities that require immense dedication and skill for success, but they also require a clear strategy. Do you build a team that is looking to hit home runs or consistently get men on base?

Home run hitting is the equivalent to finding the next Google or Amazon. Everyone wants to find the next multibagger, but while looking for a large return, you must accept the fact that there will be many strikeouts. It isn’t easy to swing for the fences every time and you need to make sure that your strikeouts don’t lose more games than your home runs win.

I believe venture capital generally has a home run-based investment approach. In their hunt to find the next billion dollar company, they willingly accept the fact that a large percentage of their investments will generate poor returns. They focus on ensuring that the effect of their infrequent winners more than makes up for the many losers in their portfolio. By investing in companies at the early stages, a savvy investor has the ability to experience exponential growth. Venture capital practices a similar investment approach to the 2016 Blue Jays – their quests for the next Facebook or Google litter the covers of magazines in the same way Jose Bautista's bat flip will be replayed on Sportsnet a thousand times over.

Home run investing is possible in asset classes like venture capital and public equities. It’s much more difficult in fixed income. As the name suggests, your upside is fixed. We strive to lend to great companies that can profitably grow their business, but even the most successful investment is only going to pay us back at par.

You might ask why anyone would forgo the seduction of large returns and ever invest in fixed income? To answer that I would turn your attention to the other side of investing that is much less discussed – every potential return must be looked at in relation to the respective risk that one takes by making that investment. Fixed-income investors generally can’t generate returns that are as high as equity investments, but they also accept much lower risk. Bonds are higher in the capital structure than equity and have a senior claim on a company's assets. There are situations where an equity investor can watch the stock price of a company plummet to zero and, despite the negative results, bond investors may still get paid back at par.

Our fixed-income approach focuses on consistency and avoiding mistakes. We take Warren Buffett's first rule of investing to heart – never lose money. Losses in fixed income can have disastrous effects on a portfolio because it’s rare that the return potential for the rest of your portfolio can make up for the loss. Every time we make an investment we ignore the potential return and focus attention on the credit worthiness of the business and its assets. After we assess the quality of the business and its risk, only then do we focus on our potential return. We only make an investment if we think the return adequately compensates us for the risk. Our focus on consistency is similar to the Kansas City Royals’ offensive strategy. By avoiding strikeouts and getting men on base, we strive to manufacture runs.

In today's low-rate world, investors reach for yield by taking on more risk. No investor can avoid risk altogether. Our approach centres on understanding the risks that we’re taking and properly quantifying both the probability that we’re wrong and the magnitude of that loss should it occur. Our credit work is the foundation of the approach and our assessment of risk. Twelve months ago, the U.S. High-Yield Index was yielding 10%. We were confident that the environment was ripe for opportunity and increased our allocation to specific high-yield investments. Today that same market has risen materially and now only offers a 6% yield. Today's higher prices and lower yields are decreasing our high-yield opportunity set, leading us to decrease our allocation to the sector.

Despite their focus on "small ball", the Kansas City Royals also hit home runs. If the pitcher makes a mistake, a professional baseball player can certainly hit a home run. If the environment changes professionals must refine their strategy. During periods of volatility, investors are bound to make mistakes. Redemptions from investment funds may lead to forced selling or an abundance of fear simply pushes many to sell anything perceived to be risky. If the market offers up the proverbial “fat pitch”, we’re happy to swing for the fences if we believe the potential return is adequate and that our credit analysis gives us confidence we’re investing with a margin of safety. This time last year we felt we had several opportunities to make equity-like returns by investing in several fixed-income opportunities and we invested in bonds trading at stressed prices. Our credit analysis and our ability to think long term gave us the edge we needed to swing at the fat pitch.

Today's credit environment of high prices and low yields is an opportune time to highlight our strategy of consistent returns. In a market that some classify as priced to perfection we must ensure that we don’t reach for yield. All market environments provide unique situations with interesting investment opportunities, but today they’re much harder to find than a year ago. While many fixed-income investors focus on when the next U.S. rate hike will occur, we’re spending our time on credit-specific issues like:

Can a company buy orphaned home health care products and re-invigorate the brands?

Can a casino in an oil-producing region continue to steal share throughout a downturn?

Do pancakes have an international appeal allowing for growth with little capital investment?

While the environment that we operate in will change, our investment approach never will. We will strive to focus our attention on thorough credit analysis where we think we have an edge. Consistency of returns and risk-first analysis should enable us to continue to generate pleasing returns. In sports I can cheer with my heart and hope the Blue Jays’ line up can continue to hit home runs, but in investing I won’t be persuaded. Rational capital allocation will always take precedent over reaching for yield. Like the Kansas City Royals we’ll shun the highlight reel, choosing a strategy that we think best aligns us with our primary goal of long-term investment results at the top of our peer group.

iJames Montier, Behaving Badly, February 2, 2006.