Things are always bad…or so you might believe – 3rd quarter, 2018

These days it seems like we live in a doom-and-gloom world. Everywhere you turn, there’s negative news slapping you in the face, and it’s made worse by uninformed, emotion-prone people who take this negativity to the next level. Here’s a great example to consider.

Of the 2,000 people who recently took a survey commissioned by robo-advisory firm Betterment, 48% thought the stock market had not gone up at all in the past 10 years, while 18% said it had gone downi. Perhaps the results provide insight into the folly of using a robot to be one’s financial advisor, but we think there is something else at work here. Below is what actually happened to the stock market:

S&P 500 Index price levels

Oct. 1, 2007 to Sep. 30, 2018

Source: Bloomberg LP. In US$. The S&P 500 Index is a broad-based market-capitalization-weighted index of 500 of the largest and most widely held U.S. stocks.

Of course the market is up substantially (426%ii) from the bottom of the crisis on March 9, 2009, but it’s also up 203% from the day Lehman Brothers failed (September 15, 2008)iii. From the previous peak, on October 9, 2007, the stock market is up 137%iv. Any way you slice and dice this one, the market definitely ain’t flat or down over the past decade.

What news sources do these survey participants consume and why would two-thirds of them be so wrong?

Bad perceptions amid a climate of fear

For many investors, the perception of bad things is often much higher than reality. Biases that may have been helpful to our ancestors when they were only dealing with dribbles of information can become a detriment in today’s world overloaded with information, data, videos and social media.

The proliferation of ominous-sounding online news makes every scary or negative event seem like it could happen to you or makes it seem far more prevalent than it really is. For example, we’re afraid of shark attacks even though we’re significantly more prone to die from choking on food, drowning or heatstrokev. Similarly, headlines may warn that we’re twice as likely as before to contract a certain disease, but in actual terms the risk has inched from 0.01% to 0.02% (although that’s not as provocative as “double the risk”). Content that can evoke your fears gets your attention. That’s the hook and that’s the goal of many content creators in this click-bait society. The result is most people think things are worse than they really are.

Want some proof?

Consider the following three questions:

1. How many of the world’s one-year-old children today have been vaccinated against some disease?

20%

50%

80%

2. In all low-income countries across the world today, how many girls finish primary school?

20%

40%

60%

3. Of the world population, what percentage lives in low-income countries?

(This is not a multiple-choice question.)

Where did these questions come from?

These questions were taken from a recent book written by Hans Rosling called Factfulness. Rosling passed away in 2017 having just completed the book. He was listed as one of Time magazine’s 100 most influential people in the worldvi and his TED talks have been viewed more than 35 million timesvii.

He wrote that this book was “my last battle in my lifelong mission to fight devastating ignorance.” The questions above are from surveys that he had been conducting for years. The results continue to shock most readers.

The survey says...

Let’s look at question one, about vaccination. Almost all children (roughly 80%) are vaccinated in the world today, which means almost all human beings have some access to basic modern health care. But only 13% of respondents got the answer right. In Canada, 15% of respondents were correct. Just 6% of respondents in Japan, Germany and France got the answer right. With only three options on a multiple-choice question, a monkey throwing darts should score 33%. Why do 87% of respondents think things are worse than they actually are?

For question two, about girls finishing primary school, only 7% picked the correct answer! Even worse, a mere 5% of Canadians got the answer right. The truth is that 60% of girls finish primary school in low-income countries. Why do 93% of respondents believe things are worse than they are?

For question three, the average guess was that 59% of the world’s population lives in low-income countries. The right answer is 9%. In 1997, 42% of the population of both India and China were living in extreme poverty. By 2017, the number had dropped to 12% in India and a miniscule 0.7% in China! Why do we look at low-income countries through the rear-view mirror?

The case for "factfulness"

The ongoing findings of Hans Rosling’s research have shown that every group of people he had asked believed that the world is more frightening, more violent and more hopeless – in other words, more dramatic – than it really is.

For example, survey participants in 30 countries were also asked the following question: Do you think the world is getting better, getting worse or staying about the same? In every country, the majority of participants said the world is “getting worse.” About 60% of Canadians said things are getting worse.

An inability to control our appetite for the dramatic prevents us from seeing the world as it is. The author’s contention is that factfulness, much like a healthy diet and regular exercise, can and should be part of your daily life. Start to practice it and you’ll be able to replace your overdramatic worldview with a worldview based on facts. It would certainly be nice if Rosling’s book was required reading in high school.

What’s the cause of this negativity?

We have a tendency to notice (and be affected by) the bad more than the good. The people who create content rely on drama and controversy to get your attention. When you hear about something terrible, you should consider whether you would’ve heard about it if there had been a similarly sized positive development instead. Would you read stories about people not getting attacked by sharks or would you want to know how many flights landed safely yesterday? Of course not – bad news sells. We wrote a commentary for the third quarter of 2010 entitled “Is there news in good news?” that addresses this phenomenon of fixating on the negative over the positive.

The media and other content creators can’t waste time on stories we won’t read. For a tweet or video to go viral, drama has to be elevated to grab your attention. Your continuous absorption of that drama causes the less prevalent to feel more prevalent, the things far away to feel near and the unusual to feel usual. The net result is an overdramatic and clearly distorted worldview.

Drama is a constant

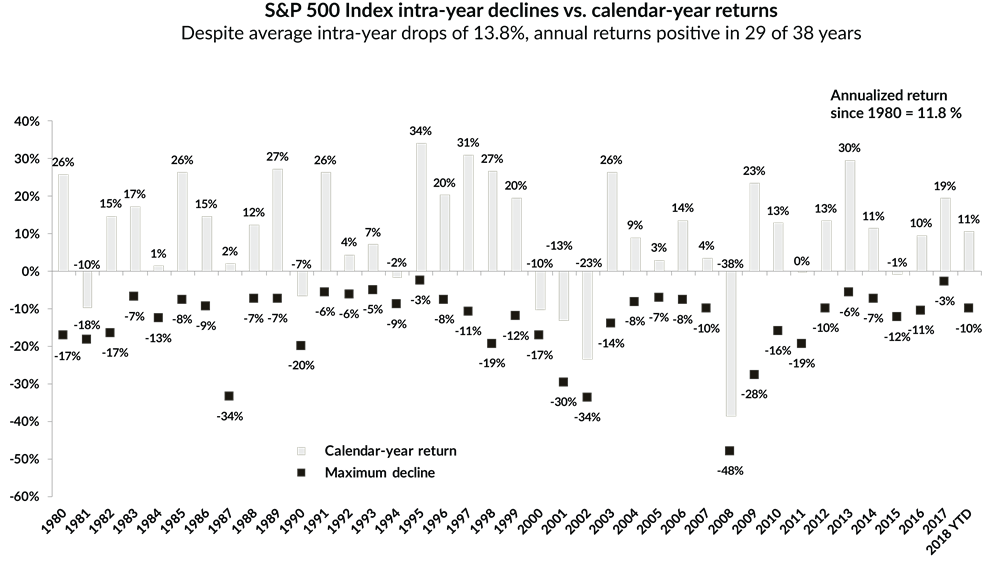

Bringing this discussion back to the world of investing, the drama is certainly never far away when it comes to the stock market and the minds of investors. Below is a chart of the S&P 500 Index going back to 1980. It shows the annual returns and also shows the annual drawdowns (i.e. how much the stock market went down at some point during the year). Look closely at the drawdowns the market has experienced each and every year. During those drops in each year there was some type of drama. A narrative took hold, fear increased and those who succumbed to the fear would have ended with undesirable results. Note that had an investor simply bought an index proxy in 1980 and held it these past 38 years through all the market drama, they would have made 11.8% per year.

Source: Bloomberg LP. As at September 30, 2018. Returns based on price index only, excludes dividends and in US$. Maximum decline is the largest intra-year market drop from a peak-to-trough during the calendar year. Calendar-year returns shown from 1980 to 2017. Annualized return includes reinvestment of dividends. The S&P 500 Index is a broad-based market-capitalization-weighted index of 500 of the largest and most widely held U.S. stocks.

Armed with the fact that the market historically has experienced an average drawdown of 13.8% every year, and that paying a lower price for an investment is better than paying a high price for that same investment, there should be no drama in the head of any strong investor the next time the market moves lower. The drawdowns should be looked at as a constant, something that has taken place every year. Knowing that it happens every year and will happen again next year will make it harder to overreact and easier to act on good investment opportunities.

Understanding these two simple facts leaves less room in one’s head for the drama. Adding in some other facts and insight about the individual businesses you own leaves even less room for the drama that will be created around you at the time, giving you a much higher probability of doing something intelligent. In fact, the lower prices will make it easier to do something intelligent with your investments as well.

The gift that keeps giving

An overly dramatic worldview, combined with people’s (and investors’!) tendency to think things are worse than they really are, can also be described as the gift that keeps giving.

In order to pay a lower price for a great business, you need insight into an investment that others don’t share. For example, you must form your own idea on how a business is poised to grow in the future, to the surprise of others today. When we find this uncommon or unique idea, we call it our “proprietary view.” Finding those ideas would be difficult in a world where investors tended to believe things were better than they really are.

Ignorance is bliss?

We’ve added 15 businesses to Cymbria this yearviii. In each situation there was either fear, uncertainty or an overly dramatic view about a short-term issue, causing pessimism about the company’s long-term future. For example, we bought a toy manufacturer during the noise of Toys ‘R’ Us shutting its doors. We bought a real estate company where struggling Sears was a major tenant. And we bought a kitchen equipment manufacturer with fantastic long-term growth prospects after it had experienced a few weak quarters. Each had long-term prospects that we felt were not reflected in the stock price.

It’s unfortunate that ignorance makes many people think things are worse than they really are, but it’s very fortunate that it can also happen with their views on individual stocks. Proprietary views on wonderful businesses would be hard to come by without it and our ability to provide you with pleasing investment results would not exist.

iiSource: Bloomberg LP. Total cumulative return in US$.

iiiSource: The New York Times

ivSource: Bloomberg LP. Total cumulative return in US$.

vSource: Mosher, Dave. "Here's how often Americans really die from shark attacks." BusinessInsider.com. May 12, 2017. https://www.businessinsider.com/shark-attack-death-statistics-2017-5. Accessed on October 1, 2018.

viSource: Time. "The World's 100 Most Influential People: 2012 - Hans Rosling." Time.com. http://content.time.com/time/specials/packages/article/0,28804,2111975_2111976_2112170,00.html. Accessed on October 1, 2018.

viiSource: Rosling, Hans, Anna Rosling Rönnlund and Ola Rosling. "Cultures, nations and religions are not rocks — they’re always changing." TED.com. May 25, 2018. https://ideas.ted.com/cultures-nations-and-religions-are-not-rocks-theyre-always-changing/. Accessed on October 1, 2018.

viiiBusinesses added to Cymbria from December 31, 2017 to September 30, 2018.