The Opportunity in allocation - 3rd quarter, 2021

One of the strongest but often overlooked features of our balanced Portfolios is their asset allocation. The ability for a team of investment professionals to tilt their portfolio to where they’re seeing the best opportunities has the potential to add considerable value. That value isn’t always easy to assess at a particular point in time, but reviewing past periods can be illustrative.

The fixed income side of our balanced Growth & Income Portfolios started 2020 with a yield-to-maturity (YTM) of around 4% and a duration under two years.i If you asked a prospective investor what their return expectations for their portfolio were, 4% would be a good starting point. A static portfolio that simply re-invests in itself until maturity would get you that result, but our portfolio is anything but static.

The Investment team spends their days looking at different investments and comparing their prospective risk-and-return levels. Our opportunity set changes every day based on individual bond price movements, new ideas and changes in investor sentiment. There are times when we see tremendous value in high-yield bonds and other times when we think investors are better suited to own more investment-grade issues.

While practising our investment approach, we don’t make top-down calls to drive the allocation between the two parts of the fixed income market. Rather, the allocation is more an output of our bottom-up approach. If lower-rated bonds of similar business quality don’t pay substantially more than their investment-grade counterparts, it’s natural that a portfolio’s weight in high-yield bonds would shrink. The opposite is also true.

The 18 months following the start of 2020 are a great example of our approach to asset allocation at work and the value that this approach can bring to clients. Let’s revisit what client expectations typically were at the beginning of 2020. Our 4% YTM at the time was driven by an allocation of 60% investment-grade bonds and 40% high yield.ii The effects of COVID-19 on the market were felt in March, with the YTM on high-yield bonds jumping from 6% to over 11%.iii This volatility created opportunity as bond prices fell and yields rose.

As you can imagine, we got to work and started finding bonds whose price had fallen but whose underlying creditworthiness remained strong. We funded those new buying opportunities by selling investment-grade bonds. Our thesis on these bonds was still intact, but their relative attractiveness had changed greatly. Our keen understanding of day-to-day price changes allows us to react quickly to changes in the relative value between investment-grade and high-yield opportunities. We think that’s most efficiently done at a bottom-up level and difficult for the average investor to recreate on their own.

Our hard work increased the high-yield allocation from 40% to 43%.iv At first glance that doesn’t sound like a material change, but think about what was happening to our existing positions during this time period. The high-yield investments that we held at the beginning of March declined approximately 14% during the month.v If we hadn’t done anything, the allocation would have fallen to about 34% of the fixed income portion of the Portfolio. Our buying actually increased our high-yield weight by more than 25% (34% to 43%), a large change in such a short period of time.

We felt confident that our actions would add value to the Portfolio, but that can only be confirmed with the passage of time. The investor who hoped we would return 4% over the next 18 months actually experienced a total return of 13.5% (or 8.8% on an annualized basis).vi Our ability to allocate between investment-grade and high-yield bonds during a period of heightened volatility was a significant driver of that return.

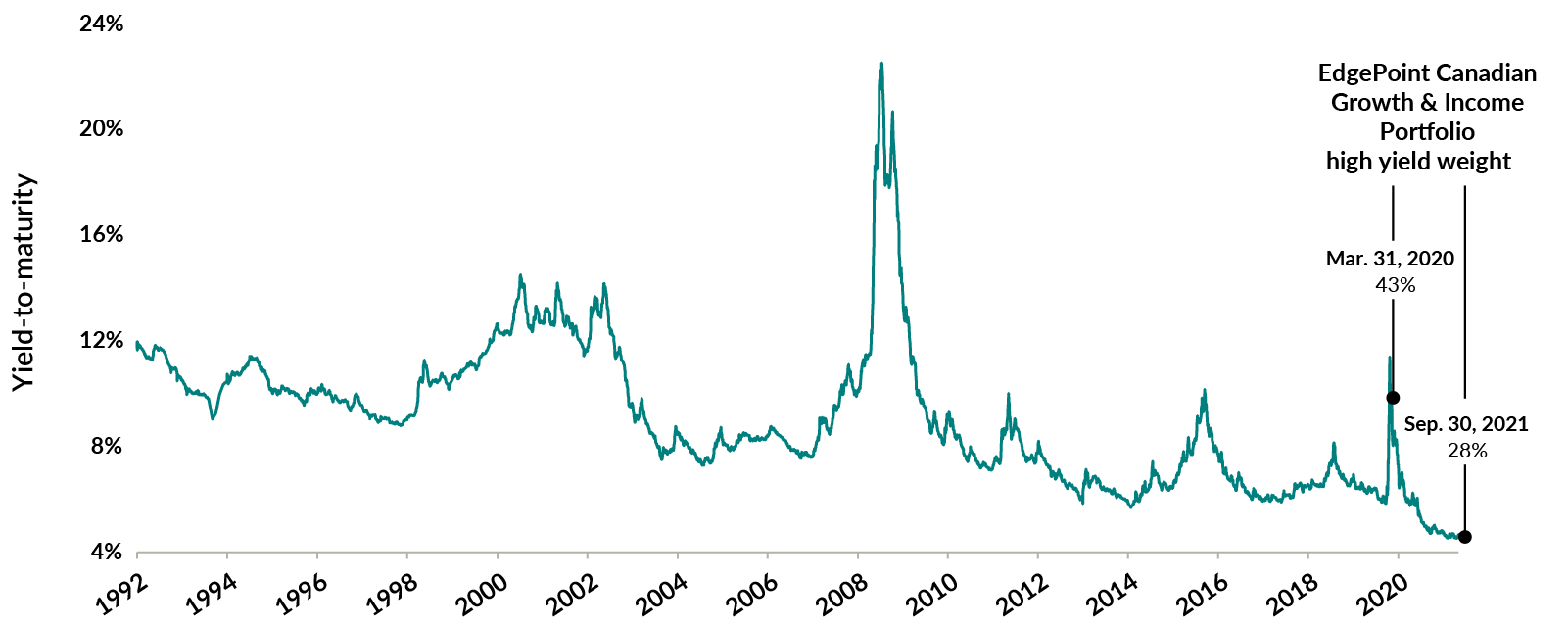

It’s interesting to observe how the allocation to high yield has trended since March 2020. It peaked at 43% and now sits at 28%, which is historically a low weight for us.vii The historically low YTM for high-yield bonds was the driving force for this low allocation. The following chart shows the historical YTM for high-yield bonds. The YTM recently hit an all-time low of just over 4.5%.viiii While we don’t buy the market, it’s indicative of the pool we’re fishing in. Today we’re struggling to find interesting high-yield bond opportunities. We don’t know how long this scenario will last, but we’re happy to increase our weighting in investment-grade positions as we wait for new opportunities.

ICE BofA US High Yield Index yield-to-maturity

May 31, 1992 to Sep. 30, 2021

Source: Bloomberg LP. May 31, 1992 was the launch date of the index. The ICE BofA US High Yield Index tracks the performance of high-yield corporate debt denominated in U.S. dollars and publicly issued in the U.S. domestic market. Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return.

A keen observer might ask how we’re thinking about the high-yield positioning in the EdgePoint Variable Income Portfolio,ix as it has historically had a large allocation. We continue to find unique ideas that are off the beaten path and appropriate for this Portfolio. It was purposely structured differently than our Growth & Income Portfolios so that it could take more concentrated investment positions in smaller issue sizes. Its core holdings in the bonds of Optiva, AutoCanada and Cineplex are examples of large weights that capitalize on the Portfolio’s flexibility and nimbleness.

The asset allocation within the EdgePoint Variable Income Portfolio is also an important part of our investment approach. Its flexibility allows us to invest across the capital structure with weightings in loans, bonds, preferred shares and convertibles. We recently found opportunities in select convertible bonds and its allocation now sits at 20% of the Portfolio.x Convertible bonds are a great fit for our investment approach. Their hybrid nature has a credit component as well as a call option on the underlying equity. Every investment we make starts and ends with valuing a business. This approach is well suited to finding unique ideas in convertibles that, over time, can add value to the EdgePoint Portfolios.

The optionality that comes from being able to allocate amongst different segments of the fixed income market can also add value to our Portfolios. During periods like today, it allows us to position the Portfolios defensively and ensure we’re not reaching for yield. During periods of increased volatility, it also lets us reposition the Portfolios and play offense. Our focus on continually evaluating the most attractive opportunities at the time drives our allocation decisions, which helps clients succeed and get to their Point B.

| Performance as at September 30, 2021 Annualized, total returns, net of fees | YTD | 1-Year | 3-Year | 5-Year | 10-Year | Since Inception* |

|---|

| Performance as at September 30, 2021 Annualized, total returns, net of fees | YTD | 1-Year | 3-Year | Since Inception* |

|---|

ii EdgePoint Canadian Growth & Income Portfolio fixed income allocation and yield to maturity as at December 31, 2019. EdgePoint Canadian Growth & Income Portfolio fixed income performance figures are shown for illustrative purposes only and aren’t indicative of future performance. They aren’t intended to represent returns of an actual fixed income fund as they weren’t investible. EPCIP fixed income performance figures are gross of fees, in local currency and approximations calculated based on end-of-day holdings data (actual trading prices not captured).

iii The ICE BofA US High Yield Bond Index’s yield-to-maturity was 6.04% on December 31, 2019 and 11.41% on March 23, 2020. The ICE BofA US High Yield Index tracks the performance of high-yield corporate debt denominated in U.S. dollars and publicly issued in the U.S. domestic market. Investors tend to seek safety during periods of volatility. The sale of high-yield bonds, generally seen as less “safe”, results in dropping prices and increasing yields.

iv The EdgePoint Canadian Growth & Income Portfolio fixed income holdings had a 40% allocation to high-yield bonds on December 31, 2019 and a 43% allocation as at March 31, 2020.

v EdgePoint Canadian Growth & Income Portfolio (EPCIP) high-yield securities. Total returns in local currency. Period measured from February 28, 2020 to March 31, 2020. EPCIP high-yield performance figures are shown for illustrative purposes only and aren’t indicative of future performance. They aren’t intended to represent returns of an actual fixed income fund as they weren’t investible. EdgePoint Canadian Growth & Income Portfolio high-yield performance figures are gross of fees, in local currency and approximations calculated based on end-of-day holdings data (actual trading prices not captured).

vi 13.5% represents the cumulative return of the fixed income portion of the EdgePoint Canadian Growth & Income Portfolio (EPCIP). EdgePoint Canadian Growth & Income Portfolio fixed income performance figures are shown for illustrative purposes only and aren’t indicative of future performance. They aren’t intended to represent returns of an actual fixed income fund as they weren’t investible. EPCIP fixed income performance figures are gross of fees, in local currency and approximations calculated based on end-of-day holdings data (actual trading prices not captured).

vii EdgePoint Canadian Growth & Income Portfolio fixed income high-yield allocation was 43% on March 31, 2020 and 28% on September 30, 2021.

viii All-time low for the yield-to-maturity of the ICE BofA US High Yield Index occurred on September 15, 2021.

ix See the Offering Memorandum (“OM”) for more details on the EdgePoint Variable Income Portfolio (“Portfolio”). This document is not an invitation to invest in the Portfolio nor does it constitute a public offering of sale. Applications for purchases in the Portfolio will only be considered on the OM’s terms, which may be obtained from your financial advisor. Each purchaser of units in the Portfolio may have statutory or contractual rights of action. The information in this document is subject to change without notice. The Portfolio is sold via OM and pursuant to exemption from prospectus requirements. As such, the Portfolio is not available to the general public and is only available to, for example, accredited investors, within the meaning of National Instrument 45-106 — Prospectus Exemptions. Please read the OM before investing.

x As at September 30, 2021.