The negative art of investing – 1st quarter, 2021

Ben Graham, a famous investor, once described the process of fixed income investing as a “negative art. It is a process of exclusion and rejection, rather than of search and acceptance.”

This is an apt description of our investment process. The return from your bond investment is capped at the interest you receive and the return of your principal. Your EdgePoint Investment team spends their days not only uncovering undervalued investment opportunities, but also making an active choice to avoid investing in many businesses and areas of the market to which others may feel comfortable lending money.

It’s been one year since the world and the financial markets were disrupted by COVID-19. I think it’s a good time to review how our investment approach remains consistent during a period of high volatility and how we seek to capitalize on those periods in our own way.

People often ask us for examples of interesting ideas that we’re finding, but rarely are we asked about areas of the market that we’re avoiding. Over time, the areas that we avoid seemingly add as much value as those that we choose to invest in, highlighting how apt the “negative art” description truly is.

Most investors hold a mix of equity and fixed income investments in their portfolio. The popularity of balanced funds highlights that many investors strive to have an asset mix that includes fixed income securities, and the popularity of our Growth & Income Portfolios echoes that sentiment. Textbooks have been written about the benefits of asset allocation and it seems that many investors now believe their balanced funds will always generate a pleasing return for them. While I certainly agree that a mix of fixed income and equity investments is an important building block for a portfolio, I believe it’s simply a starting point. A pleasing return isn’t inevitable – it’s dependent on the quality of the investments and the price that you pay for each one. Recent history has made it far too easy for investors to actively debate the merits of owning individual stocks and then simply assume that the fixed income portion of their portfolio will make them money.

I can’t blame them. For many of our clients, fixed income investments have always seemed to do well. In fact, simply owning the Canadian Broad Market Fixed Income Index over the last 20 years would have generated an annual return of 5.1%.i That is a solid return for the “less risky” part of a client’s portfolio. Now is the time to take a step back and ask yourself whether that type of return expectation can continue going forward. Today, that index is yielding 1.7%, making those return expectations almost impossible.ii The tailwind of falling interest rates is at the very least not as strong as it once was, and has recently started to become a headwind.

The challenges of today’s rate environment

To get a sense of how the average investor is positioning their fixed income investments, we pulled data on some of the largest fixed income portfolios in the country. What we found raises some concerns and is shown below.

Source: Morningstar Direct, fund websites. AUM and 5-year return as at March 31, 2021. The listed funds represent some of the largest funds in the Canadian Fixed Income category where duration and yield-to-maturity were available. Latest available MER, duration and yield-to-maturity taken directly from fund websites if disclosed or Morningstar Direct if not. Duration is a measure of a debt instrument’s price sensitivity to a change in interest rates. The higher the duration, the more sensitive a bond’s price is to changes in interest rates. Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return. "Return % not received by client” is calculated as the MER divided by the YTM of the fund and assumes a one-year holding period. “Years of return lost if rates rise 1.5%” was calculated as the “% loss if rates rise 1.5%” divided by the “Net Return”. The U.S.10-year Government Bond was used to represent rate increases in the hypothetical performance examples above.

Tens of billions of dollars are invested in bond portfolios that, on average, have a yield of 1.99% and a duration (i.e., interest-rate sensitivity) of almost eight years. After deducting management fees, these portfolios, on average, are set to earn a yield-to-maturity of 71 basis points (i.e., 0.71%). That’s barely better than what you can currently earn in most bank accounts, and the future is not certain, either. A few future scenarios could play out. If interest rates stay the same, these portfolios are poised to earn a return below inflation. If interest rates increase, they’re likely to experience material mark-to-market losses and negative real returns. The scenario that’s required to earn a pleasing return occurs if interest rates fall. As vaccination announcements gave the world and financial markets some cause for optimism, interest rates in North America have risen. Should you position your fixed income investments to only earn a pleasing return if rates fall back to levels seen when we were surprised by a global pandemic? That’s certainly possible, but I struggle to comprehend why that should be the base case going forward.

We have chosen to not to reach for yield by increasing our duration and stuck to where we think we have an edge. Fundamental credit work has been the basis for our investment approach since inception and over time it has benefited our clients. It doesn’t work every month, quarter or even every year, but over time we have consistently added value to our clients’ portfolios. Our application of the “negative art” has been to only invest in businesses that we understand and in investments where we think there is a compelling ratio of reward to risk. Investing in a manner that loses money under both the status quo and a return to normalcy isn’t attractive to us.

This time last year, the pandemic roiled the capital markets. During the first quarter of 2020, funds that were positioned like the ones in the previous table benefitted tremendously over the short term. The fear surrounding COVID-19 sent rates spiralling lower and drove the price of longer-duration bonds upward. Our fixed income investments underperformed during this period as our short-duration investments didn’t receive the same benefit.

But a key tenet to our approach is taking advantage of market volatility. Quick declines in interest rates are often coupled with increased levels of volatility as markets struggle to digest news like a global pandemic. We have always embraced this volatility as it provides opportunity. Bond prices often change faster than business fundamentals and a thorough analysis often uncovers ideas where the market is trading on fear rather than fact.

Taking advantage of market opportunities

Looking at the changes in our portfolio composition below highlights that as prices fell, our opportunity set increased dramatically. Our low duration, the very portfolio characteristic that caused our short-term underperformance, gave us the ability to invest in a market that had many more compelling opportunities.

Source: Bloomberg LP.

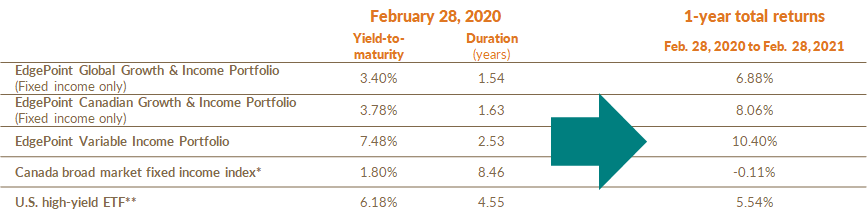

We reinvested our coupons and maturing principal payments, and re-positioned the Portfolios into our best ideas over the following months. Falling rates temporarily helped long-duration portfolios but those lower rates led to lower-yielding future opportunities. Our approach led us to more attractive future opportunities. It was not a smooth ride but our process added value. In one year’s time the results became clear and are shown below. We believe that every investor in our Portfolios should have a timeframe that’s longer than one year.

Performance as at March 31, 2021. Annualized total returns, net of fees, in C$

EdgePoint Global Growth & Income Portfolio, Series A - YTD: 7.25%; 1-year: 32.63%; 3-year: 4.20%; 5-year: 7.84%; 10-year: 9.47%; Since inception (Nov. 17, 2008): 11.42%. EdgePoint Canadian Growth & Income Portfolio, Series A - YTD: 9.29%; 1-year: 42.64%; 3-year: 5.64%; 5-year: 7.34%; 10-year: 6.33%; Since inception (Nov. 17, 2008): 9.71%. EdgePoint Variable Income Portfolio, Series PF - YTD: 6.08%; 1-year: 35.15%; 3-year: 6.59%; Since inception (Mar. 16, 2018): 6.50%. ICE BofAML Canada Broad Market Index - YTD: -5.34%; 1-year: 1.20%; 3-year: 3.59%; 5-year: 2.75%; 10-year: 3.99%; Since inception (Nov. 17, 2008): 4.48%.

*ICE BofA Canada Broad Market Index

** iShares U.S. High Yield Bond Index ETF

Note: The fixed-income portions of EdgePoint Global and Canadian Growth & Income Portfolios aren’t investible. They’re a best-estimate of the Portfolios’s fixed-income performance.

Source: Bloomberg LP. Index returns are total returns in C$. EdgePoint Growth & Income Portfolio total returns in local currency. EdgePoint Growth & Income Portfolios fixed-income performance figures shown for illustrative purposes only and aren’t indicative of future performance. They aren’t intended to represent returns of an actual fixed-income fund as they weren’t investible. EdgePoint Growth & Income Portfolio fixed-income performance figures are gross of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). The ICE BofA Canada Broad Market Index tracks the performance of investment-grade debt publicly issued in the Canadian domestic market. The iShares U.S. High Yield Bond Index ETF is hedged in C$ and seeks to track the Markit iBoxx USD Liquid High Yield Total Return Index, a US$-denominated high-yield corporate bond index. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed-income comparability from the index.

We continued to focus on corporate bonds and we aren’t alone in that thought. Many investors have chosen to invest in the investment-grade and high-yield markets as a way to reach for additional yield. What does differentiate our approach is our willingness to ignore ideas that many investors are clamouring for. Take a look at three of the largest names in the high-yield index.

Source: Bloomberg LP. Yield-to-worst is a measure of the lowest possible yield an investor would receive for a bond that may have call provisions, allowing the issuer to close it out before the maturity date.

These are fine businesses but their low yields don’t leave much room for error. A great deal can happen over the next several years and we think we can find more favourable ideas because we’re willing to look different. Finding unique ideas in underfollowed parts of the market is a necessity at times like this. A thorough fundamentally based investment approach will help uncover opportunity where the market sees risk. Smaller issue sizes that a large asset manager can’t invest in, such as unrated bonds and even the Canadian convertible bond market, are fertile hunting grounds for us, offering less competition from others. These are areas where we have found more attractive opportunities and we do not believe they come with increased risk. Looking different is not a risk to those who trust our investment approach. The benefits of doing your own credit work and thinking independently are reflected in the healthy yields below. Despite the continued environment of low interest rates, we believe our portfolio characteristics remain compelling (even our Growth & Income Portfolios which own investment-grade and high-yield bonds look attractive compared to the large high-yield issuers like the ones listed above).

Annualized total returns, net of fees, in C$. Performance as at March 31, 2021

EdgePoint Global Growth & Income Portfolio, Series A - YTD: 7.25%; 1-year: 32.63%; 3-year: 4.20%; 5-year: 7.84%; 10-year: 9.47%; Since inception (Nov. 17, 2008): 11.42%. EdgePoint Canadian Growth & Income Portfolio, Series A - YTD: 9.29%; 1-year: 42.64%; 3-year: 5.64%; 5-year: 7.34%; 10-year: 6.33%; Since inception (Nov. 17, 2008): 9.71%. EdgePoint Variable Income Portfolio, Series PF - YTD: 6.08%; 1-year: 35.15%; 3-year: 6.59%; Since inception (Mar. 16, 2018): 6.50%. ICE BofAML Canada Broad Market Index - YTD: -5.34%; 1-year: 1.20%; 3-year: 3.59%; 5-year: 2.75%; 10-year: 3.99%; Since inception (Nov. 17, 2008): 4.48%.

*ICE BofA Canada Broad Market Index

Source: Bloomberg LP.

Our emphasis on the negative art leads us to exclude investments that others are happy to own. This causes us to look different. Looking different has helped us over the long term but over the short term, anything can happen. We firmly believe that our mission would be a failure if our Portfolios earned a pleasing return but our clients did not. Many readers may think they are one and the same but, unfortunately, history has shown that many clients don’t earn the underlying return of the portfolio.

Behavioural biases are the main culprit. Investors often get scared and sell at the bottom, and are too enthusiastic and add when markets are frothy and expensive. Every investor should strive for the opposite behaviour, adding when there’s fear in the market and opportunities are plentiful.

There’s no question that this is difficult, but finding an investment approach that you trust and understand is the first step. Knowing how the portfolio manager will react during times of stress and what value they have added historically during these inflection points can give you the conviction to add to those portfolios when others are fearful. This can be difficult to do if the portfolio has leverage or is full of complex securities whose underlying value is hard to understand.

I believe it’s much easier to add to a portfolio if you’re invested in an approach that treats each investment as a business. Fixed income can sound complicated but at its core it’s simply a loan. Investors should take comfort that at EdgePoint, lending money to a business is a fundamental exercise based on what a rational business owner would do. If the price of a bond declines but its fundamentals don’t, it represents a prospective investment idea. Your conviction in our approach should be reinforced by the fact that internal EdgePoint partners are one of the largest owners of our Portfolios and frequently add to their personal positions during periods of volatility.

We think now is a crucial time for investors to examine how their fixed income investments are positioned. What has worked in the past may not work in the future. Long-duration portfolios and crowded credits are the norm. We think there are lasting benefits from an investment approach that embraces the negative art and uses fundamental analysis to invest like a rational business owner. Looking different should not be thought of as a risk, but as the foundation that will support future outperformance.

ii Ibid.