Play your part – the role of fixed income in your portfolio – 3rd quarter, 2020

Fixed income has always been part of the average investor’s portfolio. North America is aging, and many believe that as people get older, their allocation to fixed income should increase accordingly. This premise is founded on a sound rationale as older people typically need more income production from their investments and hope to build a portfolio that’s less volatile. Historically, this approach has worked well, but does that mean it will work going forward? Just because investors demand income and lower volatility doesn’t mean the market will provide it for them. Now could be a good time to start questioning conventional wisdom.

After all, we’re in the midst of an unprecedented time in most fixed-income markets and the meagre yields available today are materially different from what investors have seen before. Although investors need income, it’s become tougher to find. For decades, investors have loved balanced portfolios with the classic “60/40” split (i.e., 60% equity/40% bonds), as these balanced portfolios typically produced pleasing returns with less volatility than an all-equity portfolio. Everyone understands why the 60% equity allocation performed well over time, but most take for granted the fact that their fixed-income allocation has also done very well. The average annual return for holding 10-year U.S. government bonds from 1970 to 2019 has been 7.0%i. That’s a great return for the “less risky” part of a balanced portfolio.

That was then and this is now

History is a great starting point, but what every investor cares about today is the future. How are they going to compound their wealth in the years to come and can they expect a similar outcome to the past? Unfortunately, repeating the same pleasing returns looks close to impossible. Your starting point is very different today compared to any other time in modern history.

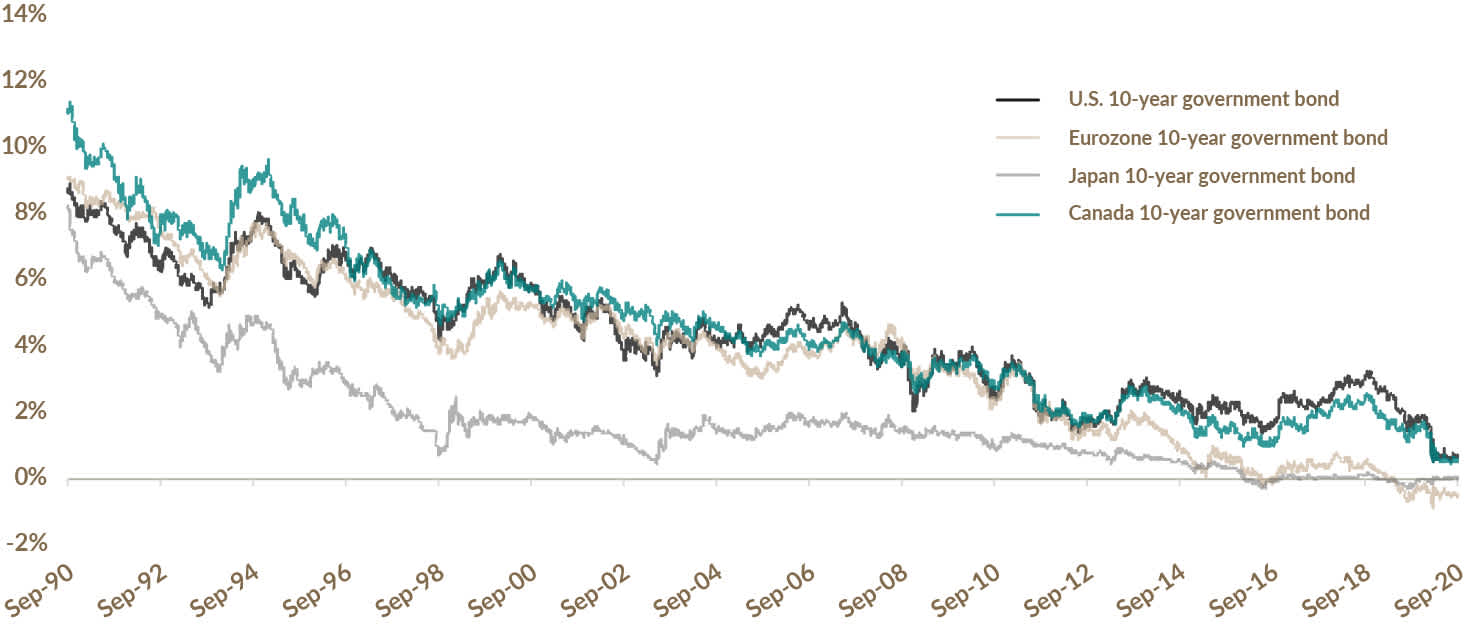

The chart below shows 10-year government bond yields over the last 30 years in the developed world. All countries display an eerily similar downward trend where rates have consistently moved lower. This trend provided a tailwind to bond returns for an entire generation of investors. As interest rates went lower, bond prices have risen, providing a significant source of return for most fixed-income asset classes. At my first job, I remember listening to a conversation between two traders who were snickering at the “paltry” 2% yield offered by 10-year Japanese government bonds. That seems like a lifetime ago and today such a yield is impossible to find in developed government bond markets.

10-year government bond yields

Sep. 30, 1990 to Sep. 30, 2020

Source Bloomberg LP. As at September 30, 2020.

Investors need to come to grips with the fact that the income production of a traditional fixed-income portfolio is now lower than most would have thought possible.

Extending the view past government bonds and looking at the ICE BofAML Canada Broad Market Index shows a similar trend. The 20-year return of 5.6% has been a rock in many Canadian investors’ portfolios, but today’s yield is only 1.2%ii. That’s better than a 10-year Canadian government bond yielding only 0.6%iii, but nowhere near the long-term return profile that investors have come to expect and need in their retirement portfolios. Investors must ask themselves if they can afford to compound a material part of their portfolio at a mere 1.2%. That yield seems unlikely to even keep pace with most people’s personal rate of inflation.

Balancing the ups and downs

There are other reasons to own fixed-income assets beyond income production. Historically, it’s provided an important source of diversification that has helped offset periods of decline in the equity markets. When we experienced declines in the equity markets, government bonds often increased in price. This provided stability to a balanced portfolio and even offered a powerful source of capital for investors allowing them to increase their allocation to equities at more attractive valuations.

| S&P 500 Index | Bloomberg Barclays US Treasury Bond 10-year Total Return Index |

|---|

Although this strategy worked in the past, now is a great time to ask if it will work in the future. Yields are much lower, prices are higher and there’s evidence that the price appreciation of government bonds may already be at their upper limit.

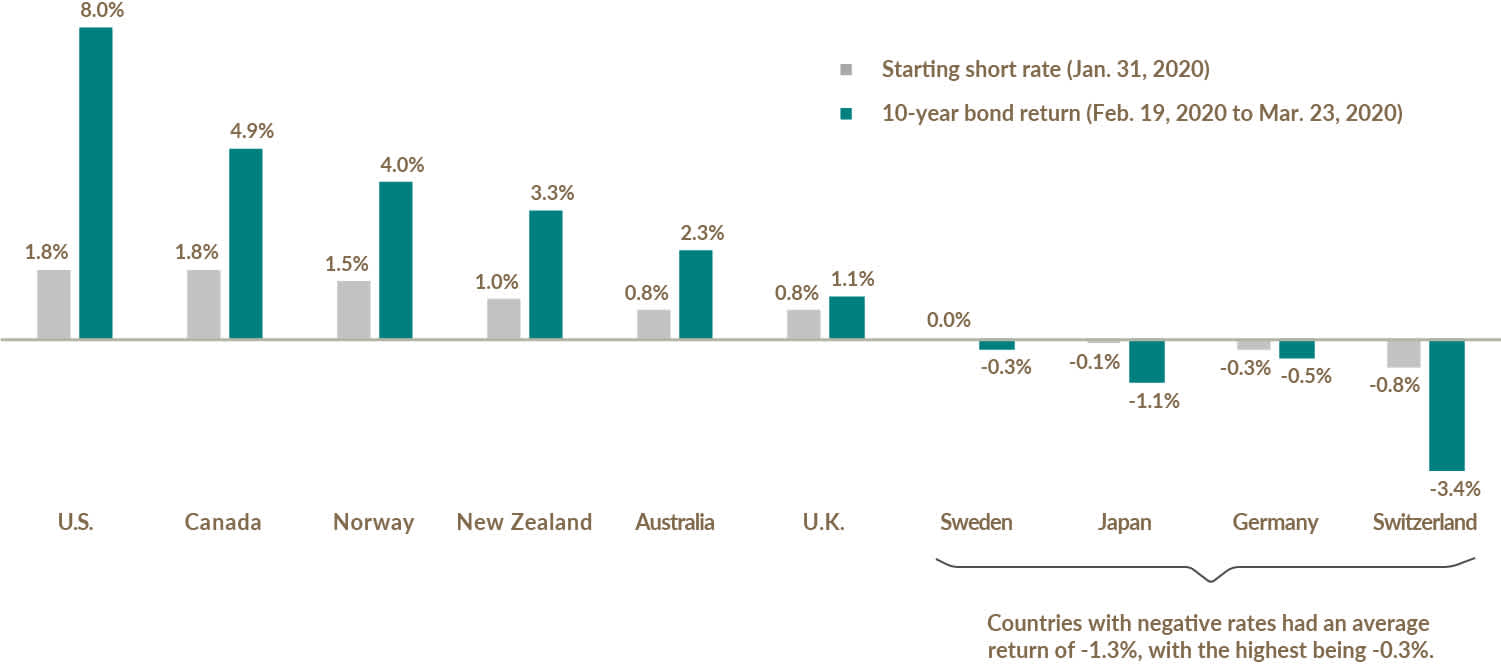

Looking back at how equity and fixed-income markets behaved during the onset of COVID-19 provides an interesting case study of how old paradigms can be challenged when rates begin at a yield that’s close to zero. GMO LLC is a well-respected asset manager that often creates thought-provoking investment material. GMO’s chart below should be of interest to all investors.

10-year bond returns and starting short rates for G10 countries during COVID-19 crisis

Feb. 19 to Mar. 23, 2020

Source: Inker, Ben, “2Q 2020 GMO Quarterly Letter”, https://www.gmo.com/americas/research-library/2q-2020-gmo-quarterly-letter/. G10, or Group of 10, countries are those that agreed to the General Arrangements to Borrow, an agreement that provides funds to the International Monetary Fund. Short rates as at January 31, 2020. 10-year bond returns from February 19, 2020 to March 23, 2020.

Uncertainty was high at the onset of the global pandemic and, as expected, equity markets sold off. What was unexpected is how bonds reacted in geographies that already had low interest rates. Rather than increase in price like they have historically, 10-year bonds in Sweden, Japan, Germany and Switzerland actually declined in price. So much for diversification!

The trend in this GMO chart is clear. Geographies with lower interest rates saw lower diversification benefits. Countries like Canada and the U.S. still had some benefit, albeit less than history has shown, but interest rates are now much lower in both countries than they were in the spring. Will this mute any future potential price appreciation if we experience more equity market volatility? Only time will tell, but in September, the S&P 500 Index had a peak-to-trough decline of almost 10% and, over that time period the current U.S. 10-year government bond actually fell in price, yet again failing to live up to its reputation as a source of stability and diversification during periods of market uncertainty.

Investors have become accustomed to fixed-income markets that have, in general, only increased in price over long periods of time. Is now the time to ask what happens if the trend reverses? We already showed the tailwind that we have experienced from declining rates around the globe. Do investors understand that a reversal of this trend now becomes a headwind for future returns? Not only have your prospective returns fallen if you own something that resembles the ICE BofAML Canada Broad Market Index, your interest rate risk for owning these assets has also increased close to an all-time high. Even strong believers in low interest rates need to question what happens if they’re wrong. There are no certainties in this world and betting that historically low interest rates will stay low forever is far from a sure thing. Less than a year ago, 10-year rates in Canada were 100 basis points (i.e., one percent) higherv. Is it crazy to think that rates could go back to that level over your investment time horizon? Any increase in interest rates would mean declining bonds prices, further inhibiting the ability of the average investor to compound their wealth.

If you begin to challenge the historic reasons for owning fixed income, should you also challenge how you’re invested in that space? It’s unlikely that most investors can handle the volatility of a portfolio that’s 100% equities, even if the long-term return potential may be appealing. Industry data shows that the average Canadian wants to own fixed income in some form. Roughly 68% of mutual fund assets are invested in portfolios that aren’t exclusively equities, with balanced funds being the largest portfoliosvi. These balanced funds are chock full of low-yielding, long-duration bonds. This is exactly the type of investment that we believe 1) offers little in the way of income generation, 2) may no longer be the diversifier it once was and 3) is subject to material risk should interest rates rise. Is that what the average investor needs today? Will that help them achieve their financial goals? The answer seems pretty obvious.

The EdgePoint approach to fixed income

We believe that corporate bonds are a more attractive alternative and have constructed a portfolio that’s focused on this segment of the fixed-income market. The extreme volatility that we experienced this year gave us an opportunity to invest in both investment-grade and high-yield bonds at spreads that we believe are highly attractive, especially when considering the alternatives available. This allowed us to create a portfolio with a yield that’s significantly higher than the benchmark index, but with much less interest rate risk (as shown below).

| Yield to maturity* | Duration** (years) |

|---|

*Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return.

**The duration is a measure of risk and measures the sensitivity of the price of a bond to a change in interest rates – the higher the duration the more sensitive the bond to a change in interest rates.Source: Bloomberg LP. As at September 30, 2020. The ICE BofAML Canada Broad Market Index tracks the performance of investment-grade debt publicly issued in the Canadian domestic market.

There’s no “free lunch” in capital markets and to generate anything over 20 basis points, which is the yield on a 1-year Canadian T-billvii, you need to take some form of risk. We choose to take credit risk because we have a specialized skillset in analyzing that type of risk. The EdgePoint investment approach is focused on analyzing businesses. We believe we have an aptitude for determining what drives a business, understanding its competitive advantages and judging its ability to service its obligations. This aptitude has provided investors with pleasing returns since our inception. While our path to those pleasing returns may not always be smooth, periods of volatility have enabled us to reposition the Portfolio and we believe this should add value in the coming months and years. Historically, it’s during these periods of volatility that we have added the most value, as shown below:

| Date* (decline bottom) | Portfolio | % Decline | 3 month -Returns following the decline bottom | 6 month -Returns following the decline bottom | 1 Year -Returns following the decline bottom | 3 Year -Returns following the decline bottom** | 5 Year -Returns following the decline bottom** | 10 Year -Returns following the decline bottom** |

|---|

* First decline: Nov. 17, 2008 to Dec. 31, 2008. Second decline: Jul. 7, 2015 to Jan. 20, 2016. Third decline: Dec. 31, 2019 to Apr. 6, 2020.

** Annualized.Source, EdgePoint: FactSet Research Systems Inc. As at October 6, 2020.These returns are shown for illustrative purposes only. They are not indicative of future performance or intended to represent returns of an actual fixed-income fund as they weren’t investible. Returns are gross of fees, in local currency and approximations calculated based on end-of-day holdings data (actual trading prices not captured). Source, index: Bloomberg LP. The ICE BofAML Canada Broad Market Index tracks the performance of investment-grade debt publicly issued in the Canadian domestic market. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed-income comparability from the index.

Investors who are willing to withstand a few short months of volatility have been rewarded over the long term.

Investing is all about assessing alternatives. Investors today are faced with daunting choices. They could change their tack given the uncertainty in this world and hide their money in the bank, which may help them feel like they aren’t taking any risk. Although this seems safe, earning close to 0% will not help you achieve your financial goals and only serves to lock in a negative real return after accounting for factors like inflation.

Investors could continue to do what they have in the past and buy something resembling the index. However, we think expectations need to be adjusted if this is your preferred route. Income production is far lower, there may be fewer portfolio benefits and it also exposes you to interest rate risk.

Alternatively, they could think about their fixed-income allocation in a different way. They could look at the benefits attained by an active manager like EdgePoint whose focus is on corporate bonds. Finding someone who has a proven skillset in navigating credit risk and taking advantage of volatility has added value over time. Again, it may not be the smoothest path, but it has historically created value and achieved the ultimate investing goal – compounding wealth over the long term.

iiSource: Bloomberg LP. ICE BofAML Canada Broad Market Index. Total return in C$ measured from October 1, 2000 to October 1, 2020. Yield-to-maturity as at September 30, 2020. The ICE BofAML Canada Broad Market Index tracks the performance of publicly traded investment-grade debt denominated in Canadian dollars and issued in the Canadian domestic market.

iiiSource: Bloomberg LP. Canada 10-year Government Bond yield as at September 30, 2020.

ivSource: Bloomberg LP. S&P 500 Total Return Index declined -9.52% from September 2, 2020 to September 23, 2020. Total return measured in US$. The S&P 500 Index is a broad-based market-capitalization weighted index of 500 of the largest and most widely held U.S. stocks.

vSource: Bloomberg LP. Canada 10-year government bonds yielded 1.69% on December 31, 2019. As at September 30, 2020 they yielded 0.56% for a total change of -1.13%.

viSource: The Investment Funds Institute of Canada (IFIC). As at August 31, 2020. 68% of mutual fund assets are from the following categories: Domestic Balanced, Global Balanced, Domestic Fixed Income, Global & High Yield Fixed Income, Specialty Funds and Money Market Funds. The remaining 32% of mutual fund assets are allocated to Domestic Equities, Global Equities, U.S. Equities and Sector Equity funds.

viiSource: Bloomberg LP. 20 basis points or 0.20% represents the yield on 1-year Canadian T-bills. As at September 30, 2020 in C$.