Love means never having to say you’re sorry (about short-term underperformance)

Roses are red

Violets are blue

We stay disciplined

And so should you

Last year we poured our hearts out to you on Valentine’s Day and we think it made our relationship stronger. We just wanted to make sure that you’re really in it for the long haul – through good times and bad – and not just into a short-term fling. Much of our relationship over the last few years has been smooth sailing, but once we hit some choppy waters towards the end of 2018, we didn’t want you to panic. We made sure you had a life vest (which you can get from your financial advisor who also acts as your therapist) to help rescue you from your own emotions. In love and investing, rocky periods are guaranteed. It’s during these times that we learn who our true partners really are.

| Return |

|---|

As you can see, our relationship has been tested along the way, but we never get discouraged when we hit the occasional bump in the road. In fact, we tend to thrive when the going gets tough. While many around us act emotionally, we take a rational approach and try to identify mispriced opportunities.

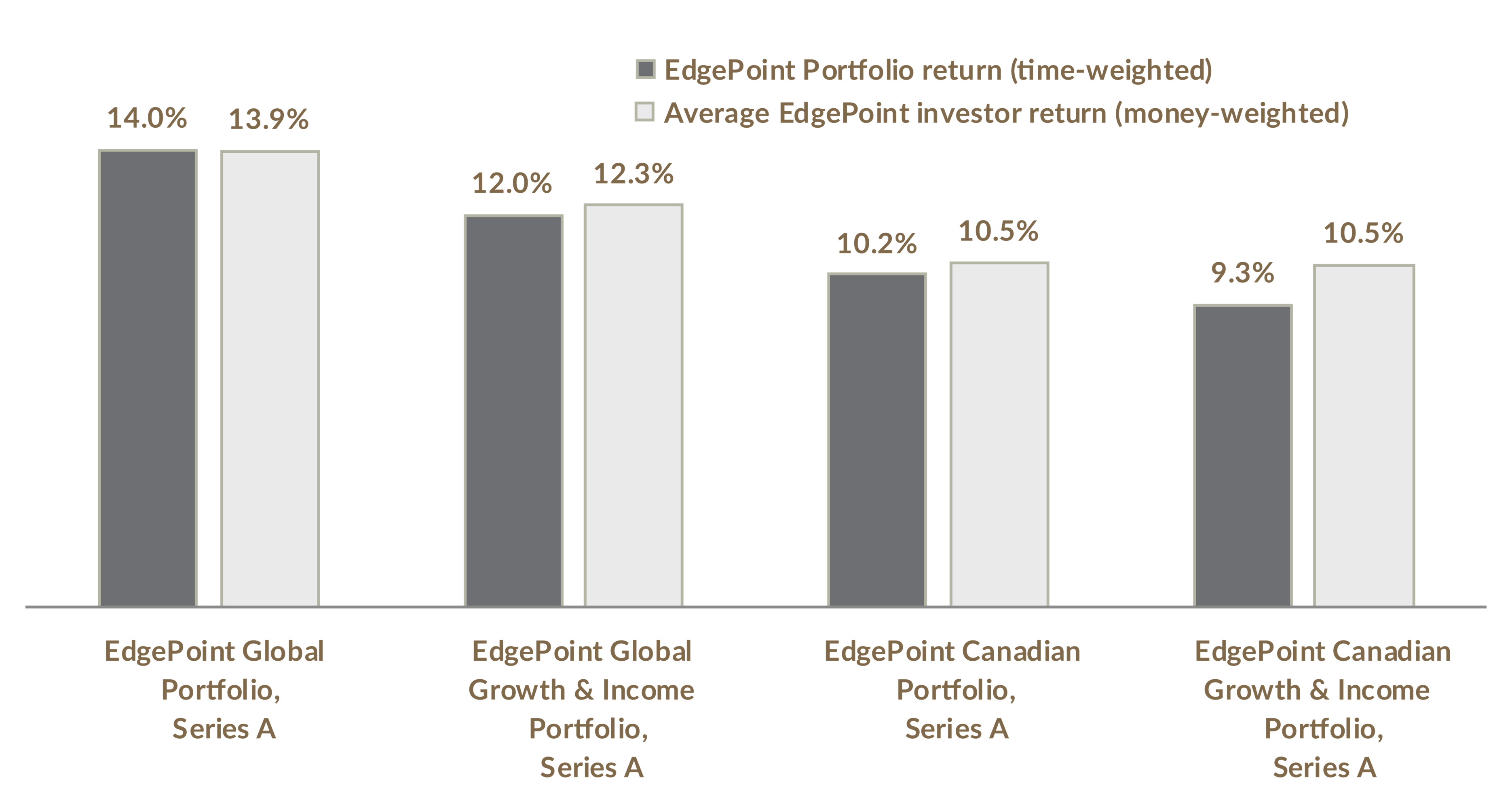

Recently we celebrated our 10th anniversary together and your devotion has been rewarded. Your average returns have closely matched the returns of our Portfolios, thanks to your long-term vision and willingness to stay the course.

Ten-year annualized returns by Portfolio

Dec. 31, 2008 to Dec. 31, 2018

Annualized total returns, net of fees, in C$ as at December 31, 2018

EdgePoint Global Portfolio, Series A

YTD: -3.42%; 1-year: -3.42%; 3-year: 8.51%; 5-year: 11.32%; 10-year: 13.98%; since inception: 14.92%

EdgePoint Global Growth & Income Portfolio, Series A

YTD: -1.18%; 1-year: -1.18%; 3-year: 7.30%; 5-year: 8.94%; 10-year: 11.99%; since inception: 12.28%

EdgePoint Canadian Portfolio, Series A

YTD: -16.34%; 1-year: -16.34%; 3-year: 4.21%; 5-year: 3.45%: 10-year: 10.15%; since inception: 10.54%

EdgePoint Canadian Growth & Income Portfolio, Series A

YTD: -10.36%; 1-year: -10.36%; 3-year: 4.74%; 5-year: 3.92%: 10-year: 9.26%; since inception: 9.30%

Source: EdgePoint Portfolio returns: Fundata Canada, net of fees. All returns annualized and in C$. Source, average EdgePoint investor returns: CIBC Mellon. Average EdgePoint investor returns are the average money-weighted returns net of fees across investors who held EdgePoint Portfolios, Series A from December 31, 2008 to December 31, 2018. EdgePoint Portfolio returns are time-weighted to best reflect the manager’s performance based on compound growth rate, which isn’t impacted by portfolio cash flows. Money-weighted average investor return takes into account the investor’s decision(s) regarding the timing and magnitude of cash flows and represents their personal rate of return.

When times got tough, not only did most of you hang in there with us, but some of you actually invested more in our relationship. In a world where investor returns are consistently negatively impacted by emotions and short-term thinking, we feel lucky to have found you.

No matter where you turn, the behaviour gap is prevalent. Most investors succumb to their emotions and aren’t able to capture the returns of the funds they hold. If only they could ignore the short-term noise and just focus on what really matters…

Behaviour gap

Average investor returns vs. actual returns by category

Source: Morningstar, Inc. DALBAR, Inc. FMMI Analysis. The average investor return analysis in the above chart is from three separate studies. Morningstar analysis includes all U.S.-based mutual funds (excluding fund of funds) in Morningstar fund categories shown. DALBAR analysis includes all U.S.-based equity “stock” mutual funds as reported in “Quantitative Analysis of Investor Behavior, DALBAR, Inc. 2017,”. ETF average investor returns are from a FMMI analysis and included all U.S.-based ETFs in the top quintile based on inflows in the categories shown. Return gap captures the return difference by fund category between the actual category return and what an average investor actually experiences. Differences arise due to timing of investor purchases and sells. As shown above the average investors return suffers due to poor timing of these purchases and sells.

We don’t let short-term distractions sway us from our long-term discipline, just like we won’t let the latest hot number break up our relationship. It won’t always be a sweet ride because we know we’ll underperform at times, but if we focus on the future, together we’ll get where we want to be.

Yours truly,

EdgePoint