About 15 years ago, a friend of mine suggested I attend the Wesco Financial Annual Meeting with him in Pasadena, California. At the time, the Chairman of the Board was Charlie Munger. The opportunity to listen to Mr. Munger answer questions about business, investing and life in general was the main reason most people attended. Charlie Munger was at the time, and continues to be, Warren Buffett’s partner at Berkshire Hathaway. Buffett has credited Munger with making him a much better investor over the years. Specifically, Munger helped him shift his investment strategy from buying deeply depressed, low-quality companies and instead turn his focus to higher-quality companies with defendable “moats” or barriers to entry.

Unlike the Berkshire Hathaway Annual Meeting which attracts tens of thousands of attendees, this meeting may have had a few hundred. Munger sat at the front of the room for four hours and answered questions from the audience. The final question of the day was a philosophical one: What was the most important lesson he had learned in his life so far? His answer had a profound impact on me.

Charlie said that in life most people try to figure out what they want and attain it. In his observation, the most fulfilled people he knew approached life differently. They figured out what they didn’t want out of life and tried to avoid it, and by default, got what they wanted. In a sense, he inverted his way of thinking compared to the majority of people. Here are some examples he gave:

The healthiest people he knew weren’t motivated to be healthy, but instead took care of their health because they didn’t want to die young of some preventable disease

His relationship with his spouse improved when he shifted from trying to make her happy to ensuring he didn’t do anything that made her unhappy

The wealthiest people he knew in life weren’t motivated to be rich, but instead, were motivated to not be poor

The last one is particularly interesting because Charlie Munger is a billionaire in his own right and counts Bill Gates and Warren Buffett amongst his closest friends (two of the wealthiest people on the planet).

Today EdgePoint is a popular investment choice for many investors. In light of this, we thought it might be beneficial to highlight this inversion insight as a means of ensuring that EdgePoint is right for you. Meaning, we want to address expectations and behaviours that we hope aren’t prevalent among our investors. If they aren’t, then by default we’ll end up with investors who are using us for the right reasons and who have appropriate expectations.

We hope you’re not using historical returns as a guide for future returns

We believe our historical returns have been pleasing. Many investors extrapolate historical returns into the future, meaning they believe the positive returns they’re seeing today, will continue into the future. The investment industry has conditioned many to think this way. The industry bombards you with advertising which highlights their historical returns in the hopes that you’ll be motivated to get rich and invest with them. This is poor behaviour on their part but regrettably we don’t see any of them changing their practices any time soon. When it comes to your investment in EdgePoint, you should NOT assume that we’ll be able to deliver the same returns in the future as we have in the past.

Why are we confident that future returns will be lower than the past? Mainly because overall valuations in the world are higher than they’ve ever been since we started the firm in 2008. And the bottom line is entry price dictates return. The lower the entry price, the higher the expected return and vice versa.

Despite our belief that future returns may be lower than past returns, we still believe that:

Of the primary ways of saving over the long term, equities still represent the best option

We’re still able to find opportunities in spite of the more expensive markets to earn outsized returns

Here’s why.

Most investors are faced with four ways of saving money for the long term. Cash, fixed income, real estate and equities. For families who hold cash, they’re earning less than 1% on that cash because today inflation is close to 2%i. That’s a recipe for going broke slowly. For those interested in the fixed-income market, Canadian 10-year government bonds earn 1.8% annuallyii. If you lend your money to the Canadian government, you’re still going to go broke due to inflation but at a slightly slower pace than if you’re holding cash. (By the way, we don’t own any government bonds in the fixed-income portions of our growth and income portfolios nor have we since inception). Canadian real estate is a hot topic these days, and we’re not sure that we can add any value on the matter other than to say that we agree with most commentators that it’s more expensive today than at any other time in history. Finally, there are equities. We continue to believe that under every circumstance we can imagine, we should be able to deliver better results over the long term than the options listed above.

Now, understand that we’re not cheerleaders for the stock market at EdgePoint and that’s because we don’t own the market. Instead we own a small collection of businesses we believe can grow in the future and where we believe the market isn’t asking us to pay for that growth in the share price today. As such, if we’re right about these ideas, then we should do better than whatever the market actually returns.

Our job is to adjust to whatever environment the market gives us and find the best ideas available at any given time. Fortunately, irrespective of the environment, the market has always co-operated and offered up opportunities. For example, in the last six months, we have found nine new equity ideas in our Global Portfolio and four in our Canadian Portfolio. We’re still in the process of accumulating most of these names so won’t go into any details about them now.

Instead we thought it might be helpful to give an example of a name we built into a meaningful position last year in EdgePoint Global and EdgePoint Global Growth & Income Portfolios which shows that we’re still finding bargains out there.

Aena SME SA is the closest thing to a monopoly that we’ve ever owned. They own 46 airports and two helipads which make up 99.9% of commercial air traffic in Spain. If you’ve ever landed or taken off in Spain, you’ve paid Aena indirectly through the price of your ticket. Spain went through a massive construction boom leading into the financial crisis. During the crisis, they suffered more than most when the bubble popped. For example, unemployment in Spain spiked to as high as 26% after the crisis, and its fiscal deficit reached around 10% of its GDP in four consecutive years. At the time, it appeared the government took stock of what they owned and what they could sell to raise money for the country. One of the most attractive assets was their airport network. Like the rest of the country, the airport network was overbuilt during the crisis and required very little capital going forward to grow. This made the airports cash flow machines, so probably something they had a good chance of selling.

Unfortunately, we weren’t aware of Aena when it first went public, but found it shortly thereafter. When we found it, we were being asked to pay roughly 11x free cash flow for it, which means if they didn’t ever grow we’d still earn 9% a year as owners of the business. (The inverse of the free cash flow multiple gives you the free cash flow yield).

9% was nice, but it was the future growth that we thought we were getting for free that really got us excited. Here are some examples of the future growth we thought we saw:

The poor state of the economy meant Aena’s domestic passenger traffic had fallen by 30% from its peak. We weren’t being asked to pay for any future rise in domestic traffic

Overbuilt airports were operating around 59% capacity. Regardless of how much traffic an airport is seeing, if it’s open, you have to insure it, heat and cool it, light it and staff it, no matter what. So any increase in passengers through an airport has a very big impact on profitability. This new revenue has almost no costs associated with it. Said differently, profitability grows a lot faster than revenue when passenger growth picks back up, and that future growth was coming for free

The average passenger that travelled through Aena airports had the same average income level as a passenger travelling through Paris or Zurich. Yet the passengers in Spain were spending less than a third of those passing through Paris and Zurich due to poor retail offerings. Any future growth in passenger spending was coming to us for free

Parking revenue per passenger at Aena’s airports was less than US$2 per passenger vs. US$10-$12 in places like Zurich, Frankfurt and Paris. Any increase in parking fees were coming for free

Aena owned close to 5,000 acres adjacent to its airports that as far as we could tell we weren’t being asked to pay for either

Fortunately, things improved for Aena. Their passenger traffic had double-digit growth, retail offerings improved, consumers were spending more in absolute terms as well as on a per passenger basis and parking revenue increased. All this led to substantial profit growth over the year. Since we built up our position, the share price reacted very positively to all this good news.

Opportunities like Aena are still out there. They’re tougher to find than any other time since the financial crisis, but they’re out there. When we find them, we recognize that the future upside is somewhat diminished because as we said, overall valuations are higher than they were in the past. So while we hope you remain optimistic about our ability to find these types of opportunities we don’t think it’s prudent to anchor your expectations to our historical results. Doing so will likely result in disappointment.

We hope you understand that volatility is your friend

Most investors want to reap large financial gains but don’t want to experience a deviation in returns unless it’s to the upside. We think this goal is completely unrealistic. Delivering pleasing returns often requires you to look wrong in the short term to be right in the long term.

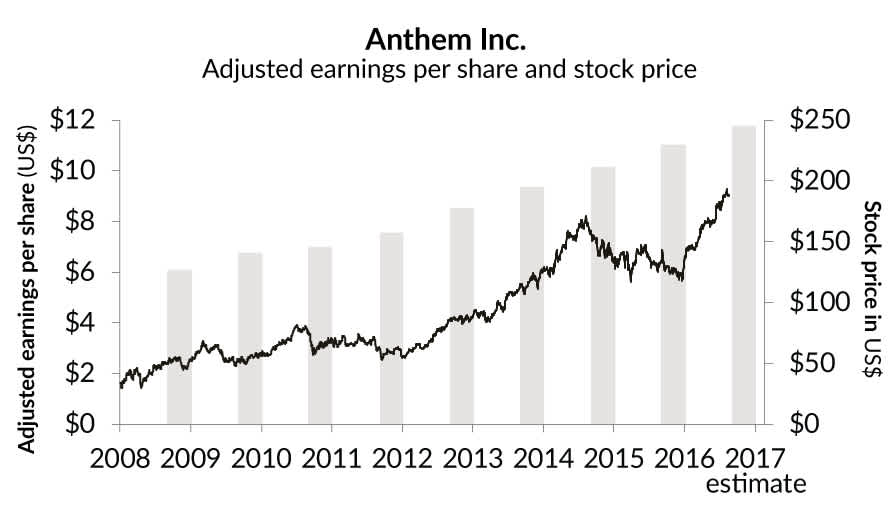

Let’s look at an EdgePoint Global Portfolio holding, Anthem Inc., to expand on this point. Below is a graph demonstrating the progression in earnings per share (a common measure of profitability) for Anthem over time:

Source: Bloomberg LP. Adjusted earnings per share adjusted for non-recurring gains or losses in US$. 2017 EPS estimate source: FactSet Research Systems Inc.

This graph shows that earnings per share have increased every year since we’ve owned it.

Now let’s superimpose the movement in the share price on top of the original graph.

Source: Bloomberg LP. November 17, 2008 to June 30, 2017. In US$.

In seven out of the eight and a half years that we’ve owned Anthem, the share price has fallen by more than 10% at one point in time during the year. The business kept growing, earnings kept going up and yet short-term fears crept into the equation. As the share price fell, an investor who sees volatility as risk is predisposed to sell at the wrong time, crystalizing losses and giving up future gains. The investor who knows the value of a business can take advantage of this volatility. They see price declines as an opportunity to add to the position instead of sell.

Owning an attractively priced business that demonstrates an ability to consistently increase its profits has proven to be a good way of building long-term wealth. Volatility will creep into the share price of even the best businesses. During downdrafts in the stock market, we typically buy more of a business if our idea about its future hasn’t changed. Likewise, we would encourage you to act similarly.

When EdgePoint Portfolios decline in value due to temporary volatility in the stock market, you should think about adding to your position instead of selling. In fact, you probably shouldn’t give us a dollar to invest when you think we look smart unless you’re prepared to do the same when you think we look dumb. Historically, adding when EdgePoint Portfolios have been down has proven to be fruitful as evidenced by the table below.

Annualized total returns, net of fees, in C$ as at June 30, 2017

EdgePoint Global Portfolio, Series A - YTD: 8.50%; 1-year: 27.46%; 3-year: 15.77%; 5-year: 19.87%; since inception (Nov. 17, 2008): 17.23%.

EdgePoint Global Portfolio, Series A. Date range: November 17, 2008 to June 30, 2017. Hypothetical scenarios.

Cash + EdgePoint Global, Series A return is calculated as the weighted average of cash withdrawn earning 0% and EdgePoint Global Portfolio, Series A earning the money-weighted rate of return.

Specifically, this table shows that simply buying and holding EdgePoint Global Portfolio since inception has resulted in a compound annual return of 17.2%. However, had an investor pulled out 10% of their investment every time the portfolio fell by more than 15% (which has occurred four times in the history of the Portfolio), then their return would have fallen to 13.9%. Alternatively, had they added 10% to their position on those four occasions, their return would have been 17.6%.

Think about adding to, instead of selling down, your EdgePoint position next time the market takes a tumble.

We hope you’re not looking at your EdgePoint Portfolio performance on a daily basis

| % of days portfolio declined iii | % of months portfolio declined iv |

|---|

These are the percentage of days and months since our inception that our Global and Canadian Portfolios have seen their prices decline. Over this measurement period the Global Portfolio returned 293% and the Canadian Portfolio 214%.

There’s very little as uncomfortable in life as watching the price of something you own go down if you don’t know its value. We’re going to guess that you don’t know the individual values of each of the businesses inside your portfolio. Therefore, psychologically, it’s tough to watch daily price gyrations.

In our opinion, daily portfolio price movements tell you absolutely nothing so you’d be better served not looking at them at all. What’s important to focus on is our investment approach. At the end of the day, this is what you’re buying, and as such should be very familiar and comfortable with it. As a brief refresher, our investment approach can be summarized as follows:

At EdgePoint, we’re long-term investors in businesses. We view a stock as an ownership interest in a company and endeavour to acquire these ownership stakes at prices below our assessment of their true worth.

We believe that the best way to buy a business at an attractive price is to have an idea about the business that isn’t widely shared by others – what we refer to as a proprietary insight.

We strive to develop proprietary insights around businesses we understand. We focus on companies with strong competitive positions, defendable barriers to entry and long-term growth prospects that are run by competent management teams. These holdings generally reflect our views looking out more than five years. We firmly believe that focusing on longer periods of time enables us to develop proprietary views that aren’t reflected in the current stock price.

Our approach is deceptively simple. We buy good, undervalued businesses and hold them until the market fully recognizes their potential. Following this approach requires an ability to think independently, a natural curiosity necessary to search out new ideas and a commitment to embrace the thorough research required to uncover opportunities the market doesn’t fully appreciate.

Even though daily price movements provide no useful information, many investors still worry when they see prices moving up and down. So it’s important to recognize that volatility of returns also reduce with time. The next chart shows you the dispersion of returns for EdgePoint Global Portfolio over time. The middle line is the average rolling return on a 1-, 2- and 3-year basis and so on. The top line shows what would have happened had you bought on the best day possible on a rolling basis and the bottom line if you’d bought on the absolute worst day on a rolling basis.

Annualized total returns, net of fees, in C$ as at June 30, 2017

EdgePoint Global Portfolio, Series A - YTD: 8.50%; 1-year: 27.46%; 3-year: 15.77%; 5-year: 19.87%; since inception (Nov. 17, 2008): 17.23%.

Annualized rolling return is calculated based on EdgePoint Global Portfolio, Series A daily return. Date range: November 17, 2008 to June 30, 2017. In C$.

To ensure that you’re reading this chart correctly, let’s use an example. Using the chart below as a guide, if you’ve owned the portfolio for a period of four years on a rolling basis and bought it on the worst possible day, your performance would have been 9.1%. Conversely, if you’d bought it on the best possible day, your performance would have been 26.0%.

Annualized total returns, net of fees, in C$ as at June 30, 2017

EdgePoint Global Portfolio, Series A - YTD: 8.50%; 1-year: 27.46%; 3-year: 15.77%; 5-year: 19.87%; since inception (Nov. 17, 2008): 17.23%.

Annualized rolling return is calculated based on EdgePoint Global Portfolio, Series A daily return. Date range: November 17, 2008 to June 30, 2017. In C$.

The key takeaway is to try to ignore day-to-day moves in your portfolio prices. We’re convinced they won’t help you make good decisions and it can be frustrating.

You’re likely already on the right path

You likely have a financial plan in place with your advisor. Somewhere in your financial plan are your long-term financial goals. If we guessed, you haven’t written “get rich” under the goal section. Instead, as Charlie Munger does, you likely inverted your objective and it’s more along the lines of “try not to run out of a comfortable amount of money before I die.” If you’ve indeed written a version of this as your goal, you’re already on the right path. By constantly focusing on making decisions that lower the probability of retiring without enough money to live comfortably, you may be positively surprised at the outcome when retirement arrives.

Conclusion

We continue to approach investing in these markets with measured confidence, value your trust in us and look forward to working to build your wealth in an effort to be worthy of that trust.

iiSource: FactSet Research Systems Inc., as at June 30, 2017.

iiiEdgePoint Global Portfolio, Series A and EdgePoint Canadian Portfolio Series A: 11/17/2008 to 06/30/2017, excluding non-trading days.

ivEdgePoint Global Portfolio, Series A and EdgePoint Canadian Portfolio Series A: 11/17/2008 to 06/30/2017, November 17 to November 30, 2008 is assumed to be one full month for the purposes of this calculation.