A random walk from Copenhagen to Cleveland – 4th quarter, 2023

At EdgePoint we talk a lot about our proprietary insights – the ideas we have about a business that aren’t widely held by others. They usually explain why we think we can buy the business at an attractive price.

One of the most-common questions we get asked is how we find these proprietary insights. In one of the early commentaries, Geoff and Tye spent a lot of time trying to explain our approach to new investors:

Proprietary insights typically evolve from meaningful research acquired over time. There’s no way to filter for them and no simple formula to nurture them. Their development is unpredictable and can often be an unconscious act. We generate insights by accumulating facts and applying reasoning to those facts. The reality is that the majority will prove worthless in fostering a proprietary view. They may help you know what others know, but no more than that. The rare time you can logically connect the facts that really matter, you gain a unique insight.

Every name in an EdgePoint Portfolio has a story behind our proprietary insight. Each one’s different, but the common thread among them all is that the idea rarely comes from a single data point. There’s usually a tale about how dots were connected or how the jigsaw pieces fell into place.

This story is about the random walk that led to two big ideas ending up in the Global Portfolio today.

Something good came out of 2020

It started in the summer of 2020 when Geoff called me into his office.

Geoff: I think we need to figure out blue hydrogen.

Me: Ok.

Me (internally): What’s blue hydrogen…? i

The hydrogen-hype cycle was in full swing and any company that was a direct beneficiary saw its multiple explode in anticipation of the future windfall. All summer we read about governments and big companies pledging to put real capital behind building a hydrogen economy, but it wasn’t obvious that any of this investment was going to provide a reasonable return. If it did, we definitely weren’t getting the growth for free by looking at any of the (premature) winners.

I thought I would have better luck finding a free hydrogen call option if I looked further down the supply chain, so I called an expert to find out what equipment was needed to build all these projects. I learned that heat exchangers were integral for virtually any process related to heat and energy efficiency – from traditional markets like HVAC, refineries and nuclear, to newer ones like heat pumps, carbon capture and green hydrogen.

That call was the beginning of an idea that ended up with us adding Alfa Laval AB,ii a global leader in heat exchanger technology, to Cymbria and the EdgePoint Global and Canadian Portfolios in 2021. (You can hear how we discussed the Alfa Laval proprietary insight at the 2022 Cymbria Day).

Fast forward to November 2022 and I’m at the Alfa Laval investor day in Copenhagen. After touring the facilities, Alfa Laval’s management and division heads joined us for dinner. Someone asked the head of the heat pump division how difficult it would be to 3D print a heat exchanger. He went into a long answer to explain why it was hard (something to do with metallurgy), but said it was getting more common for very basic parts. This was news to me. I had met with companies years ago that talked about the potential for 3D printing of industrial parts, but I had no idea that it had taken off and was being used in manufacturing today.

Taking the next steps

When I got back to Toronto, I started searching everywhere for companies talking about 3D printing. There were a lot of options, but one story really stood out. There was an article in Metal Additive Manufacturing (AM) Magazine about how Chevron had engaged a Cleveland welding company to 3D print replacement parts for a refinery in California.iii Chevron talked about how it urgently needed parts but couldn’t get them because of the supply-chain crisis. It worked with Lincoln Electriciv to 3D print the parts in the U.S. instead of waiting a minimum of three months to ship them in from Asia. These weren’t your run-of-the-mill, lightweight components either – these were nickel-alloy parts that weighed 226 kg and measured nearly a metre long. Lincoln Electric was saying it could print parts twice the size and 10 times the weight at its facility down in Euclid, OH. That was enough to get me interested.

When I started reading about Lincoln Electric, I thought I had found the next big 3D printing company that no one had heard of. As I started reading transcripts from the CEO speaking at different events, something else jumped off the page. Lincoln Electric was working on commercializing an EV charger, and management sounded very excited about it.

I couldn’t understand it – why would a welding company with a huge opportunity in additive manufacturing get involved with EV charging?

Well, it turns out that the power-management system inside a welding machine is almost identical to the one found inside the large public DC fast chargers popping up all over North America, and Lincoln Electric makes tens of thousands of these power-management systems annually in Cleveland. It always had the technology but not the interest in the EV charging market until the Biden Administration made US$7.5 billion in stimulus dollars available to build out a U.S. public charging network.v The funding came with some very strict requirements around domestic content and reliability, and as an established 100-year-old welding company in the U.S., it was already compliant. After some due diligence, Lincoln Electric realized its chargers would be faster, more durable and more reliable than anything currently on the market. With very little investment, it decided to devote some of its existing manufacturing capacity to making chargers, and expects to start selling them in 2024 for US$100k per charger. Lincoln Electric initially had my interest, but now it had my attention.

It sounded like a huge opportunity, but no one was talking about it. Other than a press release from the White House naming Lincoln Electric as a domestic charging manufacturer, it was difficult to find any information on it. When we eventually spoke to management after doing our own digging, they were very confident about their charger being the best in the industry, but refused to promote it until they were sure it worked on every vehicle. They didn’t want their century-old welding brand damaged by some communication issue with an automaker. Sensing we were longer-term shareholders, they invited us to Cleveland to show us all the other parts of the business they were excited about, too.

On a snowy day last March, we flew to Cleveland for a 3.5-hour tour of the Euclid, OH facility. We saw giant welding arms and tried out the new welding collaborative robots at the automation facility. One of the most-exciting things we learned about was on the general factory floor – Lincoln Electric has an employee profit-sharing program that creates a culture where everyone thinks and acts like business owners. Unsurprisingly, that last one resonated well with us. We walked away confident that even if the charger opportunity never played out, this was a business we were happy to own for the long term.

Getting excited about a “boring” opportunity

But why did the opportunity exist? Because the market isn’t incentivized to care about Lincoln Electric. The company generates so much free cash that it doesn’t have to come to the equity or debt markets to raise capital. This means the banks aren’t interested in Lincoln because they won’t earn banking fees. It isn’t a big index weight,vi so sell-side analysts who cover Lincoln Electric don’t get a lot of questions about it and therefore won’t use their limited time to dig deeper on a name that doesn’t generate much trading commissions. Lastly, management aren’t promotional and have a clear preference for long-term shareholders, so they try hard to discourage any short-term investors from owning their stock based on a single idea.

All of this meant that we got to buy Lincoln Electric stock at price that was 17x the earnings of the base business, which excluded any upside from chargers – a true call option.

There was nothing sophisticated about the random walk from Copenhagen to Cleveland. If it sounds like the research process was mostly a lot of reading, talking and travelling, that’s because it was.

Finding new stories to tell

For every name in an EdgePoint Portfolio, there’s a similar anecdote about how we put different pieces together to find a proprietary insight. They might not be as long and meandering as mine, but they’re all based on common sense. Deceptively simple.

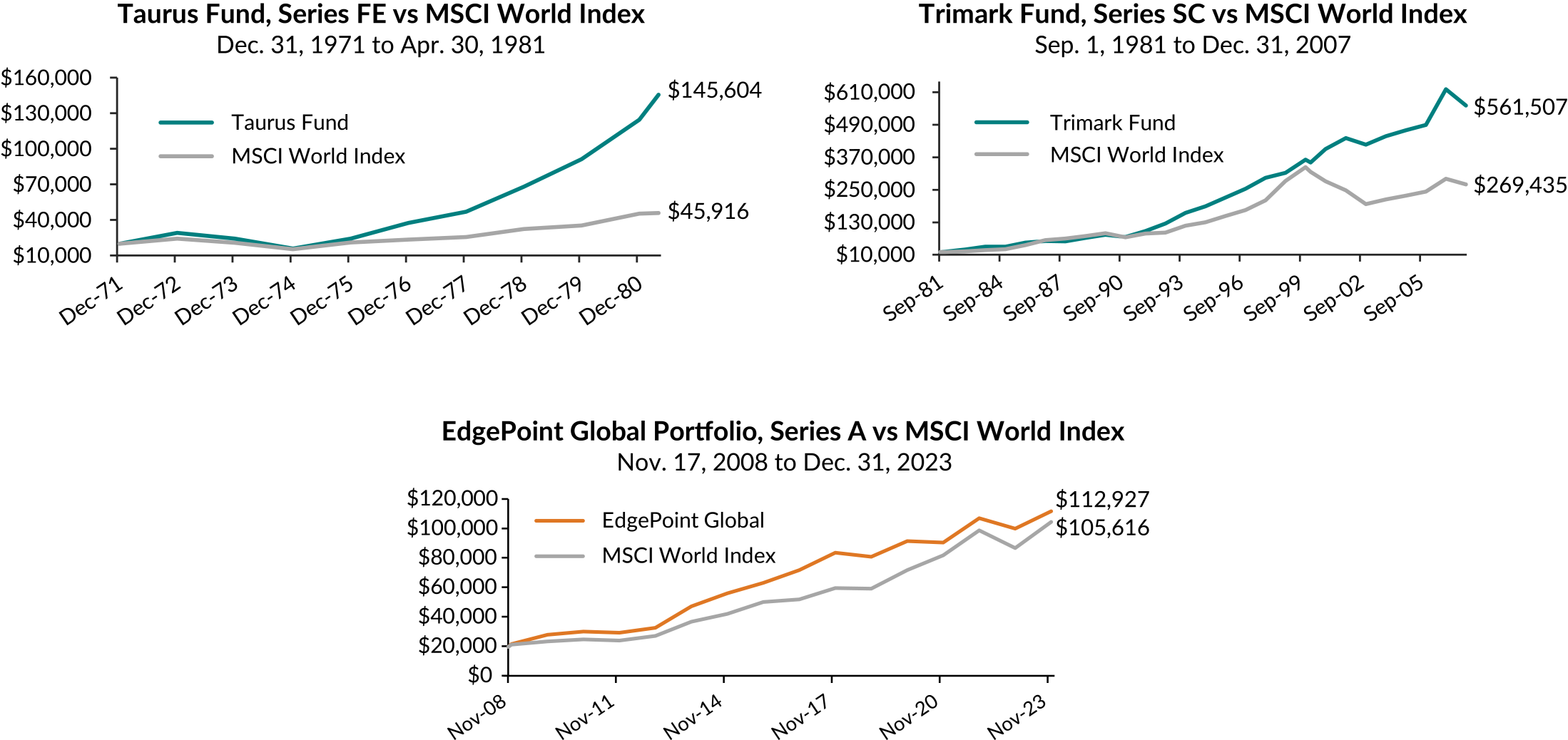

So, the obvious question we have to ask is, “Why doesn’t everyone else do this?” The track record of this approach over the last 50 years (see the end of the commentary) backs up its ability to deliver very pleasing returns for the end client through every kind of macroeconomic environment. It was started at the Taurus Fund by Bob Krembil, one of EdgePoint’s founders and the originator of the investment approach we apply today.

In a rational market, someone should have copied us by now and this kind of inefficiency should have been competed away. However, there are a few unique factors about EdgePoint that protect our moat:

No silos or style buckets – It didn’t matter that the head offices of Alfa Laval were in Europe and Lincoln Electric was in North America, was classified as growth or value, mid-cap or small-cap, paid a dividend or didn’t. The non-siloed structure of the EdgePoint Investment team means we can follow an idea anywhere in the world without worrying about straying outside of our universe. Our very small shelf of prospectus Funds means we don’t have to worry about a style bucket either. If I was the manager of large-cap European ESG fund, I could have had the same insight about Lincoln Electric but could never look at it because it was the wrong market cap, geography and had customers in industries excluded from many ESG portfolios.

No benchmark risk – If I was measured relative to a benchmark, I wouldn’t look at either company. To be honest I still don’t know their weights.vii When you’re measured against a benchmark, you have to care about the large names in it because not owning them is a career risk. This means that you could happily live your life without ever knowing or caring what happens to Lincoln and Alfa Laval. Both could be 10-baggers and no one would lose their job over it. But by removing benchmark risk, EdgePoint Investment team members can buy an ownership stake in companies that could potentially be bigger in the future without having to pay for that growth.

Long-term focus – The opportunity to buy both businesses at a reasonable price came from their having very cyclical end markets with high near-term uncertainty. We didn’t know what was going to happen to marine, energy or welding capex over the next 12 months. We still don’t, but looking further out allows us to see several ways both businesses could be materially bigger five years from now regardless of the macro environment. And the average investor seems to be unwilling to commit to a stock for more than 10 months.viii

Low turnover – Our approach is to buy good, undervalued businesses and hold them until the market fully recognizes their potential. Sometimes that can take a while. We aren’t judged or incentivized by the number of new names we produce every year, so we have the time to do the research needed to develop a proprietary insight.

Our greatest edge is our investment approach – it’s the foundation for our ability to continue finding these proprietary insights. The Investment team’s structure gives us the opportunity to compound wealth for our families and yours uninterrupted. In short, it’s what allows us to go on a random walk to find these stories behind those proprietary insights and give us the time to hopefully have a happy ending. Thank you for your trust in us. We work hard every day to be worthy of it.

The investment approach over time

Dec. 31, 1971 to Dec. 31, 2023

Total return performance, net of fees, in C$ as at December 31, 2023

EdgePoint Global Portfolio, Series A - YTD: 11.76%; 1-year: 11.76%; 3-year: 7.29%; 5-year: 6.69%; 10-year: 8.98%; 15-year: 11.49%; Since inception (Nov. 17, 2008): 12.13%. Invesco Global Companies Fund, Series SC* - YTD: 18.15%; 1-year: 18.15%; 3-year: 3.67%; 5-year: 6.98%; 10-year: 7.62%; 15-year: 9.00%; Since inception (Sep. 1, 1981): 10.71%. MSCI World Index** - YTD: 20.47%; 1-year: 20.47%; 3-year: 8.51%; 5-year: 12.01%; 10-year: 10.97%; 15-year: 11.19%; Since EdgePoint Global Portfolio’s inception (Nov. 17, 2008): 11.63%.

* As at July 27, 2018, Trimark Fund changed its name to Invesco Global Companies Fund.

** As at October 17, 2016 the Trimark Fund changed its benchmark to the MSCI All Country World Index.

Note: The Taurus Fund is no longer in existence.

Source, MSCI and Trimark returns: Morningstar Direct. Source, Taurus: Bolton Tremblay Funds Inc. 1982 Annual Report. The above values are for illustrative purposes only and do not represent an actual client’s results. Total annual returns, net of fees, measured in C$. Historical performance is not indicative of future returns. The Taurus Fund, Trimark Fund and EdgePoint Global Portfolio are used for illustrative purposes only to demonstrate the history of the investment approach. All of the funds applied the same investment approach across different companies, investment teams and members. The MSCI World Index is a market-capitalization-weighted index comprising equity securities available in developed markets globally. The MSCI World Index was used for comparison purposes as it represents a broad global equity universe across several developed market countries. The index is not investible. The three Funds were managed independently of the index used for comparison purposes. Differences for all three Funds including security holdings, geographic/sector allocations and market cap size may impact comparability.