Calling 2020 an abnormal year is an understatement. In a matter of weeks in March 2020, everyone’s normal behaviours and habits were forced to change. Fortunately, many of these new routines are already proving to be temporary. Based on recent mobility trends in geographies with high vaccination rates, people are starting to forget the lessons of 2020.

The stock market also displayed some unusual behaviours in 2020. Successful investments in stocks, which represent ownership claims on businesses, display specific characteristics. Empirically, companies with strong profitability, returns on capital and attractive valuations will typically do well over time. However, in 2020, many investors deviated from identifying companies with these attributes, instead favouring businesses with the exact opposite characteristics!

2020 – The year of irrational investing

One of the best-performing investment strategies in 2020 was simply buying businesses that had the fastest revenue growth,i without any concern for any other fundamental or valuation measures. In 2020, investors became enamoured with “work from home” stocks and rapidly growing sectors such as electric vehicles, green energy, online gambling and cannabis. If you bought only the businesses with the fastest growing revenue in 2020, you would have outperformed the market by 13%.ii

At first blush, this may seem like a sensible investment strategy; any rational business owner would like a business with growing revenues. However, the reality is that growth must be measured in relation to the costs and amount of capital required to achieve that growth. It’s not very difficult to build a business that displays revenue growth if you’re spending multiples of revenue to support that result. Therefore, a rational business owner would never make decisions based on revenue growth without considering many other important factors, including profitability measures, such as return on capital.

Fortunately, over longer periods, the stock market tends to reflect this common-sense point of view. From 2006 to 2019, buying the businesses with the fastest growing revenue and without regard for other fundamental or valuation characteristics would have resulted in underperformance of 2% per year when compared to the market’s return.iii

Investment strategy – Buy the fastest revenue growth businesses

2006 to 2020

Source: Empirical Research Partners, LLC. Total returns in US$. Total returns for the highest quintile Sales Growth factor defined by Empirical Research Partners mentioned above are relative to developed markets globally within the large-and mid-capitalization equity universe. Based on 12-month revenues compared to the previous year’s 12-month trailing revenues.

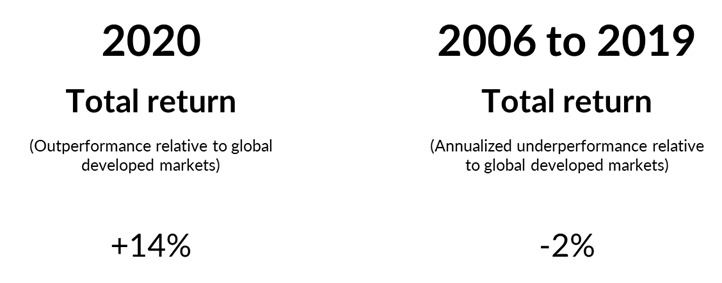

Another one of the best-performing investment strategies of 2020 was buying the businesses that generated the worst returns on equity.iv Yes, in 2020, if you had invested your hard-earned savings and bought businesses with the lowest returns on equity, you would have outperformed the market by 14%.v If this doesn’t make sense to you, then you’re not alone; it doesn’t make sense to any rational business person either. Fortunately, this appears to be another anomaly of 2020. If you employed this investment strategy from 2006 to 2019, you would have underperformed the market by 2% per year.vi

Investment strategy – Buy businesses with the worst returns on equity

2006 to 2020

Source: Empirical Research Partners, LLC. Total returns in US$. Total returns for the lowest quintile of Free Cash Flow Yield factor defined by Empirical Research Partners mentioned above are relative to developed markets globally within the large-and mid-capitalization equity universe. Net income before extraordinary items divided by average book value in the last two years.

By this point, you’re probably starting to see that acting irrationally proved to be a successful investing strategy in 2020. But here is another example. If you bought the most expensive businesses, as measured by trailing free cash flow yield, you would have outperformed the market by 15% in 2020.vii However, it’s no surprise that using this strategy over the long term wouldn’t have been successful. If you just bought the most expensive businesses between 2006 and 2019, you would have underperformed the market by 4% per year.viii

Investment strategy – Buy the most expensive businesses based on trailing free cash flow yield

2006 to 2020

Source: Empirical Research Partners, LLC. Total returns in US$. Total returns for the most expensive quintile of Free Cash Flow Yield factor defined by Empirical Research Partners mentioned above are relative to developed markets globally within the large-and mid-capitalization equity universe.

Investing with a long-term mindset

We could continue listing factors that performed well over the past year that haven’t performed well historically, but by this point I think you get my drift. Investing in companies with unattractive business qualities and high valuations doesn’t tend to work well for investors over the long term.

At EdgePoint, we believe investing is most successful when it’s most business-like. Our edge stems from applying this approach consistently. Our approach doesn’t work every day, every month or even every year, but our approach has built wealth for investors over the long term.

In March 2020, we hosted a series of national conference calls for investors to address the volatility in the market and highlighted some opportunities we were seeing at the time. The table below shows the six businesses we talked about, the revenue of each business in 2020, what happened to the share price from the beginning of 2020 to the bottom reached in March 2020, and what happened to each business’s share price since its low point from last year to the end of March 2021.

| Holding | 2020 Revenue Change | 2020 Maximum Decline | Total Return -Through March 31, 2021 | Total Return (Dec. 31, 2019-Mar 31, 2021) |

|---|

The businesses we identified as opportunities at the peak of the crisis last year had experienced dramatic share price declines. However, we believed that the disruptions brought on by the pandemic would be temporary and manageable. We also had a view, that wasn’t widely shared by others, for how these businesses could grow over the long term. Now, with the benefit of hindsight, if we look at the average year-over-year change in revenue for these businesses, their revenues decreased by an average of only 3% in 2020, while the average decline in their share prices was 44%. It’s dislocations like these between the share prices and company fundamentals that provide opportunities for those who understand what a business is really worth. All the businesses have recovered significantly from the depths of March, and the average share price is 16% higher compared to where these businesses were valued before the pandemic.ix

Our Portfolios also experienced pleasing results over this short time period since March 2020. However, relative to other portions of the market, such as those with the fastest revenue growth, lowest returns on equity or highest valuations, our Portfolios have underperformed.

| Factor | 1 YEAR RETURN AS AT MARCH 31, 2021 |

|---|

YTD: 10.27%; 1-year: 45.40%; 3-year: 5.71%; 5-year: 10.99%; 10-year: 13.23%; Since inception (Nov. 17, 2008): 15.45%

EdgePoint Canadian Portfolio, Series F

YTD: 14.02%; 1-year: 63.65%; 3-year: 6.83%; 5-year: 9.32%; 10-year: 7.86%; Since inception (Nov. 17, 2008): 12.42%

EdgePoint Global Growth & Income Portfolio, Series F

YTD: 7.56%; 1-year: 34.14%; 3-year: 5.40%; 5-year: 9.07%; 10-year: 10.74%; Since inception (Nov. 17, 2008): 12.70%

EdgePoint Canadian Growth & Income Portfolio, Series F

YTD: 9.60%; 1-year: 44.29%; 3-year: 6.87%; 5-year: 8.58%; 10-year: 7.56%; Since inception (Nov. 17, 2008): 11.03%

Revenue growth is calculated using trailing 12-month revenues compared to trailing 12-month revenues from one year prior. Return on equity is net income before extraordinary items divided by average of book value in the last two years. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers.

Fortunately, our investment approach has historically added the most value for investors when it appeared to have missed the mark in the short term. If history is a guide, actions taken during periods when we may look wrong, set the foundations for pleasing long-term returns. The table below illustrates our 10-year performance versus the successful investment approaches from 2020.

| Factor | 10-YEAR RETURN, ANNUALIZED AS AT MARCH 31, 2021 |

|---|

YTD: 10.27%; 1-year: 45.40%; 3-year: 5.71%; 5-year: 10.99%; 10-year: 13.23%; Since inception (Nov. 17, 2008): 15.45%

EdgePoint Canadian Portfolio, Series F

YTD: 14.02%; 1-year: 63.65%; 3-year: 6.83%; 5-year: 9.32%; 10-year: 7.86%; Since inception (Nov. 17, 2008): 12.42%

EdgePoint Global Growth & Income Portfolio, Series F

YTD: 7.56%; 1-year: 34.14%; 3-year: 5.40%; 5-year: 9.07%; 10-year: 10.74%; Since inception (Nov. 17, 2008): 12.70%

EdgePoint Canadian Growth & Income Portfolio, Series F

YTD: 9.60%; 1-year: 44.29%; 3-year: 6.87%; 5-year: 8.58%; 10-year: 7.56%; Since inception (Nov. 17, 2008): 11.03%

Revenue growth is calculated using trailing 12-month revenues compared to trailing 12-month revenues from one year prior. Return on equity is net income before extraordinary items divided by average of book value in the last two years. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers.

And here is what $20,000 invested in each of the strategies above, and in the EdgePoint Global Portfolio, would have grown to over the last 10 years.

Growth of $20,000 by investment strategy

Mar. 31, 2011 to Mar. 31, 2021

Performance as at March 31, 2021. Annualized total returns, net of fees, in C$

EdgePoint Global Portfolio, Series F

YTD: 10.27%; 1-year: 45.40%; 3-year: 5.71%; 5-year: 10.99%; 10-year: 13.23%; Since inception (Nov. 17, 2008): 15.45%

EdgePoint Canadian Portfolio, Series F

YTD: 14.02%; 1-year: 63.65%; 3-year: 6.83%; 5-year: 9.32%; 10-year: 7.86%; Since inception (Nov. 17, 2008): 12.42%

EdgePoint Global Growth & Income Portfolio, Series F

YTD: 7.56%; 1-year: 34.14%; 3-year: 5.40%; 5-year: 9.07%; 10-year: 10.74%; Since inception (Nov. 17, 2008): 12.70%

EdgePoint Canadian Growth & Income Portfolio, Series F

YTD: 9.60%; 1-year: 44.29%; 3-year: 6.87%; 5-year: 8.58%; 10-year: 7.56%; Since inception (Nov. 17, 2008): 11.03%

Revenue growth is calculated using trailing 12-month revenues compared to trailing 12-month revenues from one year prior. Return on equity is net income before extraordinary items divided by average of book value in the last two years. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers.

Revenue growth is calculated using trailing 12-month revenues compared to trailing 12-month revenues from one year prior. Return on equity is net income before extraordinary items divided by average of book value in the last two years.

Behaving like a rational business person wasn’t rewarded in 2020, but it is and will continue to be important over the long term. Much like our social behaviours in 2020, we think certain stock market behaviours in 2020 are an anomaly. In turn, if investors want to set themselves up for long-term success, they should continue to focus on sound investing and business fundamentals, and put little emphasis on the "lessons" learned in 2020.

ii Ibid.

iii Ibid.

iv Source: Empirical Research Partners, LLC. Total returns in US$. Total returns for the lowest quintile Return on Equity factor defined by Empirical Research Partners mentioned above are relative to developed markets globally within the large-and mid-capitalization equity universe. Net income before extraordinary items divided by average book value in the last two years.

v Ibid.

vi Ibid.

vii Source: Empirical Research Partners, LLC. Total returns in US$. Total returns for the lowest quintile the most expensive quintile of Free Cash Flow Yield factor defined by Empirical Research Partners mentioned above are relative to developed markets globally within the large-and mid-capitalization equity universe.

viii Ibid.

ix As at March 31, 2021. Prices before the pandemic are as at December 31, 2019.