EdgePoint’s worst-kept secret – Our credit franchise

When you think of EdgePoint, we hope the first thing that comes to mind is “Business Owners Buying Businesses.” It’s the deceptively simple foundation of our investment approach.

Our worst-kept secret is that we’ve always approached fixed income as

“Business Owners Lending to Businesses.” When we started EdgePoint in

2008, we launched four Portfolios – the EdgePoint Global and Canadian

Portfolios (predominantly equities) and our Global and Canadian Growth &

Income Portfolios (an equity/fixed income mix). Investing in fixed income

isn’t unique in our industry, but our not-so-secret weapons, our investment

approach and the team structure, set us apart.

Since-inception fixed income snapshoti

$21B invested in credit

Twelve different sectors

700+ unique fixed income securities (bonds, loans, preferreds, convertibles)

Deal issue sizes from $5M to $5B

Six defaults (only two impairments)

As at December 31, 2023. All figures in C$.

The non-siloed structure of our Investment Team means there’s a constant flow of valuable information between the fixed income and equity teams. Looking at the entirety of a business’s capital structure allows us to identify opportunities and avoid risks that wouldn’t be possible if we worked as distinct teams. This typically doesn’t happen in our industry – many teams view the other side as competitors and aren’t incented to share ideas.

It’s another advantage that EdgePoint has and our end clients benefit from the team’s collaborative work.

Our Investment Team’s structure is built (and thrives) on collaboration. Although we have individual focuses, we’re a team of generalists working together to apply a single investment approach across the Portfolios. Sharing research generated over many years on thousands of companies across various sectors allows the team to act quickly when the market presents an

opportunity. It also means they can leverage information to find multiple ways to invest across the capital structure – a good business to buy can also be a good business to lend to, and vice versa.

Our credit-centric approach to fixed income investing

When buying a stock, we’re buying a business, not just a piece of paper. We take ownership stakes in businesses by conducting fundamental analysis and developing proprietary insights – views about the business that aren’t shared by others. We use the very same approach when investing in bonds or, as we like to view it, lending money to businesses.

The EdgePoint fixed income investment approach looks for bonds where our opinion differs from the market. Said another way, we’re finding proprietary insights that the market hasn’t yet priced into the security. Can we find a bond that yields 10%, where we have a thesis on why it’ll increase its levels of free cash and pay down its debt? Does it have a valuable asset that we think can be sold to ensure that our principal is paid back? This is the value of true active credit management and we’re firm believers that it’s the most sensible way to invest in credit.

Over the years, we’ve developed a reputation for creativity with fixed income deals. Rolling up our sleeves and doing our own credit analysis makes us more willing to work with a business and take a leadership position in their new issue. Our input can result in a tighter security package and covenants, with the goal of earning outsized returns while better protecting our

downside. Since inception we’ve provided guidance on many deals, which means working diligently with each borrowing business and providing our clients with access to deals that wouldn’t be possible without our heavy lifting.

Two sides of a coin

Returns & risks

Of course, all the credit work we do would be pointless if we didn’t deliver on performance. Since inception, we’re pleased with the returns from the fixed income portion of our Growth & Income Portfolios.

Total annualized returns (local currency)

EdgePoint Global Growth & Income Portfolio, Series F – YTD: 3.91%, 1-year: 10.25%, 3-year: 8.71%, 5-year: 8.93%, 10-year: 7.63%, 15-year: 10.04%, Since EdgePoint inception (Nov. 17, 2008): 11.39%. EdgePoint Canadian Growth & Income Portfolio, Series F – YTD: 1.99%, 1-year: 15.05%, 3-year: 12.36%, 5-year: 13.91%, 10-year: 9.18%, 15-year: 9.57%, Since EdgePoint inception (Nov. 17, 2008): 11.63%. ICE BofA Canada Broad Market Index – YTD: 2.28%, 1-year: 8.37%, 3-year: 1.44%, 5-year: 0.36%, 10-year: 1.71%, 15-year: 3.14%, Since EdgePoint inception (Nov. 17, 2008): 3.58%.Source: Morningstar Direct. Returns shown for illustrative purposes only and aren’t indicative of future performance. The EPGIP and EPCIP fixed income returns are in local currency, net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. The ICE BofA Canada Broad Market Index was chosen as the benchmark for the fixed income portion of the EPGIP and EPCIP because it is representative of fixed income opportunities consistent with the Portfolios’ fixed income mandate. The index is not investible. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed income comparability from the index. See Important information – benchmarks and indexes and Important information – EdgePoint Growth & Income Portfolio fixed income returns for additional details.

Analyzing returns is one side of the coin, but the other side that tends to garner less attention is analyzing the risk taken to achieve those returns. Risk management is paramount in fixed income. We view risk as the likelihood of permanent loss of capital, and we weigh any potential return against the risk of making that investment. We only make an investment if we think the expected return adequately compensates us for the risk taken. Our down-to-earth, business-centric approach to fixed income has helped us avoid many risks that hurt the average fixed income portfolio.

Low-interest rate world

A rising tide lifts all boats

Let’s analyze the track record a little closer. We’ll start with the post-Global Financial Crisis world of declining interest rates acting as a tailwind to asset prices. Even though it’s not rocket science for a fixed income investor to fare well in such a favourable environment, it’s valid to ask, “How did you achieve your returns – what was the risk you took?”

It’s not surprising that many fixed income funds across the country bet that rates would stay lower for longer. That was a tailwind they enjoyed for many years. These funds were investing in long-duration bonds (duration is a measure of a debt instrument’s sensitivity to interest rates – the higher the duration, the more sensitive its price is to interest rate changes). As rates kept falling, a long duration was seen as the safe option.

We don’t have an edge in predicting macroeconomic factors like interest rate movements and think few do. We didn’t want to make a bet on interest rates as the risk to being wrong was simply too great. We felt minimizing our exposure to interest rates and sticking to what we do best, credit analysis would pay off over the long term.

Duration comparison (years)

EdgePoint Global Growth & Income Portfolio, Series F – YTD: 3.91%, 1-year: 10.25%, 3-year: 8.71%, 5-year: 8.93%, 10-year: 7.63%, 15-year: 10.04%, Since EdgePoint inception (Nov. 17, 2008): 11.39%. EdgePoint Canadian Growth & Income Portfolio, Series F – YTD: 1.99%, 1-year: 15.05%, 3-year: 12.36%, 5-year: 13.91%, 10-year: 9.18%, 15-year: 9.57%, Since EdgePoint inception (Nov. 17, 2008): 11.63%. ICE BofA Canada Broad Market Index – YTD: 2.28%, 1-year: 8.37%, 3-year: 1.44%, 5-year: 0.36%, 10-year: 1.71%, 15-year: 3.14%, Since EdgePoint inception (Nov. 17, 2008): 3.58%.

Source: Morningstar Direct. August 2020 was selected because it included the date of the 10-year U.S. Government Bond’s lowest yield and marked the start of a rising interest rate environment. Returns shown for illustrative purposes only and aren’t indicative of future performance. The EPGIP and EPCIP fixed income returns are in local currency, net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. See Important information – benchmarks and indexes and Important information – EdgePoint Growth & Income Portfolio fixed income returns for additional details.

The average investor was taking on the most duration risk they had in 40 years – a duration over seven years to earn the smallest yield they’d ever gotten – approximately 2%. That’s what tends to happen in a yield-starved world. In our view, the significant returns that investors of long-dated bonds were earning would reverse if rates began to rise and the low yields failed to compensate for this risk.

Consequently, the duration of our Growth & Income Portfolios was less than a third of the index. Through our credit analysis, we strive to identify borrowers that are paying attractive yields compared to their underlying business fundamentals. We only allocate capital when we’re comfortable with the cash flow and asset base of a particular issue, preferring a concentrated portfolio of well-researched ideas. Our strict adherence to our approach paid off for EdgePoint clients.

The following returns reflect our credit-centric approach since inception to early-August 2020 – which was the end of the low-rate era.

Annualized total returns (local currency)

EdgePoint Global Growth & Income Portfolio, Series F – YTD: 3.91%, 1-year: 10.25%, 3-year: 8.71%, 5-year: 8.93%, 10-year: 7.63%, 15-year: 10.04%, Since EdgePoint inception (Nov. 17, 2008): 11.39%. EdgePoint Canadian Growth & Income Portfolio, Series F – YTD: 1.99%, 1-year: 15.05%, 3-year: 12.36%, 5-year: 13.91%, 10-year: 9.18%, 15-year: 9.57%, Since EdgePoint inception (Nov. 17, 2008): 11.63%. ICE BofA Canada Broad Market Index – YTD: 2.28%, 1-year: 8.37%, 3-year: 1.44%, 5-year: 0.36%, 10-year: 1.71%, 15-year: 3.14%, Since EdgePoint inception (Nov. 17, 2008): 3.58%.

Source: Morningstar Direct. August 2020 was selected because it included the date of the 10-year U.S. Government Bond’s lowest yield and marked the start of a rising interest rate environment. Returns shown for illustrative purposes only and aren’t indicative of future performance. The EPGIP and EPCIP fixed income returns are in local currency, net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. See Important information – benchmarks and indexes and Important information – EdgePoint Growth & Income Portfolio fixed income returns for additional details.

When credit matters, it’s the only thing that matters

In an almost-perfect environment for fixed income investors, the proverbial rising tide lifted all boats. Simply owning the index generated pleasing returns. But what if there’s a sea change and investors have to do actual credit work to earn a return instead of getting participation awards? After 12 years of warning investors about the dangers of making an all-in bet on interest rates, we were beginning to sound like a broken record. But the sea did change…

As rates rose, the average fixed income investor suffered from making bad macro calls that erased over a decade of performance.

Our investment approach doesn’t bet on macroeconomic factors or rely on the direction of interest rates to deliver pleasing returns. When interest rates were low, we think we did well for our clients without exposing them to interest-rate risk, but how have we performed since rates started rising in mid-2020?

Annualized total returns (local currency)

EdgePoint Global Growth & Income Portfolio, Series F – YTD: 3.91%, 1-year: 10.25%, 3-year: 8.71%, 5-year: 8.93%, 10-year: 7.63%, 15-year: 10.04%, Since EdgePoint inception (Nov. 17, 2008): 11.39%. EdgePoint Canadian Growth & Income Portfolio, Series F – YTD: 1.99%, 1-year: 15.05%, 3-year: 12.36%, 5-year: 13.91%, 10-year: 9.18%, 15-year: 9.57%, Since EdgePoint inception (Nov. 17, 2008): 11.63%. ICE BofA Canada Broad Market Index – YTD: 2.28%, 1-year: 8.37%, 3-year: 1.44%, 5-year: 0.36%, 10-year: 1.71%, 15-year: 3.14%, Since EdgePoint inception (Nov. 17, 2008): 3.58%.

Source: Morningstar Direct. August 2020 was selected because it included the date of the 10-year U.S. Government Bond’s lowest yield and marked the start of a rising interest rate environment. Returns shown for illustrative purposes only and aren’t indicative of future performance. The EPGIP and EPCIP fixed income returns are in local currency, net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. See Important information – benchmarks and indexes and Important information – EdgePoint Growth & Income Portfolio fixed income returns for additional details.

The last few years showed how we can mitigate the risk of rising rates by focusing on credit and taking a duration that’s still less than a third of the index.iv At this time, we’re in a unique position compared to the index because we have more flexibility to invest into higher yields, given that roughly 20% of the fixed income securities in the Growth & Income Portfolios will mature within a year, with almost half maturing over the next two.v We don’t think investors need to time their entry into fixed income markets today if they partner with a manager like us who avoids duration risk and focuses on analyzing and lending to good businesses.

Our “margin of safety” is our ability to analyze a business. Disciplined and comprehensive credit analysis helps position us well regardless of where rates are heading. This is evident based on our 15-year track record managing fixed income within our Growth & Income Portfolios.

Even better, our pipeline for new deals today is incredibly robust. Lending from banks has dried up, which means companies need to look elsewhere. This has created a unique set of opportunities, and we believe that today is an attractive entry point and a great time to add to the fixed income sleeve of your book.

The role in your client portfolios going forward

When it comes to credit, our secret is out

While the environment in which we operate will change, our investment approach never will. We believe consistency of returns across the cycle and risk-first credit analysis should enable us to continue generating pleasing returns. If your clients have owned any of our fixed income Portfolios, they’ve benefitted from the significant relative outperformance to our benchmark that we’ve generated since our inception.

Our Investment Team is focused on bottom-up fundamental credit analysis with an expertise in finding high-quality businesses with mispriced bonds paying attractive coupons. With historically higher yields and shorter durations, looking different from the index has given us an edge in this space.

We believe all our fixed income Portfolios are nimble, flexible and well-positioned to take advantage of the new market environment. Most bond investors fear rising interest rates, while we feel excited. No matter which way rates go, our commitment to remaining “business owners lending to businesses” means that we will only buy bonds where we believe we’re being compensated for any potential risk we take. We don’t need declining rates to earn a decent return over the next five years, and investors in our fixed income Portfolios should join us in welcoming the potential for a “higher for longer” interest rate environment.

Ways to access EdgePoint credit

The role of fixed income isn’t universal for all investors. While our process of lending to businesses remains the same, we have four EdgePoint Portfolios that hold different types of credit to potentially help clients meet some of their needs.

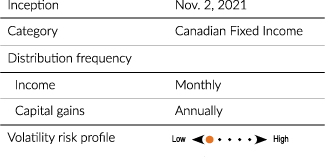

EdgePoint Monthly Income Portfolio

A collection of predominantly high-quality Canadian fixed income securities that provides a combination of income growth and capital appreciation.

We look at the borrower’s (bond issuer’s) ability to meet its debt obligations, specifically through the payment of periodic coupons and the return of the principal at maturity. The Portfolio invests predominantly in investment grade bonds, with up to maximum 20% weight in high yield bonds.

Novel fee structure

Fees also serve as a major impediment to generating attractive returns. The Portfolio has a novel fee structure that allows us to charge a tiered management fee depending on the interest rate environment. This fee structure puts our unitholders’ interests at the forefront, ensuring that our investors capture the yield we can earn in any interest rate environment.

The series’ annual management fee is a percentage of the series’ value and is determined at the beginning of each calendar quarter in accordance with the schedule of management fee tiers set out in the table below.

| Reference rate (FTSE Canada Universe Bond Index yield-to-maturity) | Management Fee - Series F/F(N) | Management Fee - Series A/A(N) |

|---|

EdgePoint decided to temporarily waive a portion of the applicable management fee such that the series’ management fee for 2024 will not exceed 0.10% for Series F Units/Series F(N) Units and 0.70% for Series A Units/Series A(N) Units of the EdgePoint Monthly Income Portfolio, despite changes to the daily average yield to maturity of the FTSE Canada Universe Bond Index.

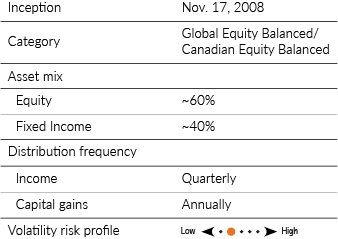

EdgePoint Global Growth & Income Portfolio and EdgePoint Canadian Growth & Income Portfolio

Balanced portfolios concentrated in quality businesses from around the world or Canada with growth potential, and also investments in fixed income securities

The Portfolios can invest in a company’s debt, equity or a combination of both depending on our view of the risk-return opportunity. We look across a company’s corporate structure to determine the best opportunities. If we feel the yield compensates us for the business’s inherent risk, we’ll invest in several parts of a company’s corporate structure (i.e., in the debt and equity). We actively manage the Portfolio’s asset allocation based on where we’re finding the best opportunities. The fixed income portion can range from 25% to 60%, providing plenty of flexibility.

We apply the research we do on our equity investments to fixed income. Many of the bonds we hold are issued by companies whose equity we also own. The in-depth analysis we perform for equities means we can gain a thorough understanding of a company’s credit profile and contrast the yield with our estimated risk level.

We view shares as ownership stakes in businesses, meaning we want to buy interests in quality companies. We look for businesses with strong competitive positions, defendable barriers to entry, long-term growth prospects and competent management teams, then acquire ownership stakes in these companies at prices below our assessment of their true value.

The Portfolios’ credit investments provide a return through coupon payments, dividend payments, interest and capital appreciation. We look at the borrower’s (bond issuer’s) ability to meet its debt obligations, specifically through the payment of periodic coupons and the return of the principal at maturity. We have the flexibility to invest globally, from government and corporate investment-grade bonds, preferred shares and convertible debt, to high yield and non-rated bonds.

EdgePoint Opportunistic Credit Portfolio

For investors who qualify via a prospectus exemption

See the EdgePoint Opportunistic Credit Portfolio offering memorandum for more information.