Deck the halls with pleasing long-term returns

As the holidays approach, we’re embracing the spirit of the season while staying focused on what matters most: helping grow your family’s hard-earned wealth.

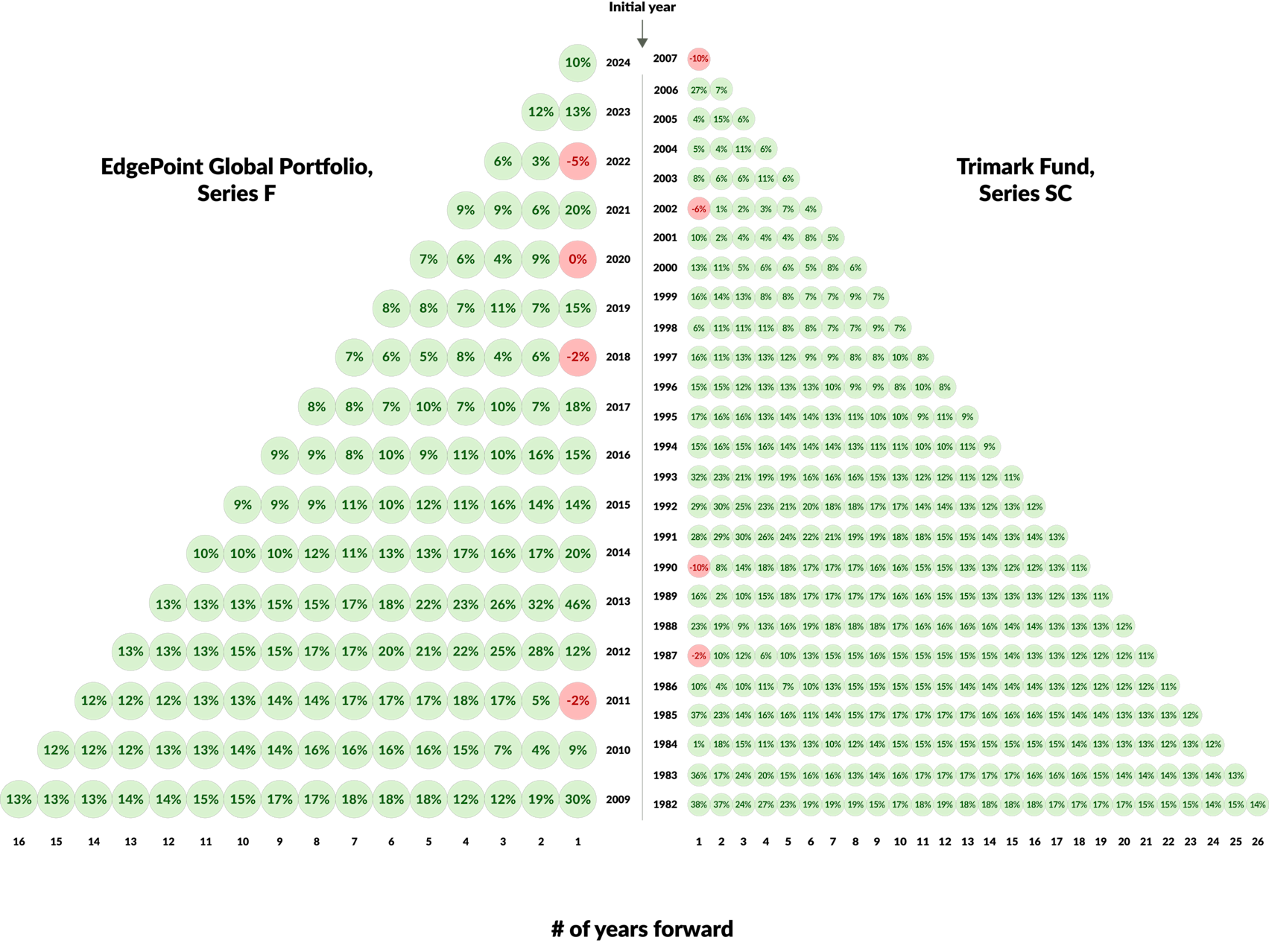

Take a look at the Christmas tree below which tracks performance through the years. Thankfully, there are only a few red ornaments! But what the chart really shows is the power of sticking to a disciplined approach, year after year.

On the left-hand side, you’ll see the performance of the EdgePoint Global Portfolio. If you’d invested in EdgePoint Global Portfolio on January 1, 2009, your return would’ve been 30% for the first year, 19% annualized over two years and 13% annualized over 16 years.

Our discipline of building diversified portfolios of proprietary, high-conviction ideas has a track record that’s decades long. The right side of the chart shows Trimark’s historical returnsi – proof that our investment approach has worked through historical bull and bear markets alike.

Annualized forward total returns (C$)

Annualized total returns, net of fees (excluding advisory fees for Series F), in C$. As at November 30, 2025.

EdgePoint Global Portfolio, Series F – Since inception (Nov. 17, 2008): 13.70%, 15-year: 12.38%, 10-year: 9.41%, 5-year: 11.13%, 3-year: 12.80%, 1-year: 14.20%, YTD: 18.27%; Invesco Global Companies Fund, Series F* – Since inception (Feb. 11, 2000): 7.74%, 15-year: 11.23%, 10-year: 9.05%, 5-year: 10.59%, 3-year: 17.22%, 1-year: 11.15%, YTD: 12.78%; Invesco Global Companies Fund, Series SC* – Since inception (Sep. 1, 1981): 11.05%, 15-year: 10.62%, 10-year: 8.40%, 5-year: 9.80%, 3-year: 16.39%, 1-year: 10.37%, YTD: 11.98%.

*As at July 27, 2018, Trimark Fund changed its name to Invesco Global Companies Fund with a Series F inception date as of February 11, 2000.

Source, Trimark: Morningstar Direct. Total annual returns, net of fees, measured in C$. Annual returns were used in all calculations above. Periods with a negative return are highlighted in red. Forward returns are calculated from the first calendar day of each starting year on the chart referenced above. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. Periods greater than 1-year are annualized. Historical performance is not indicative of future returns.

We know markets will be naughty and nice, but we can’t predict when. For investors who focus on their end goals and don’t react to short-term lumps of coal, the long-term results speak for themselves. The more years you give the approach, the merrier the results have been.

Since EdgePoint Global Portfolio launched in 2008, there have only been four calendar years with negative returns. The rest have been green branches representing years of building investor wealth. They were watered by patience, a commitment to finding great businesses and a resolve to get that growth for free.

So, as you gather around your tree this season, remember that investing isn’t about reacting to every headline or chasing the next shiny product. It’s about patience and trusting a timeless, differentiated approach that’s delivered for decades.

Our Christmas tree of returns isn’t just festive looking – it’s the proof that time and discipline are the gifts that keep on giving.

Happy holidays from our family to yours.