Geoff MacDonald, left, and Tye Bousada of EdgePoint Wealth Management. “We’re looking for a growth business at a value price.”

In January 2008, Tye Bousada shook the mutual fund industry when he left a prestigious job running AIM Trimark’s flagship Trimark Fund. His next move was just as stunning. In November of that year, as the market was crashing, he and three Trimark veterans launched a new firm, EdgePoint Wealth Management. This investment supergroup included Trimark co-founder Bob Krembil, former chief investment officer Patrick Farmer and Geoff MacDonald, another star portfolio manager.

Bousada had several reasons for leaving his job, but the main one was that the mutual fund industry was turning into more of a marketing-driven business than an investor-focused one, he says. Brilliant investors started all the big firms—Sir John Templeton at Templeton Mutual Funds, Warren Goldring at AGF, Bob Krembil at Trimark, for example—but their investor-led ethos ebbed away. Accumulating assets became the name of the game. “Marketing-led organizations have a very different outlook than investment-led ones,” says Bousada, 43.

EdgePoint doesn’t do road shows. It purposely works with only a handful of financial advisers. And it still offers just the same four funds it launched in 2008. That hasn’t stopped its funds under management from growing from $450 million at the outset to $7.5 billion today. The partners have taken their iconoclastic approach because they can, says MacDonald, 44. “A lot of fund companies have gone public, and now they’re answering to shareholders who want more assets and high fees,” he says.

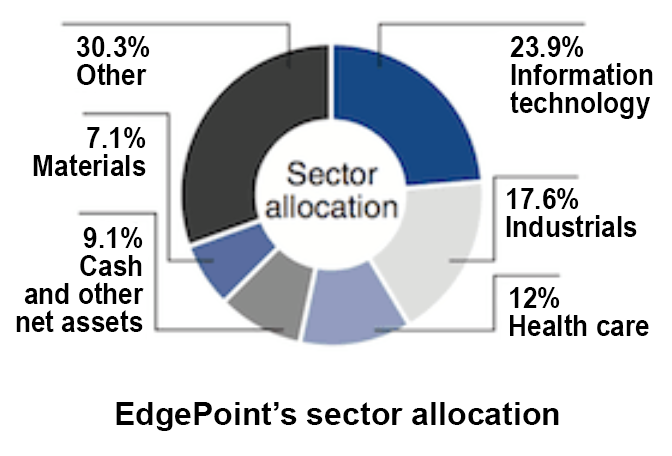

EdgePoint also takes a distinctive approach to investing. In contrast to large-company funds that hold upwards of 50 stocks— which leads them to become “closet indexers,” matching the risk and return of the broad market—its funds hold about 30. They also don’t hold more than 6% of assets in a single name. Bousada and MacDonald are proud bottom-up stock pickers, who look at high-quality companies, not trends in sectors or countries.

As a result, their portfolios look nothing like the index. Only 15 of the companies in their global fund are in the MSCI World Index’s 1,600-stock universe, while fewer than half of the names in their Canadian fund are in the S&P/TSX composite.

While this approach has worked so far—EdgePoint’s four-star Global Portfolio Series fund has a 13% five-year annualized return, nearly 3% better than the category average, according to Morningstar—it’s going to be tested. Between 2008 and 2013, Bousada and MacDonald could find five good buys for every 100 companies they looked at. Now, they say, they have to comb through 300 businesses to find one good idea.

Title: How EdgePoint Wealth Management finds growth businesses at a discount

Author: Bryan Borzykowski

Publisher: Canadian Business

Photographer: Thomas Dagg

For a printer-friendly version, click here