You’re probably pretty sensitive to your investments dropping in value – we can’t think of anyone who’s thrilled about parting with their money. However, while your first instinct may be to ditch your short-term losers and replace them with recent winners, for your own sake you need to come to terms with the fact that occasional underperformance from top investment managers is perfectly normal. You can’t think of it as necessarily being a sign that something’s amiss. You should instead count on and accept periods of weak returns from even the best managers out there. Believe it or not, the irony of achieving long-term outperformance is being able to bear short-term underperformance.

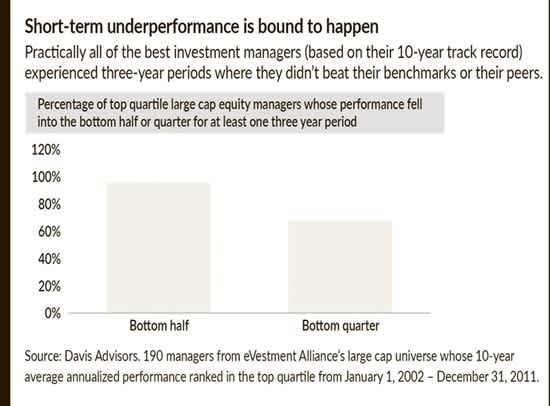

More than one study has shown that the vast majority of successful managers have at times failed to exceed their benchmarks or their peers, particularly over periods of three years or less.* And they’ve sometimes lagged by a wide margin, with half of top-performing funds over 10 years falling short by three percentage points compared to their benchmarks and 25% by five or more percentage points for at least one three-year interval.** Of course it’s easy to lose confidence in an investment after suffering through a negative period but in our opinion, selling (or buying, for that matter) purely based on short-term numbers is one of the worst things you can do as an investor.

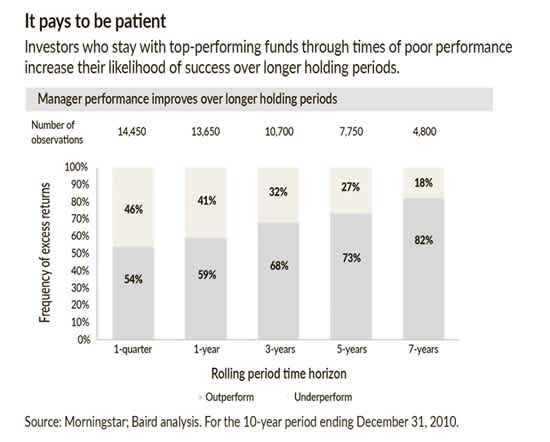

Undeniably, your behaviour during stretches of underperformance is what really makes or breaks your long-term outcome in an investment. When you redeem rather than stick it out, you forego the opportunity to benefit from an eventual recovery, which is doubly detrimental to your bottom line. Investors also have a tendency to buy into funds only when they’re doing well, in effect buying high and selling low, precisely the opposite of what they should be doing.

More than one study has shown that the vast majority of successful managers have at times failed to exceed their benchmarks or their peers, particularly over periods of three years or less.* And they’ve sometimes lagged by a wide margin, with half of top-performing funds over 10 years falling short by three percentage points compared to their benchmarks and 25% by five or more percentage points for at least one three-year interval.** Of course it’s easy to lose confidence in an investment after suffering through a negative period but in our opinion, selling (or buying, for that matter) purely based on short-term numbers is one of the worst things you can do as an investor.

Undeniably, your behaviour during stretches of underperformance is what really makes or breaks your long-term outcome in an investment. When you redeem rather than stick it out, you forego the opportunity to benefit from an eventual recovery, which is doubly detrimental to your bottom line. Investors also have a tendency to buy into funds only when they’re doing well, in effect buying high and selling low, precisely the opposite of what they should be doing.

Do yourself a favour – after picking the right investment for you based on a variety of factors, stay loyal barring any major changes to its investment process, management, etc. After all, the longer you stay in the game, the greater your chances of coming out ahead. That goes for us as well. Don’t replace some other fund with one of ours simply because it has underperformed lately. Give us your money because you agree with our investment approach and understand how we can help you long term.

“Good managers can/do underperform”.

**Robert W. Baird & Co. Inc., “The truth about top-performing money managers”. 2011.