Another uneventful year in a year full of events – 4th quarter, 2014

Looking back at stock market history, most years were just as uneventful as the next even though each year was full of events, drama and intrigue. As they often do, stocks go up even in the face of scary headlines. 2014 was no different. In fact, stocks go up many more years than they go down. So let’s chalk 2014 up to just another year stocks went up.

During each year there will be at least one period of drama. The fear of loss, need for certainty as well as lack of differentiation between short-term volatility and the kind of risk that really matters causes the drama to be significantly more dramatic than necessary.

As we’ve said before, we don’t deal in drama. And that means we do everything we can to not fall victim to the drama that surrounds short-term volatility.

Decisions in the face of uncertainty

The world is uncertain and most minds aren’t wired for uncertainty. The vast majority of minds are constantly searching for rigidity, clarity and an antidote to uncertainty. In this uncertain world, you have entrusted us with a portion of your hard-earned savings. It’s our job to grow these savings over a meaningful amount of time. In order to do this, we have to make decisions about the future when that future is uncertain.

From a business perspective, some might argue that we’d be wise to try to convince you that we know the future. The simple truth is we don’t. If you turn on a TV, browse the web or read a newspaper, you’ll be bombarded with people trying to convince you that they know exactly what’s going to happen in the short term to things like interest rates, exchange rates, the price of oil or the price of a particular stock. They want to convince you to invest with them and are trying to capitalize on the fact that your mind craves certainty.

We have a different objective at EdgePoint. First and foremost, we want to deliver investment performance at or near the top of our peer group over a 10-year time frame. To achieve our goal we have to have the self-awareness to know that we don’t know what’s going to happen in the short term. The biggest benefit of realizing that you can’t predict the future is that it frees up your mind to focus on more meaningful endeavours like how to prepare for uncertainty. Our goal at EdgePoint is to be prepared to thrive under variable conditions over a meaningful period of time, not guess the future. So the obvious question is, how do we do this?

Following are a few things we attempt to do to achieve our goal of having superior performance over the long term, or said differently, what we try to do to be worthy of your trust. This is by no means a comprehensive list, but does include a number of the major things on which we focus.

We try to stay focused on the investment approach

Over time, our approach has delivered pleasing returns to those who have entrusted us with their savings. We believe our approach has been successful because it revolves around identifying a business that can grow in the future irrespective of what happens in the global economy (within a band of reason), and not paying for that growth today. We call the combination of these two things proprietary insights and it’s these insights that sit at the centre of everything we do.

Being at peace with the fact that the future is uncertain allows us to focus on identifying businesses that can succeed even if the future is tougher than everyone hopes. Here’s an example of a business we’ve owned in our Global Portfolios since inception in November 2008 to highlight our investment approach at work.

Ryanair is Europe’s largest airline. Most people have been pre-conditioned to believe airlines are a terrible business, and in almost all cases they’re right to believe that. However, Ryanair seems to be an exception to that rule. Following are things Ryanair has had to contend with since we first invested in the company over six years ago.

Oil jumped from US$45 a barrel to over US$120 and hovered at that price until recently

Greece, Spain, Portugal and Italy flirted with bankruptcy

Winter 2014, one of the worst winters in a century in Europe, closed airports from London to Barcelona for extended periods

Two full-blown European recessions

Russian hostilities in Eastern Europe

Deflationary forces throughout Europe

A collapse in tourism across many of Ryanair’s end markets

A financial crisis of unprecedented proportions impacted its home market of Ireland

Unemployment levels were above 10% in Ireland and in some countries exceeded 25% in Ryanair’s end markets

An Icelandic volcano eruption shut down European airspace for a prolonged period during one of its busiest times

When we originally made the investment, we couldn’t have forecasted many of these negative headwinds. However, in spite of these issues, Ryanair increased the number of passengers it carries from 58 million per year in 2008 to close to 90 million per year today, while increasing its pre-tax profits more than sixfold over the last six years. During the same time, its share price increased from approximately €3.00 to over €9.50 and it's given us a special dividend equivalent to €0.68. This brings us back to the original thesis on Ryanair. In 2008, we believed Ryanair could grow almost irrespective of what happened in the economy and we weren’t being asked to pay for that growth at €3.00 a share. The simplified version of our thesis was that Ryanair’s focus on being a low-cost operator would allow it to grow even if the economy stunk. What gave us this confidence was Ryanair’s cost position relative to its competition. Ryanair’s cost of operation per passenger was, and continues to be, about 50% lower than its closest competitor. As such, Ryanair could offer fares below its competitors’ costs and still make healthy profits. Our research also led us to believe Ryanair would continue to build on its low-cost position increasing the value of its business.

When making investment decisions in the face of uncertainty, we try to identify businesses that can grow no matter what happens in the economy and try to get that growth for free.

We try to work with people who understand the true definition of risk

It’s easier to ignore short-term volatility if you don’t associate it with risk. We view risk as the possibility for permanent loss of capital. Unfortunately, many investors associate risk with short-term market volatility.

How do you define risk? Is risk how you feel when stocks go down? Do you have too much debt and lack the liquidity to be as invested in the market? Or perhaps you don’t really understand what you own. Maybe your investment horizon is too short because you need funds in the next year. Perhaps you lack knowledge of market history. Whatever the case, your perception of risk needs to change because stocks do go down and believing negative shorter-term volatility is risk might cause you to turn a normal, regularly occurring event into something much more harmful. You might make decisions that you think will protect you from “risk” but unfortunately create real longer-term risks that are far more harmful than normal short-term market fluctuations.

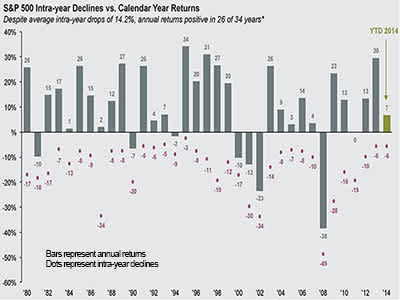

Annual returns and intra-year declines

Source: Standard & Poor’s, FactSet Research Systems Inc., J.P Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refer to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Calendar-year returns shown from 1980 to 2013 and 2014 year-to-date. Data as at September 30, 2014. Guide to Markets – U.S.

But what could be more harmful than the feeling you get when stocks go down? Real harm comes from any action you take that increases the probability of not having enough money for your retirement. Here are a few that come to mind:

You like to spend and don’t save

You save, but don’t have a sound investment plan to keep up with inflation

You save and have a reasonable financial plan but you don’t stick to it because you encounter fearful feelings when things get a little volatile. That fear causes you to forget about the risk that really matters (running out of money) and you focus on the perceived “risk” around shorter-term volatility

We often espouse the benefits and serenity investors experience when they realize shorter-term volatility is not risk. We try to surround ourselves with the right people and believe we have the best, most informed investment partners in the business. Flows into our investments demonstrate this. Despite a decline in the markets from September 18 to October 15, 2014, when the MSCI World dropped almost 6% and the S&P/TSX Composite Index fell over 10% (returns in C$), our fund flows remained consistent with the weeks preceding the drop when the markets were viewed as “safe”. In contrast, periods of short-term volatility like this will often cause investors to panic and either stop investing or pull their money from the market.

Based on this behaviour, we’d like to think our investment partners have knowledge of market history, are aware shorter-term volatility occurs every year and know it’s their discipline and knowledge of the past that prevents them from converting this temporary event into a permanent loss of capital.

The chart below shows an unfortunate reality. The average investor’s performance is worse than every asset category and barely beats inflation. Combining our time-tested investment approach with the long-term discipline exhibited by our investment partners to date, we collectively have a chance to change the look of the chart below for our valuable partners.

20-year annualized returns by asset class (1993 – 2013)

Source: Bloomberg. Bonds: Barclays Capital U.S. Aggregate Bond Index; Oil: Bloomberg WTI Cushing Crude; Gold: Bloomberg Gold Spot Price per Troy Ounce; Homes: S&P/Case Shiller U.S. Home Price Index; Inflation: U.S. Consumer Price Index; Average Investor Returns: Calculated using Dalbar fund flow information. The average investor return is the average of Equity, Fixed Income and Asset Allocation investor returns. S&P 500 Index is a broad-based, market-capitalization-weighted index of the 500 largest and most widely held stocks in the U.S. All returns annualized and in US$.

If the only risk that really matters is longer-term risk, which for most of us is at least 20 or 30 years, there are few periods where real returns have been negative. Everyone might point to Japan, but try to name another. The beauty of longer-term bear markets that wreak havoc on our long-term capital is they’re not only rare, but they don’t affect all markets. If the average investor understood what risk really is and understood how rare these longer-term bear markets are, we’d have much less drama in the stock market.

We try to remember that time is the friend of a great business

We believe we own many great businesses; however, there are few as recognizable to every person reading this commentary as Tim Hortons Inc. (now called Restaurant Brands International Inc.).

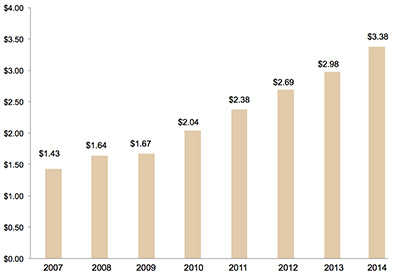

Below is a chart showing the growth in annual earnings per share (the portion of the company’s profit allocated to each outstanding share) of Tim Hortons over time. To illustrate, if you owned one share of Tim Hortons on January 1, 2007, your share of the 2006 profits would have been $1.43. By 2014, your share of the profits increased to $3.38. As the profits per share go up, the value per share usually follows.

Progression of profitability

Tim Hortons’ annual earnings per share (EPS)

Source: Bloomberg, Annual adjusted earnings per share in C$. FactSet Research Systems Inc.: Q4–2014 estimate source.

Two of the most important reasons Tim Hortons is a great business are that it has had, and continues to have, many growth opportunities and requires very little capital to grow.

Here are some opportunities for growth that we see for Tim Hortons:

If you consider the number of stores per capita in Ontario and assume other provinces achieve the same level of penetration, Tim Hortons could grow its retail locations by 28% in Canada alone. This assumes no other stores are added in Ontario

Tim Hortons has barely scratched the surface of the U.S. market with most locations concentrated in the Northeastern U.S. Over time, we expect it will expand into other areas of the U.S.

Tim Hortons is constantly innovating so its customers spend more. 15 years ago you probably wouldn’t have thought of Tim Hortons as a place to have lunch but today it does more business at lunch than any other quick-serve restaurant in Canada (including McDonalds and Subway)

In addition to capitalizing on growth, Tim Hortons is in the favourable position of not having to invest a lot of capital to generate that growth. Said differently, Tim Hortons is primarily a royalty company. So for every cup of coffee sold, the franchisee kicks back a portion of the sale price to Tim Hortons. In most cases, the franchisee puts up the money to build a Tim Hortons and that same franchisee pays Tim Hortons a royalty on everything they sell for the right to use its brand.

A company that’s very profitable, has lots of opportunities for growth and requires very little capital to grow is usually a great business. We knew this in 2008 when we originally purchased Tim Hortons at $27.15 per share and we also knew it when Burger King showed up a few months ago and offered us $65.50 per share in cash and 0.8025 common shares of the new company for the right to merge with it. As such, we continue to own Tim Hortons today as part of the larger company called Restaurant Brands International (which contains both Tim Hortons and Burger King). We continue to believe time will be the friend of Tim Hortons/Restaurant Brands.

When making investment decisions in the face of uncertainty, we find it helpful to remember that time is the friend of a great business.

We try to remember that our goal is different than most investors

Most investors want to reap large financial gains but don’t want to stray from the normal path unless it’s to the upside. We think this goal is completely unrealistic. In trying to make decisions about the future, we realize that in order to achieve outsized returns, you can’t look like the index you’re trying to beat. In fact, beating an index sometimes requires you look wrong in the short term to be right in the long term.

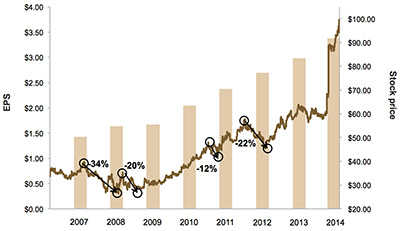

Let’s return to Tim Hortons to expand on this point. Below is the same graph we just showed demonstrating the progression in earnings per share for Tim Hortons over time but we’ve superimposed the share price on the original graph.

Earnings growth and share price volatility

Tim Hortons’ annual EPS and stock price growth

Source: Bloomberg. Annual adjusted earnings per share and stock price in C$. Decline in stock price does not include reinvestment of dividends. 34% decline: 12/10/2007 – 11/20/2008; 20% decline: 01/02/2009 – 05/22/2009; 12% decline: 05/10/2011 – 08/08/2011; 22% decline: 05/07/2012 – 12/04/2012. Stock price as at December 12, 2014. FactSet Research Systems Inc.: Q4–2014 EPS estimate.

In four periods during the last seven years the share price fell by more than 10%. The business kept growing, earnings kept going up, and yet short-term fears crept into the equation. As the share price fell many investors found themselves paralyzed because they didn’t know the value of the business and/or didn’t want to commit to buying more of a business whose share price was going down. They were fearful of having performance that diverged in the short term from the index.

Our goal is to build wealth over ten years so we saw the short-term decline in price as an opportunity to buy more of a great business for less. We added to our position in Tim Hortons during three of the four periods and weren’t worried our performance might diverge from the index in the short term.

Share prices will fall in the short term for all sorts of reasons and many aren’t company specific. If you know the value of a business, you can take advantage of price declines to build wealth. To do so, you have to know more than the value of the business. You also have to be comfortable with the notion that your performance might look different than the index.

When making investment decisions in the face of uncertainty, we find it helpful to remember that to meaningfully beat a benchmark over ten years, you can’t look anything like a benchmark.

We try to remember that we’ll make mistakes

Decisions can be nerve-racking because the outcome is never known at the time of the decision. It’s the fear of making a mistake that sometimes interferes with the decision process itself. At EdgePoint, we make decisions based on facts and then apply sound reasoning to those facts. In order to maintain confidence in our judgment, we must first get comfortable with the idea that every year we’ll make mistakes. Here are the holding period returns (in C$) of some of our dumbest investments over the past six years:

EdgePoint Global Portfolio

Connaught PLC: -68%

Western Union Co.: -26%

EdgePoint Canadian Portfolio

BlackBerry Ltd.: -76%

Lululemon Athletica Inc.: -11%

Anderson Energy Ltd.: -57%

Vero Energy Inc.: -49%

Pace Oil & Gas Ltd.: -63%

Portfolio performance as at December 31, 2014. Annualized total returns, net of fees, in C$

EdgePoint Global Portfolio, Series A: YTD: 18.71%; 1-year: 18.71%; 3-year: 23.98%; 5-year: 14.92%; since inception: 18.58%. EdgePoint Canadian Portfolio, Series A: YTD: 9.39%; 1-year: 9.39%; 3-year: 14.56%; 5-year: 10.07%: since inception: 16.49%.

At the beginning of every year we believe we own the best collection of businesses. However, it’s the realization that some of those ideas won’t work out as planned that makes us diversify our Portfolios by business idea. By having a collection of different ideas, we try to limit our exposure to inevitable errors in judgment.

We’ve written extensively on the importance of diversification in the past. For more of our thoughts on this topic, go to chapter five of our Investor Day 2012 video in the Resources section at www.cymbria.com. While the discussion is focused on Cymbria, it represents our overall philosophy on diversification.

We try to live in a narrow emotional band

The best portfolio managers live in a narrow emotional band. They never get excited when things are going their way, and never get down when things are moving against them. They stay focused on the facts.

The markets are irrational due in large part to the human emotions of fear and greed. The best example of this is how the markets fluctuate by significant amounts over short periods. Businesses don’t experience wild changes in value daily, but when you add emotion to the mix, their stock prices suddenly do.

At the end of every day commentators will pontificate about why the markets did what they did that day, but it’s almost all nonsensical noise. We have yet to hear a commentator tell their audience the truth, which would sound something like this: “The markets gyrated a lot today, but the underlying business values didn’t really change all that much. The root cause of the gyrations was reporters like me reporting stuff of little value which somehow had an effect on the human emotions of fear and greed.”

When making investment decisions in the face of uncertainty, we try to remember that shutting out the noise is a valuable skill.

We try to surround ourselves with sharp thinkers

It’s tough to find individuals with the right blend of passion, intelligence and energy in this business. We are fortunate to work with three people who have just the right mix. Ted Chisholm, Frank Mullen and Andrew Pastor add a lot of value to your EdgePoint investments because they each bring different personalities, perspectives and skills to the table every day. We work as a cohesive team with each member contributing in their own unique way. While it isn’t decision by committee, we do work as a collective, and in our minds we wouldn’t be where we are today without the contributions of each team member. Making decisions in an uncertain world can be easier when you’re surrounded by some of the best thinkers in the business.

Conclusion

The world is uncertain, and we appreciate that you've entrusted a portion of your savings to us in this uncertain world.

We continue to approach investing in these markets with measured confidence, value your trust in us and look forward to building your wealth over the long term.

Fixed-income comments

By Frank Mullen, portfolio manager

We’re often asked how the EdgePoint investment approach applies to our fixed-income investments. We approach fixed-income investing in the same manner as we do equity investing. We’re long-term investors who seek to acquire ownership stakes in quality businesses at prices below our assessment of their true worth. Buying equity is simply purchasing an ownership stake in a business while buying a bond is lending money to a business. Despite the differing investment perspective (i.e., owner vs lender), the investment process for both equities and fixed income starts with an analysis of the underlying business. No investment is worthwhile if the underlying fundamentals of the business aren’t solid and don’t offer an attractive risk/reward potential.

Many investors find fixed-income investing complicated. While there can be complications, it’s helpful to think about bonds in terms of first principles. In its most basic form a bond is simply a loan. The primary concern of anyone who provides a loan is whether or not they will get their money back. In general, a high yield isn’t enough for us to justify buying the bond of a company that we aren’t confident will pay us back. For this reason, fixed-income investing at EdgePoint begins with credit analysis and a deep-dive review of the underlying value of the business to which we’re loaning money. This credit analysis is very similar to how we begin analyzing an equity investment and we often find fixed-income investment ideas while researching a business's equity.

We believe we have an edge in analyzing a business’s future prospects and risks, and developing a thesis as to how that business can grow in the future. Growth is important for many of our fixed-income investments as it often results in the company generating a growing level of free cash that increases its ability to service the debt and return our principal. Many people believe that fixed-income investing is simply clipping a coupon and earning a yield. Although that can be true, our best fixed-income investments have come from our ability to develop a thesis about how a business can grow and de-lever faster than the market thinks. If our thesis is correct, we not only earn the coupon but can also benefit from the bond's capital appreciation.

We also believe that we have an edge in credit analysis and our history has shown that when we’ve used this edge, we’ve had pleasing results. Fixed-income investors must also consider future interest rates as they affect the future value of bonds. While we always consider interest rates when making a fixed-income investment, we don’t think we have an ability to forecast where rates will be in the future. At the beginning of 2014, 67 economists were surveyed by Bloomberg and all forecasted rates would rise in the U.S. in 2014. A large group of well-educated people were unanimous in thinking rates would rise and they were all wrong. In fact 10-year rates in the U.S. fell approximately 80 basis points and 30-year rates fell an even greater amount. The world is a very uncertain place and we acknowledge the fact that we don’t think we’ll ever have an edge at predicting rates or the shape of the yield curve.

In light of the above, we view interest rates as a source of risk. At the beginning of 2014 we believed the risk of rates rising far outweighed the risk of rates continuing to decline. When we looked at the yield on longer-term bonds with higher interest rate risk, we didn’t get excited and questioned whether we were being properly compensated to take on the additional interest rate risk. With 10-year Canadian government bonds yielding 2.75%, it doesn’t take much of a rate increase to result in a negative return. We weren’t predicting that rates would increase; rather, we were concerned we weren’t being compensated for taking on additional risk. So we kept the duration of our Portfolios' fixed-income component quite low, at around three years. Looking back, we would have been better off owning longer-duration bonds that increased in price as rates decreased over the year. Nevertheless, I don’t think we could justify owning these bonds and still be true to our investment approach. We didn’t have conviction that rates would fall but remained confident that we could continue to find quality credit investments. By allocating 100% of our fixed-income holdings to corporate bonds, we focused our ideas on where we believed we had an edge and didn’t speculate on rates by buying longer-duration government bonds.

Tervita

Our investment in Tervita bonds is a great example of our investment approach at work. Tervita is a private waste-service company that does a great deal of work in the oil patch. We analyzed the business's assets and cash flow and were comfortable it could service its 9% coupon debt. We met with Tervita's management, analyzed its competitors, assessed the market opportunity and felt that Tervita could handle their large debt load. We believed the company could grow, use its increasing cash flows to pay down debt and potentially go public. After investing, we continued to follow its progress and evaluate whether our thesis was playing out. Unfortunately, the business's fundamentals didn’t improve as we expected. We still believed Tervita had quality assets but it was neither growing nor reducing debt at the levels we hoped for. Despite its bond price increase, we lost confidence in our thesis and chose to sell our position, generating a holding period return of 9.38%.

This example highlights key parts of the EdgePoint investment approach. We began with a thorough credit analysis and thesis development because again, we don't invest to simply clip a coupon. To be comfortable with the investment, we did extensive due diligence conducted in large part because the company had no publicly traded equity. It’s this in-depth analysis and due diligence that make our Portfolios truly go-anywhere, meaning they can invest wherever we think there’s an opportunity. Our investment in Tervita was actively managed from the outset as we constantly challenged our thesis. Finally, when we were no longer confident in our thesis, we exited the position. Regardless of the bonds' relatively high yield, we could no longer justify owning them. By focusing on business fundamentals, we identified a company that we thought was a weaker credit risk than the market did. Although not our most successful investment example, Tervita illustrates the lifecycle of our investment approach.