Keeping it simple when it comes to risk – 3rd quarter, 2024

The latest round of interest rate cuts by central banks around the world has reignited enthusiasm for bonds, as shown by recent flows into U.S. fixed income assets.

Bond fund flows (US$)

Jan. 1, 2017 to Sep. 26, 2024

Source: LevFin Insights, US Flows, September 26, 2024.

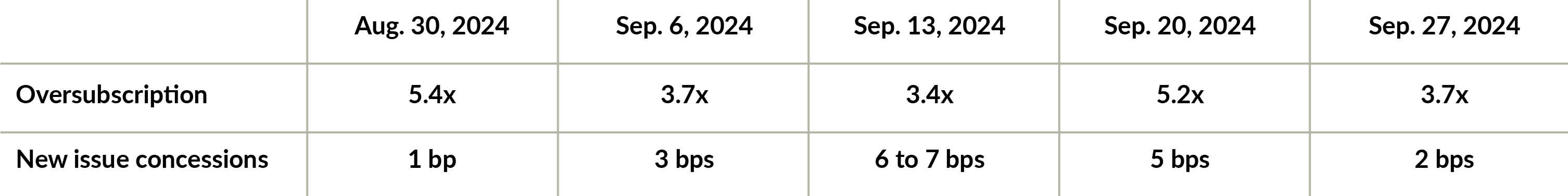

Demand has outweighed supply for new issues, resulting in subscribers willing to take a lower new issue concession (spread premium or less “extra spread”) compared to bonds available in the secondary market.i Two Canadian investment-grade bonds issued at the end of September even had negative spread concessions, meaning that investors were willing to overpay in the primary market rather than buy existing bonds on the secondary market.

New bond issues – concessions and oversubscriptions

Aug. 30, 2024 to Sep. 27, 2024

Source: Morgan Stanley, Morgan Stanley Investment Grade Highlights for the Week, August 30 2024 to September 27, 2024. As at September 30, 2024. “bps” are basis points, the equivalent of 0.01%.

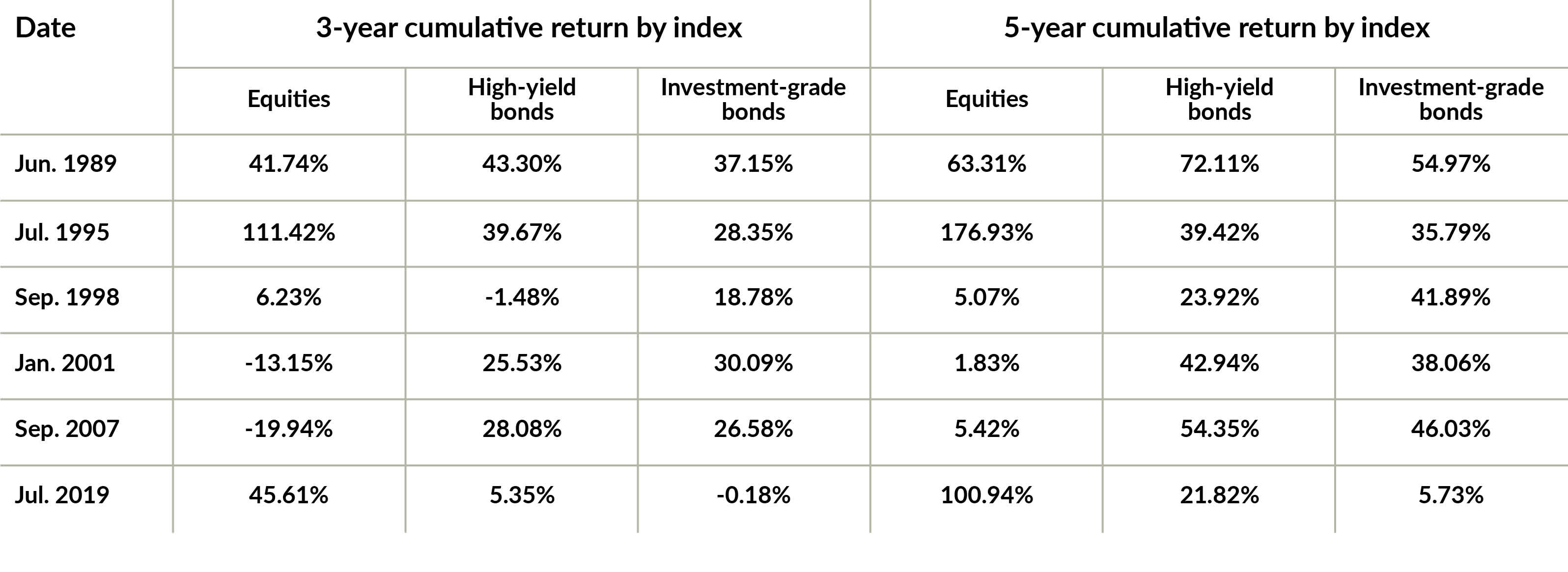

The excitement likely comes from the past. Of the six periods when the U.S. Federal Reserve lowered interest rates since 1989, U.S. fixed income assets had relatively outsized returns over the three- and five-year periods following the first rate cut. High-yield bonds outperformed their equity counterparts four out of the six possible periods on a five-year basis, while both types of fixed income beat stocks half of the time over three years. We don’t rely on these types of statistics, but people who trade based on past patterns probably think this is some kind of insight.

S&P 500 Index, ICE BofA US High Yield Index and ICE BofA US Corporate Index returns

Source: Bloomberg LP. Total returns in US$. As at September 30, 2024. The indexes are the S&P 500 Index (equities), the ICE BofA US High Yield Index (high-yield bonds) and the ICE BofA US Corporate Index (investment-grade bonds). The indexes are not investible. The dates selected were the first month-ends following the first interest rate cut by the U.S. Federal Reserve. See Important information – Indexes and benchmarks for additional details.

Before anyone gets too excited about fixed income, we think it’s important to take a moment to consider the associated risks because, in our mind, betting on interest rate declines is a risky proposition. You need to ask yourself, “What risks are your clients willing to take?” and “Do they fully understand these risks?” And more importantly, “Are you prepared to manage those risks if they materialize?” You certainly don’t want to be surprised after it occurs because it can be detrimental to your portfolio. It’s vital to have a more informed understanding of the risks beforehand.

Measuring the risk doesn’t have to be complicated

“Risk comes from not knowing what you’re doing” - Warren Buffett

Measuring fixed income risks doesn’t have to be rocket science, especially if you view it like we do and consider it as “businesspeople lending to businesses.”

Investors often make managing risk more complex than necessary. If you search for “risk of investing in fixed income” online, you’ll find lots of jargon and convoluted calculations. The desire to quantify things to simplify decision making is natural – even I was consumed by it during my academic years.

I would calculate how long it took to walk between classes or the best time (down to seconds) to go for lunch based on when the line was the shortest. This obsession extended to my studies, particularly in Financial Risk Management, where I was fascinated by various models used to quantify risk.

However, if you expect me to delve into specific models like VaR or the Merton Model in this commentary, you may be disappointed. The experience of Long-Term Capital Management LP taught me a crucial lesson: no model can perfectly quantify risk in advance.ii Models might be able to calculate the probability of default and loss given defaultiii using all kinds of regression, but they wouldn’t help if your definition of the risk is wrong and your view isn’t forward-looking. Given this reality, how can we genuinely understand and measure the risks we face?

In my view, measuring risk should be straightforward. As the famous saying goes, "If you can’t explain it simply enough for your grandparents to understand and share with her friends, then you don’t understand it well enough yourself." There are all kinds of risks you can take when investing in fixed income, but ultimately the primary risk should be the permanent loss of capital. While you’ve probably heard this from us before, I wanted to expand on it by breaking down four types of fixed income risk: credit, interest rate, liquidity and ESG. You might think, "This isn’t new information." However, I encourage you to stick around for what’s coming next – let's see if you still feel that way afterwards.

Credit risk

“Credit risk” is something we do take on at EdgePoint every day, although we prefer to call it “business risk.” Assessing credit risk is about knowing the likelihood that each borrower (i.e., issuer) will not pay you back.

I’ve always liked the word “credit.” It comes from the Latin word credere, meaning “to believe” or “to entrust.” When we extend credit to businesses, we’re essentially placing our trust in the borrower to repay the loan according to the terms of the agreement. As businesspeople, we’re constantly assessing and studying the companies we lend to.

Key questions we ask include:

Is the company likely to improve its profitability and generate positive free cash flow?

When the economic cycle turns, how will the company perform in a stressed scenario?

How large is the debt relative to the company’s business value? Is that proportion reasonable? What is the quality of the company’s assets? Could they cover the debt in the event of bankruptcy?

How well do the covenants protect us? What about collateral, credit enhancements or loan guarantees?

Thanks to our concentrated portfolio and dedicated 15-member Investment Team, we have the time and resources to thoroughly study and monitor businesses, allowing us to be highly selective in our credit choices.

EdgePoint Portfolios vs. benchmarks – Issuers and holdings

Credit rating agencies have created a letter-based rating system to make it “easier” for people to gauge the credit risk they’re taking. However, if those ratings were always accurate, credit analysis probably wouldn’t exist as a profession. Remember Credit Suisse’s Additional Tier 1 bonds? These corporate bonds were being reviewed by rating agencies for upgrade to investment grade as of December 31, 2020, before they were forced to restructure in March 2023.

Credit Suisse Group AG, 7.25% perpetual

Dec. 31, 2020 to Mar. 31, 2023

Source: Bloomberg LP. In US$. As at September 30, 2024.

We believe that managing credit risk goes beyond relying on ratings. It’s about truly knowing the business inside and out. Always ask yourself about the business risk to reduce the likelihood that something catches you by surprise in the future.

Interest rate risk

Interest rate is a risk. Bond prices typically move inversely to the direction of interest rates, and the last rate hike cycle is still fresh in our minds – along with the reminder of double-digit negative returns for some fixed income investors. At EdgePoint, we manage interest rate risk by avoiding it as much as we can. We believe investors should demand a risk premium for bearing this risk. While this may sound intuitive, it's often overlooked.

In Finance 101, we learned about the relationship between risk and reward. The longer you’re exposed to a risk, the more compensation you should demand. In technical terms, if a bond has a longer duration, shouldn’t you expect a higher yield to account for the extended risk?

We’ve been asked numerous times by investors, “Why is your portfolio’s duration shorter?” The simple answer is that we don’t believe we would be adequately compensated for taking on long-term interest rate risk when the yield curve is inverted and short-term rates are higher than long-term rates. You might point to “reinvestment risk”,iv but if you aren’t certain about both the direction and size of the rate move, why would anyone accept lower compensation for holding risk over a longer period?

We always keep interest rate risk in mind, but we don’t see ourselves as macroeconomists – we aren’t willing to make big bets on economic forecasts. Instead of playing games trying to predict where interest rates are moving, we manage such risk by avoiding it as much as we can. If you ever see us increase our duration, it’s only because we believe we’re being adequately compensated for taking that risk.

If you, like us, prefer not to bet on whether interest rates parallel shift (i.e., move in the same direction across all maturities), steepening or flattening the yield curve, you probably want to manage your interest rate risk and look at a portfolio that works under different rate environments.

EdgePoint fixed income returns vs. ICE BofA Canada Broad Market Index

Annualized net of fees fixed income total returns since inception (local currency)

Performance as at February 28, 2025. Annualized total returns, net of fees (excluding advisory fees), in C$.

EdgePoint Global Growth & Income Portfolio, Series F – YTD: 3.91%, 1-year: 10.25%, 3-year: 8.71%, 5-year: 8.93%, 10-year: 7.63%, 15-year: 10.04%, Since EdgePoint inception (Nov. 17, 2008): 11.39%. EdgePoint Canadian Growth & Income Portfolio, Series F – YTD: 1.99%, 1-year: 15.05%, 3-year: 12.36%, 5-year: 13.91%, 10-year: 9.18%, 15-year: 9.57%, Since EdgePoint inception (Nov. 17, 2008): 11.63%. ICE BofA Canada Broad Market Index – YTD: 2.28%, 1-year: 8.37%, 3-year: 1.44%, 5-year: 0.36%, 10-year: 1.71%, 15-year: 3.14%, Since EdgePoint inception (Nov. 17, 2008): 3.58%.

Source, EdgePoint: FactSet Research Systems Inc. Source, index: Bloomberg LP. As at September 30, 2024. August 2020 was selected because it included the date of the 10-year U.S. Government Bond’s lowest yield and marked the start of a rising interest rate environment. The EPGIP and EPCIP fixed income returns are in local currency, net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. See Important information – Indexes and benchmarks and Important information – EdgePoint Portfolio fixed income returns & fees for additional details.

Liquidity risk

Liquidity risk matters if you’re flipping bonds all day or if the bonds in your portfolio don’t trade at all. I think measuring liquidity risk without considering the investment strategy is like going to the airport without checking your flight status. It’s clear that a high-frequency trading strategy would have higher liquidity requirements. More trades mean more transactions and higher costs, increasing the significance of liquidity risk. Or if you invest in an asset whose pricing isn’t transparent or tested by the market, then you should be cautious about the reported returns on those illiquid assets.

Here are the percentages of EdgePoint credit holdings that we’ve held to maturity for each of our EdgePoint Growth & Income Portfolios since their inception:

EdgePoint Growth & Income Portfolios – Percentage of credit holdings held to maturity

When we purchase a bond, our expectation is always to hold them until maturity or until they are called by the company. The result is less turnover and fewer transactions throughout the investment horizon, making liquidity risk less important to us. Also, all the bonds in our prospectus Portfolios are publicly traded with continuous market making.v Our long investment horizon and transparent pricing give us the comfort to take a liquidity premium when we think we’re being compensated for it.

Environmental, Social and Governance (ESG) risk

By now, ESG risk shouldn’t be a new concept to anyone. At EdgePoint, we think it's crucial to understand how the businesses to which we lend are contributing to environmental sustainability, society and strong governance practices. As such, ESG is one of the considerations in the investment process. They aren’t determinative in our decision-making process, but they’re a limited part of the hierarchy of investment considerations. Equally important, however, is understanding how our investment strategy and approach may impact broader market efficiency.

As a business owner, focusing on ESG helps identify and manage related risks. We can also contribute as a lender to these businesses. We have opportunities to direct capital to the right borrowers facing short-term financial challenges that have the potential to improve profitability in the long term. Ideally, this allows that company to continue contributing to the growth of the economy and society at large. To us, that’s probably the most “ESG thing” in the world. Identifying the right companies to lend to isn’t an easy job, but adopting a long-term, bottom-up approach has helped broaden our perspective. Our deep credit dives give us an edge towards this goal. We might not always be right, but having a clear vision of what we’re working towards helps us manage risk more effectively.

Keeping it simple can pay off

We don’t believe there’s a perfect quantitative model that can measure every nuance of risk. We take comfort knowing that we assess risks by thinking like “businesspeople lending to businesses.” After all, we believe risk should be articulated in simple terms, not hidden away in a mysterious black box. We have often said that our approach is deceptively simple, but our track record speaks for itself.

Growth of $100 – fixed income performance comparison

Nov. 17, 2008 to Sep. 30, 2024

Performance as at February 28, 2025. Annualized total returns, net of fees (excluding advisory fees), in C$.

EdgePoint Canadian Growth & Income Portfolio, Series F – YTD: 1.99%, 1-year: 15.05%, 3-year: 12.36%, 5-year: 13.91%, 10-year: 9.18%, 15-year: 9.57%, Since EdgePoint inception (Nov. 17, 2008): 11.63%. iShares iBoxx $ High Yield Corporate Bond ETF - YTD: 2.34%; 1-year: 10.04%; 3-year: 4.37%; 5-year: 3.89%; 10-year: 3.96%; 15-year: 5.34%; Since inception (Nov. 17, 2008): 7.26%. ICE BofA Canada Broad Market Index – YTD: 2.28%, 1-year: 8.37%, 3-year: 1.44%, 5-year: 0.36%, 10-year: 1.71%, 15-year: 3.14%, Since EdgePoint inception (Nov. 17, 2008): 3.58%.

Source, EdgePoint: FactSet Research Systems Inc. Source, index/ETF: Bloomberg LP. Total returns net of fees in local currency. As at September 30, 2024. Although not the official benchmark, the iShares iBoxx $ High Yield Corporate Bond ETF was chosen because it is an investible product that provides investors with exposure to high yield fixed income securities. The ETF returns are net of fees and based on market prices. This is a hypothetical scenario. The above values are for illustrative purposes only and do not represent an actual client’s results. Past performance is no guarantee of future results. See Important information – Indexes and benchmarks and Important information – EdgePoint Portfolio fixed income returns & fees for additional details.

Do your clients want to bet on the direction of interest rates and simply hope it goes well or would they rather invest in a common-sense, time-tested investment approach of lending money to businesses? You need to understand what risks lurk in your bond portfolio. If your clients have a hard time understanding concepts like “standard deviation,” “duration” and “convexity,” then you might want to think about risks in the EdgePoint way. Knowing is half the battle, while the other half is making sure you’re ready to tackle them! Like Benjamin Graham says, “Successful investing is about managing risk, not avoiding it.”

The indexes are not investible.ICE BofA Canada Broad Market Index (EdgePoint Global Growth & Income Portfolio and EdgePoint Canadian Growth & Income Portfolio fixed income benchmark)

The ICE BofA Canada Broad Market Index tracks the performance of investment-grade debt publicly issued in the Canadian domestic market. The index was chosen as the benchmark for the fixed income portion of the EdgePoint Growth & Income Portfolios because it’s a widely used benchmark of the Canadian fixed income market. FTSE Canada Universe Bond Index

The FTSE Canada Universe Bond Index tracks the performance of investment-grade debt denominated in Canadian dollars and issued by Canadian government and corporations. The index was chosen as it is a widely used benchmark of the Canadian fixed income market.iShares iBoxx $ High Yield Corporate Bond ETF

The iShares iBoxx $ High Yield Corporate Bond ETF seeks to track the iBoxx USD Liquid High Yield Total Return Index, which tracks the performance of U.S. high yield, non-investment grade corporate bonds denominated in U.S. dollars. The ETF returns are price returns, net of fees and based on market prices. As at September 30, 2024 the management expense ratio for the ETF is 0.49%. An ETF that tracks an index is subject to tracking error where its holdings and return differ from the underlying index. Factors such as fees, transaction costs and the inability to fully replicate the constituent holdings. Note on comparisons

We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as yield, duration and credit quality may also impact comparability.S&P 500 Index

The S&P 500 Index (equities) is a broad-based, market-capitalization-weighted index of 500 of the largest and most widely held stocks in the U.S. ICE BofA US High Yield Index

The ICE BofA US High Yield Index (high-yield bonds) tracks the performance of high-yield corporate debt denominated in U.S. dollars and publicly issued in the U.S. domestic market. ICE BofA US Corporate Index

The ICE BofA US Corporate Index (investment-grade bonds) tracks the performance of investment-grade corporate debt denominated in U.S. dollars and publicly issued in the U.S. domestic market.Important information – EdgePoint Portfolio fixed income returns & feesThe EdgePoint Global Growth & Income Portfolio (EPGIP) and EdgePoint Canadian Growth & Income Portfolio (EPCIP) fixed income returns are hypothetical, local currency and net of fee approximations calculated based on end-of-day holdings data (actual trading prices not captured). A hypothetical management expense ratio (MER) of 0.62% was applied to EPGIP and EPCIP fixed income returns and prorated daily. The fixed income MER was calculated based on the average MER for EPGIP and EPCIP (0.84% and 0.85%, respectively), relative to the EdgePoint Global and Canadian Portfolios’ MER (0.97%), then scaled to reflect the average fixed income weight of EPGIP and EPCIP (35%).