Let's get ready to rumble – 3rd quarter, 2022

Mike Tyson is famous for saying that “everybody has a plan until they get punched in the mouth.” It’s debatable whether Iron Mike was truly the “Baddest Man on the Planet” during his prime, but you can’t dispute that the bond market this year has taken one on the proverbial chin.

Investors have had a simple yet effective plan in place for the last several decades – hedge your stock portfolio with an allocation to fixed income. The asset class provided a steady return and had the added benefit of rising in price when stocks declined. It was a great scenario for investors and gave rise to the common 60% equity/40% fixed income portfolio that’s commonplace today. 2022 has been a one-two punch that’s challenged this plan and many are scared that central banks have the conviction to deliver the knockout blow.

We have been warning clients for years about the extreme level of complacency in fixed income markets. It was the forgotten part of people’s portfolios that many hoped they could just set and forget. We flagged that lower yields had forced people to reach and that there were more risks in the system than many were willing to acknowledge. The structure of most portfolios and the incentives of their respective managers made these risks easy to ignore and bask in the comfort of hiding in the middle of the investment herd.

Our fixed income portfolios are unique. They don’t look like an index or any other portfolios in their categories. We have a time-tested investment approach that guides our portfolio construction and focuses on only taking risks when we think we both have an edge and we’re getting paid appropriately. That's an easy thing to say and most would believe that all managers take that approach, but it simply isn’t true. Behavioral biases and fund structures get in the way of many portfolio managers leading to sub-optimal returns.

Ignoring the roar of the crowd

Herding is a well-discussed behavioural bias. It’s deeply rooted in our human psyche and stems back to our primal survival instincts. A quick clip of a lion hunting gazelles is all you need to watch to understand why we’re hardwired to herd. It’s much safer to be surrounded by others than to be the lone prey traversing the savanna solo. In nature, independence is generally not rewarded and often results in disaster.

Although we have evolved from our primal days, we still seek safety in numbers and want to be rewarded. This isn’t new information and many investors understand the concept of herding, yet most don’t change their behaviour because they’re not incented to do so. If you want to get to the root of the situation, ask a portfolio manager how they’re compensated. It’s industry practice for managers to be rewarded for short term performance and measured against their benchmark. It’s not surprising to think that someone who gets paid to beat an index over a brief period of time builds their portfolio off of that very same index.

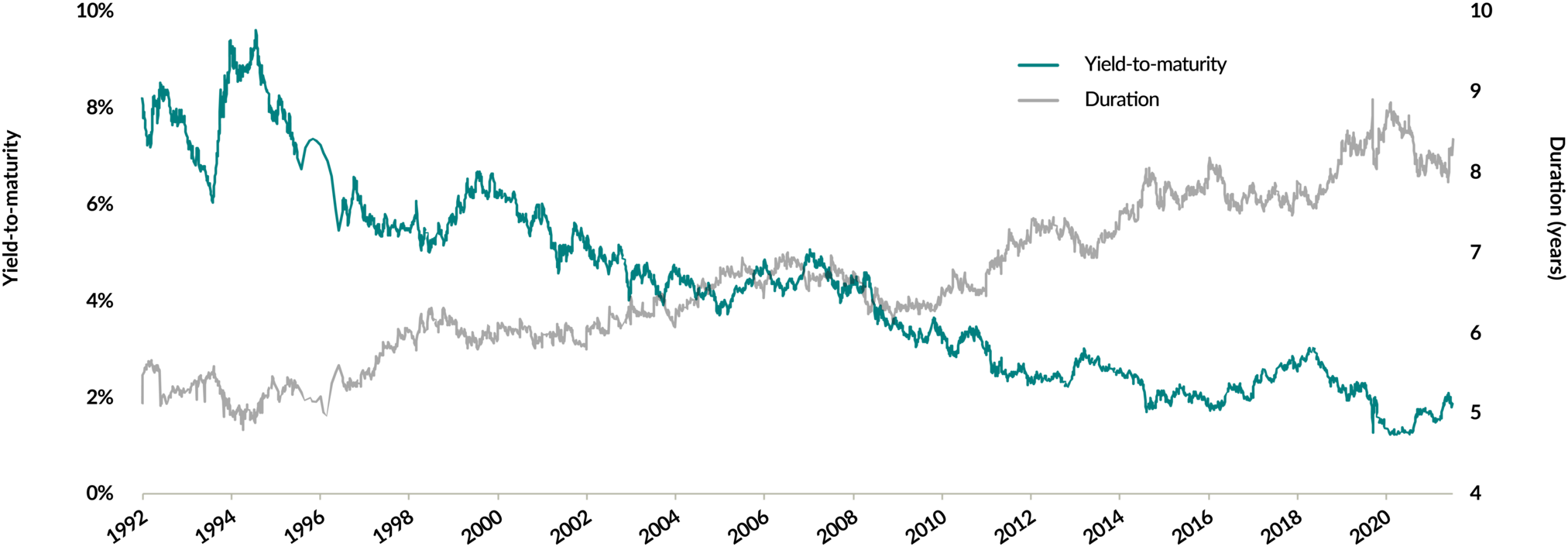

Regardless of your personal convictions, building a completely unique portfolio is often too risky for many investment professionals’ personal compensation. Who knows what a collection of unique ideas will return in a short period of time? It’s much easier to match the benchmark you’re being compared to and adjust individual weights based on your conviction. That makes sense for the portfolio manager’s pay cheque but is that how you would manage your own money? What if the index is poorly positioned and isn’t a rational starting place? You’re forgiven for thinking that something so nonsensical couldn't happen to an entire industry of professionals, but unfortunately you’re incorrect. The following chart shows the historic yield of the Canadian fixed income index and its interest rate risk as measured by duration.

ICE BofA Canada Broad Market Index Yield-to-maturity vs. duration

Jun. 30, 1992 to Dec. 31, 2021

Source: FactSet Research Systems Inc. As at December 31, 2021. The ICE BofA Canada Broad Market Index tracks the performance of publicly traded investment-grade debt denominated in Canadian dollars and issued in the Canadian domestic market. Duration is a measure of a debt instrument’s price sensitivity to a change in interest rates. The higher the duration, the more sensitive a bond’s price is to changes in interest rates. Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return.

As the yield has come down, the duration (or level of risk) has increased. That’s the definition of reaching for yield. You had to go further out on the yield curve by buying bonds with longer durations to earn a return and the index was happy to do so, regardless of the additional risk. That risk didn’t hurt anyone for over three decades. Now, only nine months into 2022, index investors have experienced a loss that’s wiped out several years’ worth of return. How did the average portfolio in the Canadian fixed income market fare? They’re down -11.9% for the year,i in line with the index’s return of -11.5%.ii So much for active management!

I wouldn’t be offended if you suspected that I’m cherry picking the time period. Surely most managers have beat their benchmark over the last 10 years. Unfortunately, the following table shows that most fixed income categories in Canada failed to add value over the last decade. I struggle to think that’s a coincidence.

| Category | Benchmark | Average fund in category | Benchmark | Excess return |

|---|

Rest assured we didn’t take the same risk. It’s not because we had a crystal ball that predicted interest rates would rapidly increase in 2022. We avoided taking duration risk because we didn’t think we were getting paid to take it. Low yield and high risk weren’t appealing to us regardless of what our peers were doing – that independent thought has paid off since EdgePoint’s inception. This year is another great example that allowed us to add value to our clients’ portfolios.

At EdgePoint, we avoid the herd by strictly adhering to our investment approach. We build a portfolio from the bottom up on a bond-by-bond basis and rely on our ability to generate insights. We will never get comfortable with a risk simply because others seem willing to take it. True risk in our mind is losing money and doing so alongside others is just as uncomfortable as if we were alone.

Our fixed income portfolio is grounded in our approach, but also supported by our incentive system. EdgePoint Investment team members are compensated on longer time periods consistent with our goal of long-term outperformance. This gives us the freedom to look different from the index. The odds of a concentrated portfolio beating the index on a quarterly basis are no better than a coin flip in my mind, but they increase materially when the investment approach has time to succeed. Matching our incentives to a longer period allows us to tune out the crowd and deviate from the herd. This is the only way you can beat the crowd and our investment approach improves our odds of success.

Afraid of getting hit

Loss aversion is another common behavioural bias that regularly influences investors. It’s well documentedv and often illustrated using a simple coin flip experiment:

Imagine I hand you a coin and ask you to flip it. If a coin lands on heads I will give you $10, otherwise you owe me $10. Would you take that bet? This experiment has been conducted many times and most people choose not to take the bet. The fear of losing $10 overwhelms the potential of winning $10. That’s a rational decision as the expected value is $0 – both scenarios have a 50% chance of happening.

It gets more interesting if I offered you $15 if it lands on heads but you only have to pay me $10 if it lands on tails. The odds are now in your favour since the bet has a positive expected value, yet behavioural experiments show that most people still don’t want to take the bet. Psychologists believe that the fear of loss is twice that of the pleasure we receive from winning and coin flip experiments often prove that out.vi Most people need to be offered $20 to eventually take the bet. This is the definition of irrationality but it’s part of our human psyche.

I believe this concept affects all investors and has a greater effect on fixed income managers. Fixed income investing generally focuses on loss avoidance first and return generation second. That makes sense as your potential return is generally fixed at your coupon rate and return of principal, yet you risk the loss of 100% of your principal. You have to be very certain that you’re not going to lose your principal for that to be a rational decision.

Ben Graham literally wrote the book, Security Analysis, the original bible for most investors. In his chapter on fixed income, he says “Bond selection is primarily a negative art. It is a process of exclusion and rejection, rather than of search and acceptance.”vii This quote reinforces the notion that you shouldn’t take undue risk in fixed income and the industry is full of examples that show most managers take that advice to heart. The crazy fact is that by trying to avoid loss and being influenced by the investment herd, they often open themselves up to the very risk they’re trying to avoid.

The following table shows the top 10 in the index on May 31, 2020:

iShares US High Yield Bond Index ETF Top 10 holdings

As at May 31, 2020

* Total return in local currency and annualized for return periods greater than one year. Return period: May 31, 2020 to Sep. 30, 2022 unless the debt was called.

** If S&P ratings were not available, DBRS, Moody’s or Fitch ratings were used.

Source: Bloomberg LP. All data as at May 31, 2020 except for Total return which is as at September 30, 2022. May 31, 2020 was chosen because we highlighted the state of the high yield market during the EdgePoint June 2020 fixed income webinar. Issue size in local currency. The iShares US High Yield Bond Index ETF is a market-capitalization-weighted ETF that provides exposure to a broad range of U.S. high yield, non-investment grade corporate bonds. A call date is when a debt issuer used the option to repurchase an outstanding debt issue at par or at a premium to par on a specific date defined in the issue prospectus. Yield-to-worst is a measure of the lowest possible yield an investor would receive for a bond that may have call provisions, allowing the issuer to close it out before the maturity date. Averages are simple averages.

I picked this date because we showed this exact table during a 2020 fixed income webinar. So-called risk-averse fixed income investors were attracted to the perceived safety of telecommunications companies (Altice, Sprint and Charter) as their revenue streams were thought to be durable and recession resistant. Healthcare (Centene and Teva) was also a common theme for similar reasons. Seven of the top 10 were rated BB, which is considered a high-quality tier below investment grade, and all were large and liquid issues. These are top index names and most credit portfolios were filled with bonds from these issuers.

So how did these bonds perform since May 31, 2020? On average, the top 10 returned 3.4%.viii The high yield ETF had already declined by -6.6% in 2020ix and the returns since then have been unsatisfactory at -4.4%.x The perception of safety was very high, but in reality there was real risk. An investor that bought the ETF on May 31, 2020 has lost money. Supposedly safe business models, high ratings and liquid issues felt good two years ago but don’t feel so good today.

Our approach rewards deviation from the herd and is focused on avoiding true risk, i.e., permanent loss of capital. The strength of our insight into each individual bond and issuer is what we rely on to build a portfolio. Take a look at the top 10 holdings in EdgePoint Variable Income Portfolio over the same time period.

EdgePoint Variable Income Portfolio vs. iShares US High Yield Bond Index ETF Top 10 holdings

As at May 31, 2020

Annualized total return, net of fees (excluding advisory fees), performance in C$ as at September 30, 2022

EdgePoint Variable Income Portfolio, Series PF - YTD: -0.12%; 1-year: 2.43%; 3-year: 7.27%; since inception (Mar. 16, 2018 to Sep. 30, 2022): 6.20%.

iShares U.S. High Yield Bond Index ETF - YTD: -16.07%; 1-year: -15.70%; 3-year: -2.83%; since inception (Mar. 16, 2018 to Sep. 30, 2022): -0.09%.

* IRR (Internal rate of return) and Total return in local currency and annualized for return periods greater than one year. Return period: May 31, 2020 to Sep. 30, 2022 unless the debt was called/sold.

** If S&P ratings were not available, DBRS, Moody’s or Fitch ratings were used.

Source: Bloomberg LP. All data as at May 31, 2020 except for IRR or Total return which is as at September 30, 2022. May 31, 2020 was chosen because we highlighted the state of the high yield market during the EdgePoint June 2020 fixed income webinar. Issue size in local currency. EdgePoint Variable Income Portfolio is only available via prospectus exemption to qualified investors. See the EdgePoint Variable Income Portfolio offering memorandum for more information. IRR is money-weighted return that accounts for the timing and magnitude of cash flows into an investment and represents an investor's actual return. A call date is when a debt issuer used the option to repurchase an outstanding debt issue at par or at a premium to par on a specific date defined in the issue prospectus. Yield-to-worst is a measure of the lowest possible yield an investor would receive for a bond that may have call provisions, allowing the issuer to close it out before the maturity date. Averages are simple averages. The iShares US High Yield Bond Index ETF is a market-capitalization-weighted ETF that provides exposure to a broad range of U.S. high yield, non-investment grade corporate bonds. Although not the benchmark for EdgePoint Variable Income Portfolio, it was chosen for comparison because it is representative of high yield corporate bonds consistent with the Portfolio’s mandate. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including credit quality, issuer type and yield may impact fixed-income comparability and could result in periods when our performance differs materially from the index. Additional factors such as security holdings and geographic/sector allocations may impact comparability from the index.

Critics would look at our list and laugh. Most probably haven’t heard of several of our issuers. They were lower rated, smaller in size and in industries that weren’t perceived to be safe. We disagreed and built a heavyweight portfolio based on our conviction.

Let me be clear, we are loss-averse investors. We just define risk in a different manner. We don’t think it’s risky to look different or own small names, nor do we rely on the work of credit rating agencies. We thought it was risky to buy an over-levered cable company at the paltry yield of 3.9% (Charter). We didn’t think it was risky to lend money to a leading auto dealer with parts and service tailwinds at 10%. Paying a high price (low yield) for a great business can be a risky proposition because it’s priced to perfection. We would rather buy something with a larger margin of safety, an advantage that we can only leverage by looking for ideas in areas where others aren’t focused.

All investors have biases, and we think they’re compounded in fixed income. A generation of investors have become focused on short-term results and perverted the negative art espoused by Ben Graham. We think the only way to make money in fixed income is to act independently and develop insights consistent with our long-term investment approach. Our credit analysis and investment approach increase our odds of success, limiting potential losses and constructing a better risk/reward scenario than a coin flip.

Having the right people in your corner

Acting differently is only half of the equation for success. You could be wildly different but just plain wrong in your view. We believe our investment approach tilts the odds of success in our favour and our structure gives us the foundation to build upon. It isn’t something that many investment managers discuss, but I think it’s very important. The structure of the asset manager, the team and the individual fund are all important aspects that should be considered when evaluating an investment portfolio. Even a great investor can have poor results if they’re forced to act within a restrictive structure.

Our structural advantage starts with our team. We are truly one investment team that considers themselves business analysts above all else. This is different from most firms that promote division (and often competition) amongst equity and fixed income teams. We’re better investors because we always look at a business holistically and our team structure promotes this to everyone’s benefit. There have been countless times where we were able to quickly and efficiently get up to speed on a new fixed income investment due to the prior work completed by a teammate. Knowledge sharing goes both ways – several equity ideas have made their way into the Global and Canadian equity Portfolios because of the work done underwriting a fixed income idea. Our ability to underwrite specific fixed income deals has been enhanced by our Investment team’s focus on unique business models.

Structuring fixed income deals is another advantage that we can leverage. It allows us to deviate from the herd by taking a leadership role underwriting a new deal. We can use our structuring expertise to set deal terms, covenants and other investor protections that wouldn’t be available to more passive investors aiming to own hundreds of different investments. It further exemplifies how we differentiate between superficial and true loss aversion, helping improve an investment’s return profile and decreasing its risk profile. Not every investment will be a smooth ride, but ensuring that we have strong security and real covenants helps us sleep at night. Our reputation for deal structuring has enabled us to help bring new issues to market with companies with whom we had prior relationships. These companies were often not large or well-known enough to be on the radar of most fixed income investors and our relationships and structuring helped create an investment opportunity. This isn’t something that the average fixed income team is willing to do and we thrive in that type of environment.

Float like a butterfly, sting like a bee

Some days it feels like we’re stepping into the ring with Mike Tyson. A quick gut punch can frazzle investors causing them to flail blindly in hopes of landing a lucky punch. Closing your eyes and hoping that your bond fund will rebound is akin to landing a haymaker. It could happen but the chances are very low. A real boxer would never make that choice, and neither should a real investor.

Others put their chin down, remember their training and execute their plan. Our plan is time tested and centered on our investment approach. We recognize the inherent biases that all investors have and try to use them to our advantage by looking for ideas where others aren’t. We will always endeavour to deviate from the crowd and will leverage our unique structure to ensure that we are finding differentiated opportunities.

The fixed income market this year has caused many investors to be caught flat footed. We’re in a position to take advantage of their complacency and capitalize on the volatility that’s brought a very attractive opportunity set to us. All of the EdgePoint fixed income portfoliosxi are actively deploying capital into new and existing ideas at prices that are far superior to where they were three short months ago. We have bobbed and weaved as the market threw countless surprises at us and we think now is the time to go on offence.

| Morningstar category | Definition |

|---|

| Benchmark index | Definition |

|---|

Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Please read the prospectus and Fund Facts before investing. Read our full disclaimer at www.edgepointwealth.com/en/Disclaimers.