Calling a foul on benchmarks – 2nd quarter, 2024

If you’re familiar with EdgePoint, you know we rarely pay much attention to economists. I never thought I would start a commentary by quoting one, but I recently came across an adage that stuck with me. Goodhart’s Law, named after British economist Charles Goodhart, states:

When a measure becomes a target, it ceases to be a good measure.

In our increasingly data-driven world, we’re often searching for the right data points, key performance indicators (KPIs) or objectives & key results (OKRs) to measure success. Managers strive to find the best performance targets to incentivize employees to behave in a way that helps the organization reach its broader goals. However, Goodhart’s Law argues that these targets rarely align individuals with their intended purpose. Essentially, human nature causes us to myopically focus on meeting targets rather than achieving the intended goals behind them, leading to undesired outcomes.

Missing the (three) point

Success, however it’s measured, breeds imitators. In 2016, the Cleveland Cavaliers beat the Golden State Warriors to win the NBA championship. They were the league’s top-two teams in 3-pointers made for the season,i and hopeful copycats saw a clear correlation (yet unclear causation) between making 3-pointers and winning. The Portland Trailblazers were a playoff team that year and thought that adding 3-point shooting would push them to the top. They had signed Maurice Harkless, a player who made 30% of his 3-point shots over his career (below the league average of 35%), to a contract with a clause they hoped would encourage him to improve his accuracy. Every season of the contract that he hit more than 35% of his 3-pointers, he would earn an extra US$500,000.

The Trailblazers wanted their players to shoot more 3-pointers accurately. Maurice made 68 out of 194 (35.1%) of his 3-point attempts for the 2017 season, but looking at the last five games of the regular season tells an interesting story:

Maurice Harkless box scores – final five games of the 2016-2017 regular season

Source: NBA.com

After hitting his incentive target on April 3, 2017, Maurice stopped shooting 3-pointers because it might have cost him a half-million dollars. Before the last game of the season, a reporter asked him if he would shoot a 3-pointer during the game. His response? “ Would you?”ii

The Trailblazers won three fewer games that season and failed to win a playoff game. The clause was an excellent example of Goodhart’s Law – the incentive caused unwanted behaviour and, maybe more importantly, it’s still unclear whether the selected metric helped drive winning.

Crossover

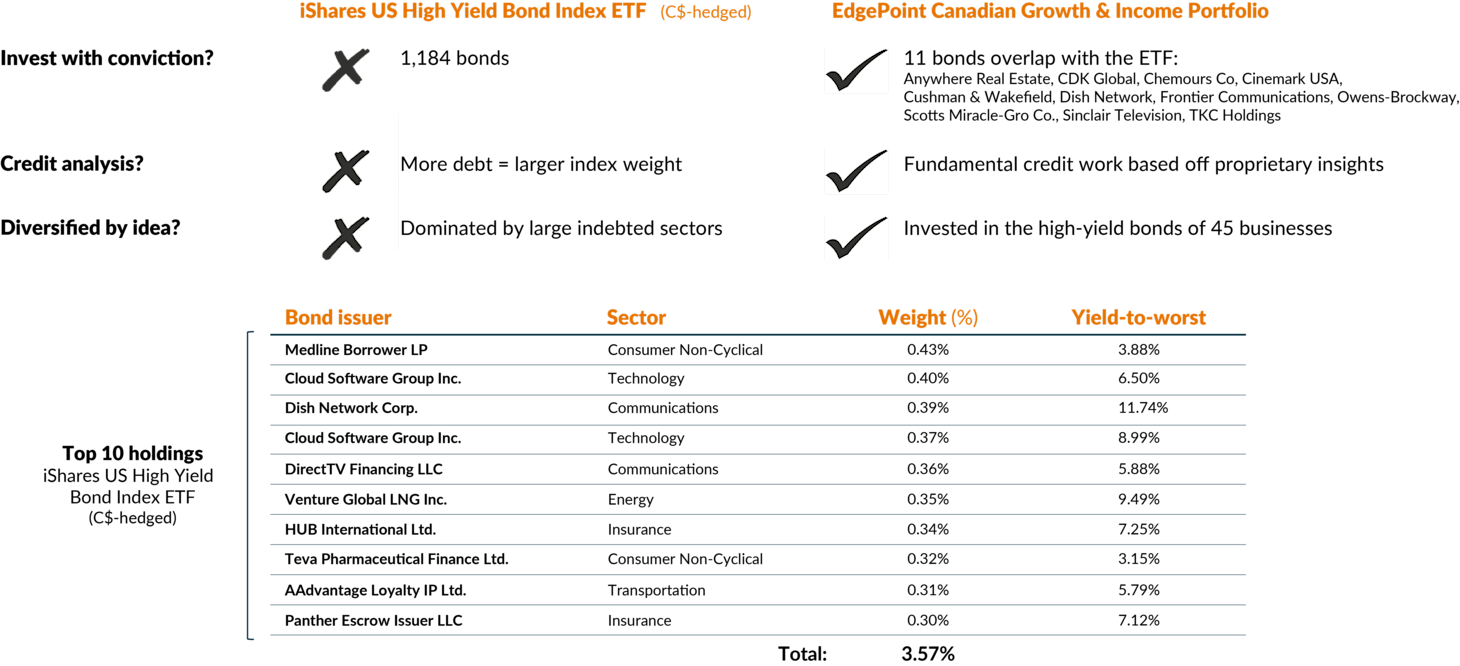

Readers who are still following along here are probably wondering, “What on earth does this have to do with my fixed income portfolios?” The investment industry is constantly looking for new measures or metrics to better align investment professionals to end clients. Investment organizations operate not too differently from NBA teams – looking for ways to drive their investment teams to generate pleasing performance for end investors. However, the same issues seem to come up constantly. Our industry is obsessed with finding the right way to measure investment performance. Scores of CFAs evaluate different benchmarks to determine the targets against which investment funds should be judged. Indexes are created out of baskets of securities to represent “market performance” for various asset classes. They then become benchmarks for investment performance for which active investors are judged against.

Tell an investment professional that most of their bonus is tied to beating their benchmark index over a one-year period and the first question they will probably ask is, “What’s in my benchmark index?” It shouldn’t be surprising that this increased scrutiny of benchmark indexes has led to the prevalence of closet indexing (mimicking the index while claiming to be an active manager) in our industry. Investors who are incentivized to beat an index often start portfolio construction from the index and decide where they want to “overweight” or “underweight” positions compared to their index weights. If an investor is beating their index at the end of November and needed to maintain that outperformance for a year-end bonus in December, then their choices are either A) continue to manage their portfolio and ignore the index, or B) closet index for the remainder of the year and lock in their incentive. What do we think the investor is incentivized to do in this situation? Perhaps we should ask Maurice Harkless!

Out of bounds

Investment performance can’t be judged in isolation, which is why indexes became the commonly accepted measure. Money managers have become so used to measuring themselves against benchmark indexes that they often fail to ask whether the measure is a good one or, even more importantly, whether it’s appropriate for their end investors. If the goal is to help them meet their financial goals, then maybe we shouldn’t be using the index as a benchmark in the first place!

Before we get ahead of ourselves, we should ask ourselves fundamental questions like, “What’s an index and why do we use them?” Going straight to the source, index provider MSCI says that:

Indexes measure the performance of a market and enable investors to better understand the collective movement of a group of stocks, bonds or other security types. Indexes play an important role in financial markets. They help investors better measure performance, understand risk, and inform and guide the development of financial products.iii

I bolded the last part because it’s acknowledging what the industry is doing: using indexes as a measurement tool that we rarely question regarding their construction, position weightings and rebalancing rules. At EdgePoint, we don’t construct our Portfolios based on an index and don’t believe it’s the best way to achieve investment goals. The most popular equity index in the world, the S&P 500 Index, tracks the equities of the 500 largest public companies in the U.S.iv If the market thinks they’re the most valuable companies in the world, they end up as the largest weights in the index. Using the index as a guide for your portfolio is effectively a closet form of momentum investing (buying and selling stocks based on their historical trading activity) – companies with rising market caps see their index weights increase and companies with falling market caps see their index weights decline. Investors mirroring the index are effectively following the herd (and pushing constituent share prices higher by buying more of those stocks). While we don’t agree with the idea of investing in this manner, we can at least say the equity index construction is following an investment strategy – in this case, a form of momentum investing.

Clearing the bench

Fixed income index weights are determined differently. Constituent weights are based on the notional values of the bonds in the index. In other words, the larger the bond issue the larger the weight in the index. This means that the companies who issue the most debt (i.e., borrow the most money) are the issuers who end up with the largest weights in the index. Therefore, rather than increasing weights in businesses that are reducing their debt loads and improving their ability to repay remaining debt balances, the index increases weights in businesses that are adding to their outstanding debt and actually reduces weights in businesses that are paying down debt!

Additionally, businesses in the most capital-intensive industries tend to make up the largest weights in the fixed income index. This leads to a lack of diversity in business ideas within the index. When telecommunication companies are in their growth phases and borrowing heavily to build out their footprints, they become large weights in the index. The index suddenly becomes a large bet on a specific sector, such as the U.S. high-yield index in 2016:

| Bond issuer | ETF weight | Sector |

|---|

When a previously healthy industry falls on hard times, many of the businesses in that industry see their debt downgraded and enter the high-yield index. During the COVID-19 pandemic, several airlines and cruise lines that previously borrowed in the investment-grade market were downgraded and became large weights in the high-yield index, as they had to issue substantial debt to cover their “cash burn” during lockdowns and travel bans. The index suddenly had a significant allocation to the debt that was issued to businesses in a very different market environment, meaning increasing exposure to businesses directly impacted by the pandemic and with uncertain credit outlooks.

| Bond issuer | ETF weight | Sector |

|---|

Compare this to our flagship opportunistic fixed income fund (not the actual name of the Portfolio, but you can read all about it here) that was lending to companies that were benefiting from the environment near the start of the COVID-19 pandemic – such as a liquor store operator, a logistics and trucking company, car dealerships and a home shopping network, to name a few. We were able to sleep well at night knowing that we could still actively manage the Portfolio and ignore what the index was doing.

| Bond issuer | Fixed income weight | Sector |

|---|

We don’t have to look back far to remember when the investment-grade index reached extremes. In 2021, the ICE BofA Canada Broad Market Indexvi duration hit historic highs while yields were at all-time lows. Investment-grade corporate borrowers, along with governments, were taking advantage of low interest rates by borrowing for longer periods of time and locking in low borrowing costs. As the largest borrowers in the index increased their duration and the magnitude of their borrowing, their weights in the index increased and the index’s overall duration followed suit.

Government of Canada 10-year bond & ICE BofA Canada Broad Market Index – yield vs. duration

Jun. 30, 1989 to Mar. 31, 2022

Source: Bloomberg LP. As at March 31, 2022. Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return. Duration is a measure of a debt instrument’s price sensitivity to a change in interest rates. The ICE BofA Canada Broad Market Index duration only available from January 1997.

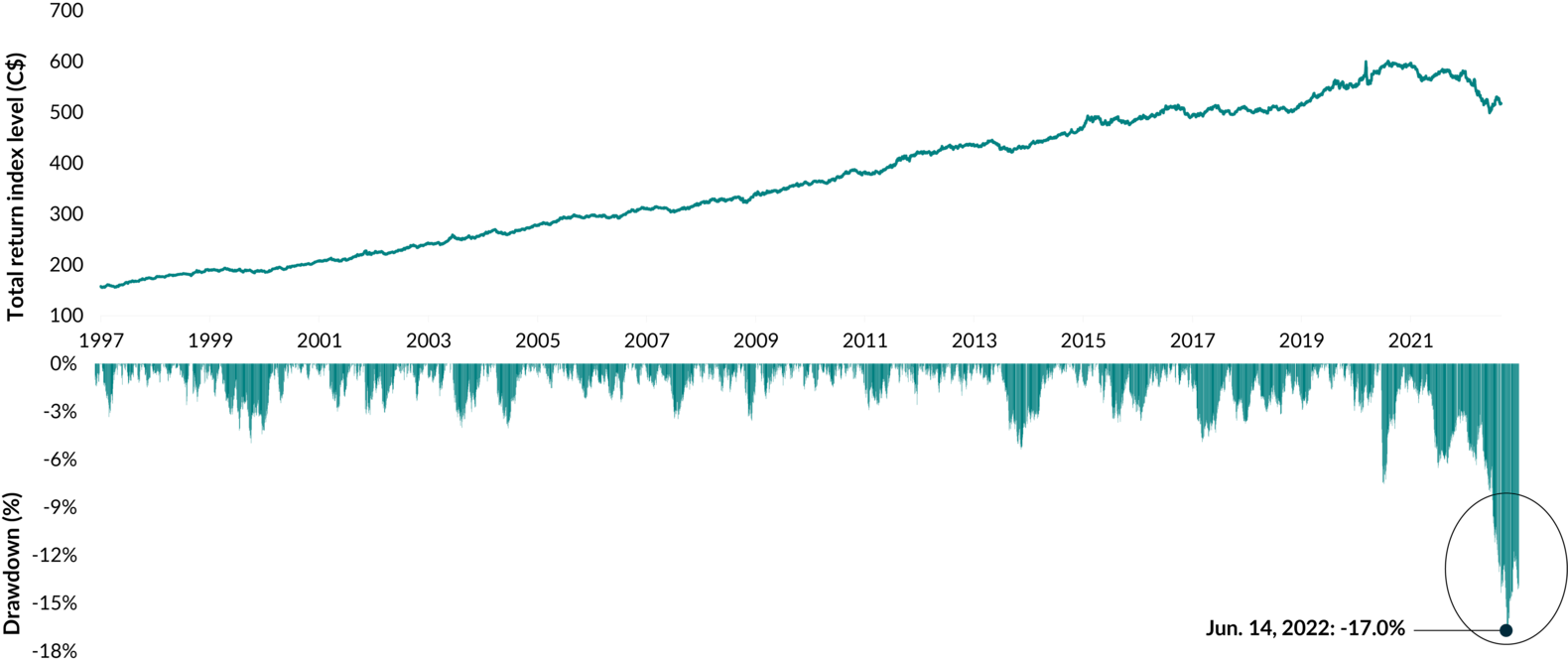

Fixed income investors had a choice to make here. Either they actively choose not to lend at these long durations and risk short-term underperformance (as yields were lower at shorter durations), or they choose to match the index’s duration to offer end investors a slightly higher yield. As the index experienced its greatest drawdown (percentage decline from its high), the choice to look more like the index led to record declines in 2022 as the interest rate environment changed. The positioning of the index was, in fact, chock full of risk.

ICE BofA Canada Broad Market Index – level vs. drawdown

1996 to 2022

Source: FactSet Research Systems Inc. As at August 31, 2022. Drawdowns calculated in C$.

A different playbook

Investors who are incentivized to outperform an index over the short term tend to look more and more like the index. It creates a conflict on how the manager and the end investor define risk – when a manager’s incentives are tied to outperformance of an index, their risk becomes the risk of underperformance or the risk of looking different from the index. The risk for the end investor remains the same –the risk of not reaching their Point B. At EdgePoint, we define risk as the risk of permanent loss of capital, a definition we believe aligns us with our end investors.

As Goodhart’s Law states, “Once the measure becomes the target, it ceases to be a good measure.” Index portfolios may not be ideal for most investors with the lack of diversification in business ideas, cost to construct and risk/reward of top weights. This is especially true for fixed income indexes. Much like incentivizing 3-point shooting in hopes of producing more team wins, incentivizing short-term outperformance against a benchmark index can produce undesirable consequences.

At EdgePoint, the Investment Team is compensated based on long-term performance over three and five years against our peer group. Our goal is to generate pleasing returns for our end investors and this is the measure we use to judge ourselves. This gives us the ability to ignore the index and to construct a portfolio lending to approximately 40 to 50 bonds issued by businesses. We believe we have proprietary insights on changes these companies are undergoing – how they’re improving on their ability to repay us while the price of their debt doesn’t yet reflect those insights. We make sure to stress test our Portfolios to ensure that we’re diversified by business idea. We believe that active management is the superior way to invest our end investors’ hard-earned dollars in fixed income to help them reach their ultimate goals.

Source, bonds: BlackRock, Inc. Source, yield-to-worst: Bloomberg LP. As at June 30, 2024. Number of businesses invested in represents high-yield holdings in EdgePoint Canadian Growth & Income Portfolio only. Yield-to-worst is a measure of the lowest possible yield that an investor would receive for owning the bond. See endnote v for additional information on the iShares US High Yield Bond Index ETF. Although the ETF is not an official benchmark of the high-yield portion of the EdgePoint Canadian Growth & Income Portfolio, it is representative of high-yield corporate bonds available to fixed income investors.

Overtime

I started this commentary by quoting an economist, so I felt it would only be appropriate to close it by quoting a famous fundamental investor. Benjamin Graham once said:

Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.

At EdgePoint, the Investment Team is incentivized to ignore the games being played in the market and we refuse to bow to pressures to look more like a benchmark. We’re structured in a way that allows us to focus on executing our investment approach, which we would put up against any closet indexer’s approach. When it comes to putting our end investors first, we think the choice to measure our success against their long-term returns is a slam dunk.