This time’s different…right? – 2nd quarter, 2024

Cymbria, which owns 20.1% of EdgePoint Wealth Management Inc., recently held its 16th annual Cymbria Day in Toronto at the architecturally stunning Koerner Hall, otherwise known as the headquarters of The Royal Conservatory of Music. The Investment Team takes immense pride in seeing investors from across the country for this event and always looks forward to the opportunity to spend meaningful time with likeminded individuals. For anyone who hasn’t attended a Cymbria Day in person, I strongly urge you to consider coming next year – we would love to see you there.

After 16 years you'd think we would have the format down to a science, and yet every year we tweak it because, while the investment approach doesn't change, just about everything else does. The major change this year was an extended Q&A session – we shortened the prepared remarks to give more time to answer audience questions. The goal here was twofold, as it gave an opportunity for more members of the Investment Team to contribute, while also allowing us to spend more time talking about topics that the audience found most relevant. Naturally, we can only answer so many questions and even though we answered a record 21 this year (up over 100% from last year!), it represented a small fraction of the total questions submitted. The goal of this commentary is to help answer some of the questions we didn’t get to at the event, and it will probably surprise no one that the most asked-about topic this year was artificial intelligence (A.I.).

What makes Cymbria Day special is that it’s so much more than the annual meeting. There are many meaningful interactions between the Investment Team and likeminded investors who attend. We get plenty of time to share our views while also hearing the opinions of others. Across those interactions, there was an oft-repeated phrase when the topic of A.I. came up: This time is different.

A.I. – a byte-sized intro

As the name implies, A.I. is the concept of recreating human-like intelligence through computers. It’s existed in some form since the first computers, with an endless series of firsts where computers could do something better than humans for the first time, such as checkers in the 1950s, chess in the 1990s and the game Go in 2016 (although A.I. isn’t all fun and games, as we’ll discuss).

Why’s A.I. so exciting now? There have been some meaningful breakthroughs that have allowed the technology to take a huge leap in capabilities. The biggest came in 2017 when researchers at Google discovered the "transformer model," an architecture that profoundly impacted the field of natural language processing. Its discovery and application led to advanced models like ChatGPT from OpenAI. Since 2017, we've seen a much steeper rate of progress in A.I. The optimism around this continued trajectory is fueling the excitement both from people within the industry and outside of it.

Don’t believe the hype?

Gartner is a U.S. technology research and consulting firm that, among other things, is famous for introducing the "hype cycle." According to the hype cycle, technologies often go through a period of inflated expectations before reality sets in. This process turns stocks into roller coasters with great climbs followed by equally great descents. We've seen this play out for countless technologies over the years, including blockchain, virtual reality, the internet of things, 3D printing and, of course, the internet itself.

The hype cycle

Source: Gartner, Inc. “Gartner Hype Cycle”, Gartner.com.

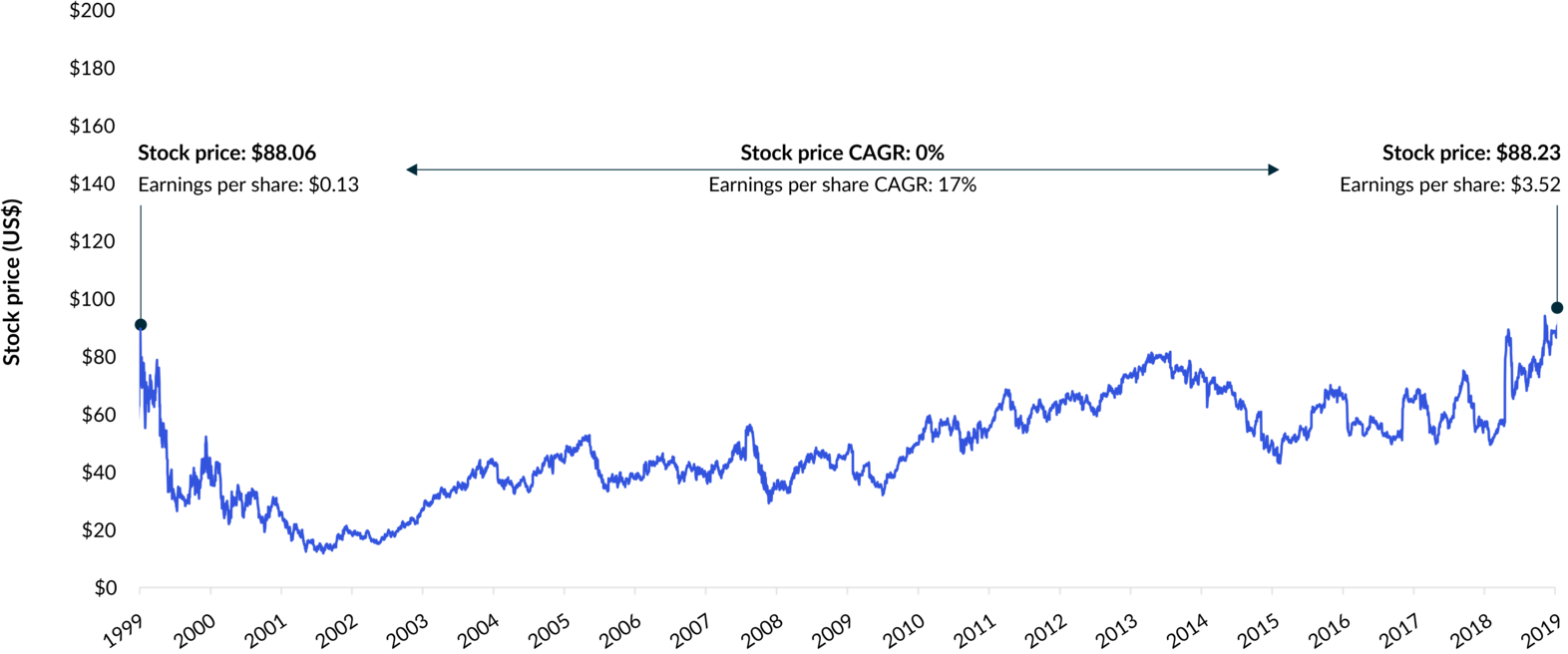

The internet led to one of the greatest investing bubbles the world had ever witnessed. It also led to some of the greatest technological changes the world had ever experienced. While investors were right about the magnitude of change, poor timing resulted in countless bad investments. In many ways, A.I. is comparable to the technology bubble. It’s a wide-reaching technology that promises to fundamentally change the way the world works. Where many say it's different this time is that the companies are "real" or profitable. This implies that the companies from the tech bubble were neither, and yet many were, such as Microsoft, Amazon, Intel, Adobe, Cisco, Texas Instruments, Comcast and Qualcomm. They still exist and thrive today, but they took a decade or more to meaningfully surpass their late 1990s/early 2000s highs. A perfect example of a quality business whose share price was overvalued for the early part of this century is Qualcomm:

Qualcomm Inc. stock price

Dec. 31, 1999 to Dec. 31, 2019

Source: Bloomberg LP. EdgePoint started buying Qualcomm securities on January 12, 2023, in EdgePoint Global Portfolio, EdgePoint Global Growth & Income Portfolio and Cymbria and on August 8, 2023, in EdgePoint Canadian Portfolio, EdgePoint Canadian Growth & Income Portfolio. As at June 30, 2024, Qualcomm securities were held in all the above-mentioned portfolios. Information on the company’s securities is solely to illustrate the application of the EdgePoint investment approach and not intended as investment advice. They are not representative of the entire portfolio, nor are they a guarantee of future performance. EdgePoint Investment Group Inc. may be buying or selling positions in the company’s securities.

So, we come back to the four words that John Templeton described as the four most-dangerous words in investing: “Is this time different?” We don't know. What we do know is that outside of Nvidia Corp. and a small number of related businesses, we have yet to see the revenue or earnings that would typically be associated with the trillions of dollars in market cap that investors have associated with A.I. Only time will tell.

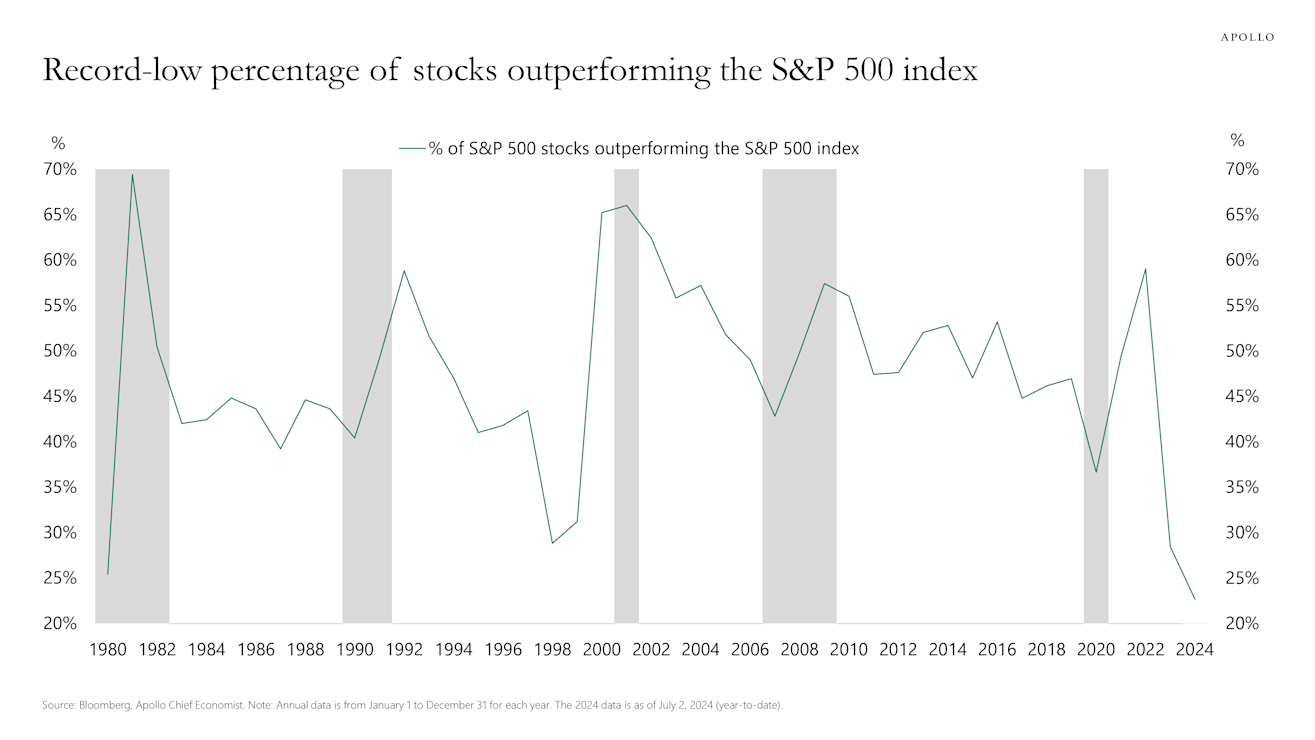

One indisputable similarity to the tech bubble is market breadth, which measures the number of stocks beating the market. Like the runup in 1998 and 1999, we're seeing an exceedingly small subset of stocks in the S&P 500 Index beating the overall index. In fact, 2024 is on pace for the fewest stocks beating the index in 50 years, taking the podium spot from 1998. The prominent theme within that small group of outperformers is the idea that they will be A.I. winners.

Percentage of S&P 500 Index stocks outperforming the index

Jan. 1, 1980 to Jun. 30, 2024

Source: Torsten Sløk, "Percentage of S&P 500 Stocks Outperforming the Index", July 11, 2024, ApolloAcademy.com. The S&P 500 Index is a broad-based, market-capitalization-weighted index of 500 of the largest and most widely held U.S. stocks. The index is not investible.

There are a number of companies that were winners in the tech bubble that are now considered A.I. winners. One interesting example is Corning Inc., a manufacturer of fibre optics. For those who are unfamiliar, fibre optic cables are the highways of the internet, the infrastructure that allows data to be sent around the world at the speed of light.

It didn’t take long for investors to realize that the internet would require vast networks of fibre optics, and Corning was an industry leader. Between 1999 and 2000, Corning’s revenue increased by 70% while the company posted record profits (yet another example of a real and profitable company). Countless billions were spent on fibre optic networks to get ahead of the untold wealth that would be created from the internet, but there was only one problem. While the money was spent and the networks were built, the promised revenue from the internet was about a decade late. This led to the bankruptcy of many fibre companies, including WorldCom, Global Crossings and others. Corning’s stock price was more than US$100 at the peak in late 2000 before falling 99%. It’s 24 years later and the stock is still down over 50% from its highs.i

There are interesting similarities to today. Much like the internet, most people believe A.I. will have a meaningful impact on society over the coming decades and, just as fibre was the backbone of the internet, semiconductors are the backbone of A.I. Billions of dollars were spent on fibre just as billions are being spent on semiconductors. The question now is, “When will companies start earning a return on all that investment?” Think about yourself or your family. Do you currently pay a subscription to use A.I.? Do you use an A.I. service daily? If you don’t, do you know people who do? What are the products today that will justify the amounts being spent on A.I. infrastructure?

Second-level thinking

Like other technological breakthroughs, the internet led to businesses and products that weren't initially obvious, such as cloud computing and smart phones. In investing, we look for these opportunities through second-level thinking.

A.I. can do a lot of things, including help demonstrate the process of second-level thinking. We can start by asking the question, "What if A.I. has a major impact on society over the coming decades?"ii For this scenario to happen, people must use it. The more users, the bigger the potential impact. This has implications:

A.I. requires semiconductors

Today, when you interact with ChatGPT or another model, your data is sent to a data centre where the model is stored and operated. This means you may be giving your data away when you interact with them. Oftentimes, you also must pay a subscription fee to cover the costs that come with running a data centre. Naturally, people will want to get the benefit of A.I. without giving up their data or paying to use someone else's computer. Since most of us carry a computer in our pocket, why not use the one we've already paid for? Over time, we could see an increasing amount of A.I. on-device such as your phone, laptop or even your car. This requires significant increases in the amount of compute on-device, while ideally not having a major impact on battery life. This would benefit Qualcomm Inc., a global leader in designing energy-efficient semiconductors.

Manufacturing semiconductors requires specific equipment

Regardless of where A.I. happens, whether it's on your phone or in a data centre, it's going to require a lot of semiconductors. Making semiconductors requires highly specialized equipment that only a small number of companies provide. Applied Materials, Inc. is a global leader in manufacturing the equipment needed to make semiconductors.

Data centres need cooling

We're already seeing A.I. impact the design of data centres. Companies are building larger facilities that require more power. Prior to A.I., data centres required tens of megawatts of power compared to the hundreds they require today. With more power comes more heat that needs to be dissipated.

The traditional way to cool down electronics is with fans. Fans require miniature ball bearings and the leading global manufacturer of miniature ball bearings is MinebeaMitsumi, Inc.

Data centres are getting to a point where fans alone aren’t enough because there’s just too much heat being produced. This is forcing data centres to incorporate liquid cooling in addition to fans. Liquid cooling systems require heat exchangers and the leading global manufacturer of heat exchangers is Alfa Laval AB.

Data centres also need power

After roughly two decades of flat electricity demand, we’re beginning to see signs of a return to long-term demand growth, with data centres being a major contributor. The owners of data centres are looking to renewable sources to provide energy, and this led Brookfield Asset Management Ltd. to sign one of the largest power supply agreements ever announced with Microsoft – an agreement that had a target to develop 10.5 gigawatts of new renewable energy over the next five years.

These are five businessesiii that you own in our Portfolios that are all global leaders in what they do. They could have significant exposure to A.I. over the next decade but their share prices suggest that they aren’t considered beneficiaries today. For each one of these businesses, we have a thesis on why they can be significantly larger in five years, and we're not being asked to pay for that growth. None of our investments in these businesses was based on an A.I. thesis. In other words, A.I. represents a free option for each.

Getting real with artificial intelligence

Mark Twain's famous line "history doesn't repeat itself, but it rhymes" is probably the best summary of the current situation. Regardless of what area of investing is currently in vogue, you can rest assured that we're sticking to our timeless approach of buying businesses with an underappreciated opportunity for future growth.

We're optimistic about A.I. and see incredible long-term potential. There are ways you can begin incorporating it into your business today and we're working on sharing some of the research we’ve done so far. If this is something you're interested in, please reach out to EdgePoint.

Thank you for your trust. We work hard every day to be worthy of that trust.