Wait – didn’t the majority of economists predict a recession for the first half of 2023?

Wasn’t it absurd to think Chair of the U.S. Federal Reserve Jerome Powell could raise interest rates by 500 basis points (bps, or 5%) in just over a year – and if he did, wouldn’t he break the economy??

Aren’t we in a banking crisis?!?

It’s what makes investing based on macro forecasts so hard – even if you get the event right, the impact to markets is impossible to predict. Yes, this is another sermon on market timing. The futility of trying to get the timing right and how expensive it can be to be wrong.

The question that comes up most when talking to investors is whether it makes sense to invest today if we’re sailing headlong into a recession. The truth is, if you know with absolute certainty that in the next few months we’re headed into a recession and that any recession isn’t already reflected in the price, then you might as well wait for that better opportunity that’s right around the corner. But you better be right. Fast.

With interest rates where they are, fixed income investors especially need the market correction to happen relatively quickly for it to be worth the wait. Bonds differ from equities in that their return over time is driven largely by interest payments that accrue daily. At today’s rates, those interest payments start to pile up in a hurry. Take the high yield index with a yield-to-maturity of 8.6%.i Even assuming that all we can do is match the market, and adjusting for fees and assuming some losses, it’s hard to imagine that an investor shouldn’t earn an 8.0% return over time.

Time’s-a-tickin’

There have been six double-digit drawdowns in the high yield index since its launch in 1986. As investors waiting to buy the dip forgo the 8.0%+ in yield currently available, we can see how large and how punctual different episodes need to be for the market timer to be better off sitting out, rather than buying today. For example, we’d need a savings & loan and commercial real estate crash on par with the early 1990s in the next 18 months, or a near-80% collapse in the Nasdaq, similar to the tech crash, within the next two years. Beyond that, we’d make more money in the time before the correction. And that assumes sideline investors can pick the bottom!

ICE BofA US High Yield Index – declines greater than 10% and “market-timing estimator”ii

Aug. 1986 to Dec. 31, 2021

| Time you have to be right (assuming you buy the absolute bottom) |

|---|

Then again, we should acknowledge that we’re already experiencing the seventh double-digit drawdown as measured by the high yield index; the index was down 15% at one point last year (marking the third-largest drawdown in high yield history). It still sits 7% below its all-time high set in December 2021. Adjusting for the fact that the high yield market is already 7% into the drawdown, we would need another pandemic by the first quarter of 2025 to be better off stashing our cash and waiting for that better opportunity.

ICE BofA US High Yield Index – declines greater than 10% and market-timing estimator accounting for the current drawdown

Aug. 1986 to Dec. 31, 2021

| Adjusting for the 7% decline we’ve already had (still assuming you buy the absolute bottom) |

|---|

And yes, any bond math wiz out there will know this is a silly exercise, but the point is that investors think in absolutes. They will take a pass on today’s returns out of fear they might have to endure a negative short-term result. But what if your worst case is already in the price? It’s worth asking about the drawdown you’re trying to avoid and the severity of the recession you’re predicting. It might take a bit of a cataclysm if it doesn’t happen in the next few months.

Using our prospectus-exempt Fundiii as the best proxy for the high yield debt in our Portfolios,iv the investor who sat out the past 12 months for fear of imminent recession missed out on the Fund's double-digit return. We had no clue what the market or economy had in store at this time last year, and have no clue what’s in store today. There’s a lot of uncertainty in the world and you never know what’s around the corner. Our head start of over 10% is a pretty deep hole that anyone who sat on the bench will need to dig their way out of.

Opportunities abound

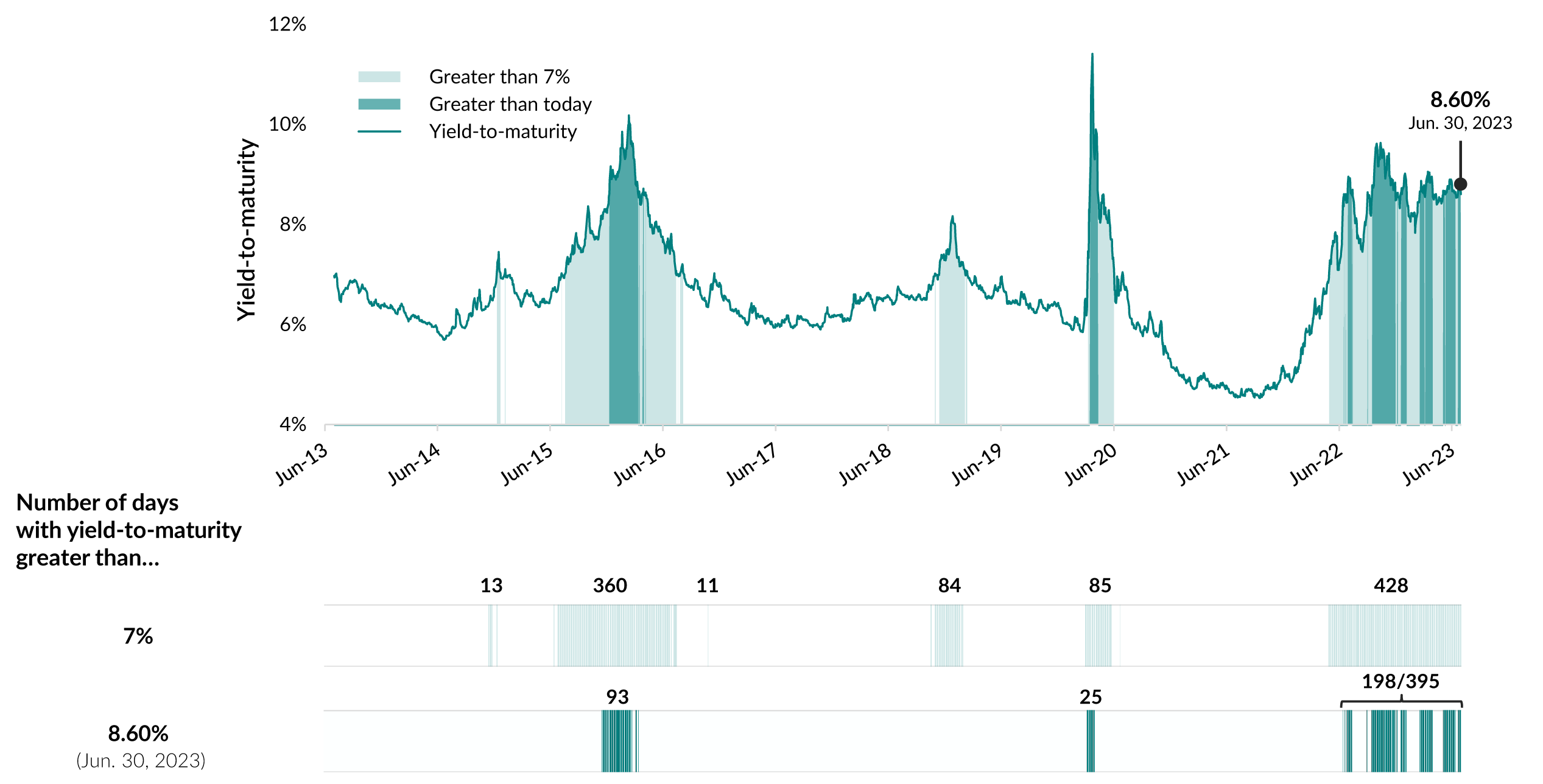

The following chart best captures the outsized opportunity today. We’re now at about 430 days into a high yield market with a “yield-to-maturity” above 7%. That creates a lot of disruption for companies that are looking to borrow money or refinance existing debt. At 8.6%, the yield available today is higher than 90% of the days in the past decade.

ICE BofA US High Yield Index yield-to-maturity

Jun. 30, 2013 to Jun. 30, 2023

Source: Bloomberg LP. Yield-to-maturity is the total annualized return anticipated on a bond if it's held until it matures and coupon payments are reinvested at the yield-to-maturity. The ICE BofA US High Yield Index tracks the performance of high-yield corporate debt denominated in U.S. dollars and publicly issued in the U.S. domestic market. The index is not investible. Number of days are days with a consecutive count above thresholds of 7% and 8.60% (the level on June 30, 2023). The third period for Number of days with yield-to-maturity greater than 8.60% is between June 1, 2022 and June 30, 2023.

There are two components to “yield-to-maturity,” including a government bond yield plus a credit spread. As much as all-in yields are among the highest we’ve seen, credit spreads aren’t exactly jumping off the page. At 405 bps as at June 30, spreads sit well off their decade-low of 301 bps at the end of 2021, but are actually tight to their 10-year average of 446 bps (spreads were as high as 465 bps at one point in June and hit 522 bps in March, so it’s not like this is a static component).v

“Credit spreads are tight and I’m waiting for them to widen,” is probably the most common refrain we hear from investors skeptical of current market conditions. This is absolutely a fair position – and 100% an accurate assessment of the circumstances. One day in the future, spreads will be wider than they are today. But who knows when? And it’s anyone’s guess what “spreads moving wider” ultimately looks like.

Maybe spreads widen because interest rates move lower – but if that happens, could spreads widen while high yield bonds trade higher…? It’s quite possibly a massive mistake to assume that interest rates will always move lower in a recession (a story for another day), but Pavlov’s dogs managing the average bond fund and buying long-duration bonds to hedge a recession probably think so.

If rates don’t move lower while spreads do move wider, that’s the episode that would be crushing to all asset classes – it’s also a scenario captured in our first exercise, and the one that would get us most excited. Each of these drawdown events would coincide with a material widening in credit spread. And with rates as high as they are, the ending yield would be eye-popping. We show those guesstimates in the following table.

But again, any decline needs to start now, because every day it doesn’t occur means that current bond investors just keep clipping their coupons and anyone sitting on the sideline benefits less and less from the eventual downturn.

ICE BofA US High Yield Index – declines greater than 10% and market-timing estimator accounting for the current drawdown

Aug. 1986 to Dec. 31, 2021

Source: Bloomberg LP. Total returns in US$. “Time to be right” is calculated based on the decline divided by an estimated yield of 8.0%. This figure is

based on the ICE BofA’s 8.6% yield-to-maturity as at June 30, 2023, minus hypothetical fees and costs. Implied yield-to-maturity is calculated using the

current yield-to-maturity of the ICE BofA U.S. High Yield index, which was 8.60% as at June 30, 2023, plus the change in yield from the start date to the

end date of each decline period. Implied ending credit spread is calculated using the current option-adjusted spread of the ICE BofA U.S. High Yield

index, which was 405 bps as at June 30, 2023, plus the change in yield from the start date to the end date of each decline period.

It’s precisely because high yield bond returns improve so dramatically in the face of any decline that this is such an attractive asset class. And in the event of a drawdown, as the yield available on bonds surges higher, the businesses whose bonds we own will keep paying interest and making principal repayments at maturity (excluding any defaults that are our job to avoid). All those proceeds get reinvested at the higher rates. So even if an investor picks the worst-possible time to invest in the high yield market, they can still look forward to benefitting from any “painful” short-term price decline they might endure.

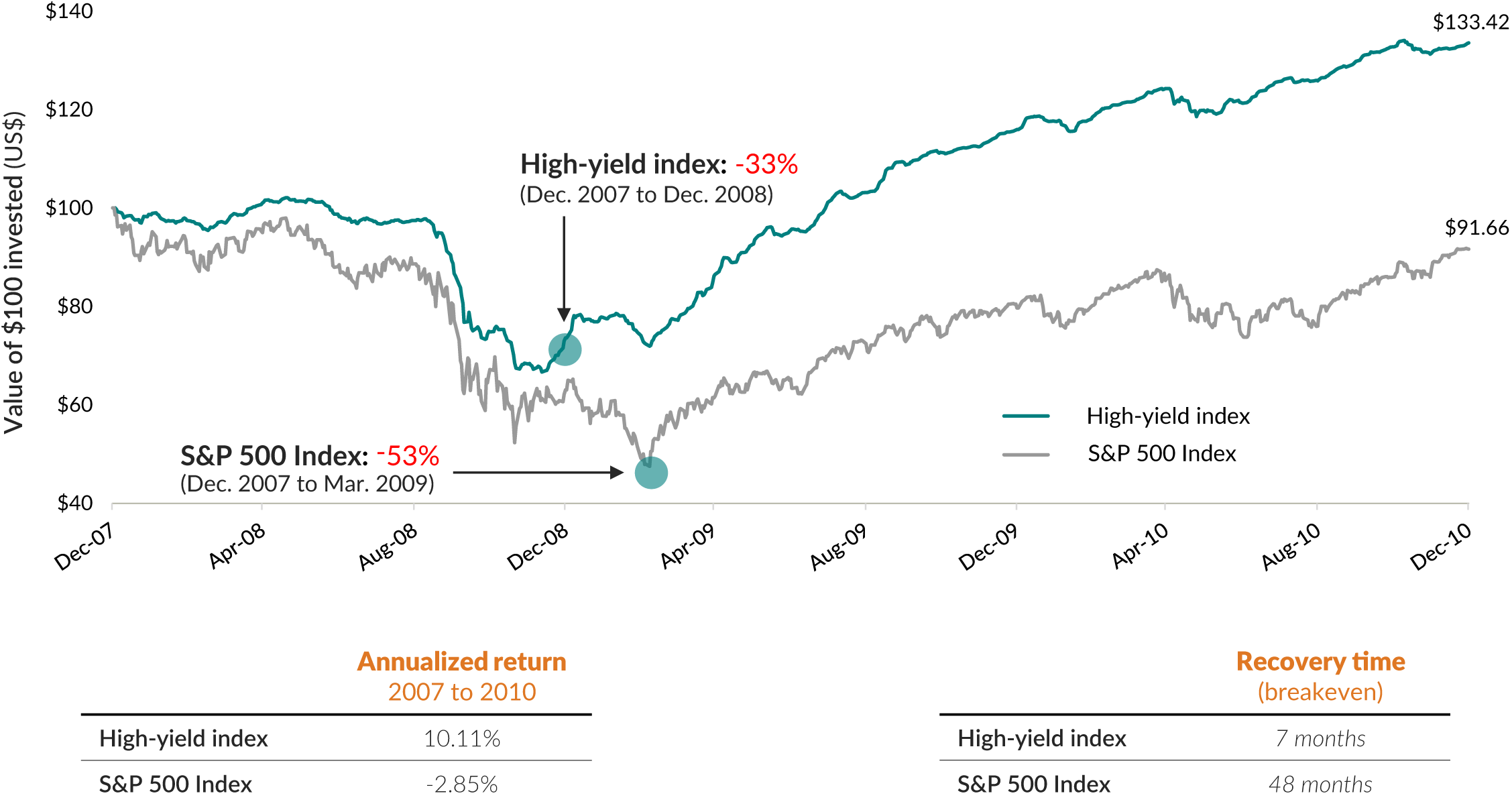

You want bad timing? Take the shmuck who bought both the high yield index and the S&P 500 Indexvi on December 31, 2007. That’s about as bad as it gets. But after the high yield index experienced a -33% decline in 2008,vii all those interest and principal repayments being reinvested in what proved to be the most attractive market ever, produced a subsequent windfall as the index surged +57.5% in 2009. After another strong performance in 2010, this “painful” three-year period generated our “shmuck” a 10.1% annualized return and 33.4% cumulative total return, while the S&P 500 (the “highest-quality” equity index in the world) sat lower by -8.3%.viii

Growth of $100 - High yield index vs. S&P 500 Index

Dec. 31, 2007 to Dec. 31, 2010

Source: Bloomberg LP. Total returns and in US$. The high yield index is the ICE BofA US High Yield Index versus the S&P 500 Index. The comparison is shown solely to compare the experience of an average high yield investor against that one an equity investor following the global financial crisis.

We buy the bonds issued by businesses, we don't buy the market

And we haven’t gotten to the best part yet. All we’ve described so far are the characteristics governing “the market.” But we aren’t buying “the market.” We’re buying individual bonds issued by businesses when we have a view of the business that’s not shared by others, and only when we are appropriately compensated (or better yet, overcompensated) for taking that view. If our decision to invest was based solely on buying or selling “the market,” we would be sitting on the sidelines with the guy waiting for a recession. Who wants to lend to a bunch of crummy businesses at below-average credit spread?

From an individual-business standpoint, it's hard to overstate the disruption we’re seeing. We’re seeing opportunities everywhere. Businesses that exhibit even the slightest hiccup or uncertainty in outlook are being sold indiscriminately and treated with disdain at any attempt to raise new capital or refinance existing debt. It’s a shoot-first, ask-questions-later type of market – the type of market we like to see.

No one is immune to wild swings in price (well, unless you’re a private debt or private real estate fund reporting fake prices). But if we do our job correctly, we believe we should be able to deliver a pleasing result over time and don’t really care what “the market” has to say about it. Our approach involves the careful study of a business to formulate a view as to how that business could be more profitable in the future than it is right now. In many cases, the businesses we lend to are already priced for – even experiencing – some kind of disruption or slowdown. If the future looks different than the recent past, that’s the opportunity.

We aren’t buying the market’s credit spread. We’re usually buying a business with a much wider spread, and we think that business is much higher quality based on what it will look like three, five or 10 years in the future. The malaise beneath the surface today means there are plenty of opportunities for this differentiated view.

Widening credit spreads are mathematically indistinguishable from rising interest rates as a short-term headwind (but long-term tailwind) to high yield bond returns. Each could lead to a “bad” high yield market. But every time we make an investment decision, we do so assuming a “bad” high yield market is right around the corner. The next 12 months could be a “bad” high yield market…just like 2022. If you look at some of the top contributors to our performance last year, they all had one thing in common – they were able to materially increase earnings in the face of all the “badness.”

Twelve months ago, these bonds were mispriced relative to their future earnings power – we just needed to figure out what that earnings power was going to be. Earnings go up, bond prices go up. Who knew?

Notable high-yield contributors to EdgePoint Portfolios

2022

Performance as at February 28, 2025. Annualized total returns, net of fees (excluding advisory fees), in C$.

EdgePoint Global Growth & Income Portfolio, Series F – YTD: 3.91%, 1-year: 10.25%, 3-year: 8.71%, 5-year: 8.93%, 10-year: 7.63%, 15-year: 10.04%, Since EdgePoint inception (Nov. 17, 2008): 11.39%. EdgePoint Canadian Growth & Income Portfolio, Series F – YTD: 1.99%, 1-year: 15.05%, 3-year: 12.36%, 5-year: 13.91%, 10-year: 9.18%, 15-year: 9.57%, Since EdgePoint inception (Nov. 17, 2008): 11.63%. EdgePoint Monthly Income Portfolio, Series F: YTD: 1.52%; 1-year: 6.93%; 3-year: 2.84%; Since inception (Nov. 2, 2021): 2.10%.

*Weighted average purchase/sold price.

**Total return in local currency. Return period: Dec. 31, 2021 to Dec. 31, 2022 unless the debt was purchased after Dec. 31, 2021 or sold before Dec. 31, 2022.

Source: FactSet Research Systems Inc. Calendar year 2022 was chosen for this analysis as it represented a challenging period for fixed income securities due to rising interest rates. Examples are for illustrative purposes only and not intended as investment advice. It is not representative of the entire portfolio, nor is it a guarantee of future performance. EdgePoint Investment Group Inc. may be buying or selling positions in the above securities. Securities above were held in the following Portfolios as at December 31, 2022: Talen Energy - both (EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Growth & Income Portfolio); Shawcor (EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Growth & Income Portfolio, EdgePoint Monthly Income Portfolio); Carpenter Technology (EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Growth & Income Portfolio, EdgePoint Monthly Income Portfolio); New Gold (EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Growth & Income Portfolio). The only exception was Talen Energy, 6.5% due 2025/06/01 which was sold June 9, 2022.

Sweet dreams are made of these

I feel compelled to add that I go to bed dreaming that we have loads of investment partners sitting on the sideline licking their chops, waiting to back up the truck the next time markets start falling apart. (If anyone forecasting a recession is reading this, please keep us in mind the next time credit spreads hit 1,000 bps.) But it’s incorrect to think that the current market doesn’t offer excellent opportunities for fixed income investors to generate outsized returns.

It’s a much better environment to be a lender today than it has been for most of the past decade. That’s what we know. We don’t know if the environment will be even better tomorrow, and trying to invest based on such predictions can be a very costly exercise if the predictions don’t pan out. We could also be on the brink of a nasty, gut-wrenching recession – but we plan for that, too. Before making any investment, we ask ourselves what each business would look like in a worst-case recession. It’s an extra layer of resilience built into your Portfolios.

Through any recession, we look to come out stronger than we went in; your EdgePoint fixed income Portfolios are designed to thrive through the dislocation. We believe that past episodes of market turmoil have been a benefit to EdgePoint fixed income investors. We expect the next will be the same, whether it arrives tomorrow, or 10 years from now. If it’s the latter, our goal is to make a boatload of money while we wait for it.

ii U.S. commercial real estate (1990) – The early 1990s U.S. commercial real estate crash is attributed to the failure of savings & loan institutions in the late 1980s to early 1990s, due to inflation of those properties. Tech bubble (2002) – A period near the start of the 2000s characterized by the popularity of stocks associated with internet companies and high valuations. Financial crisis (2008) – Complex debt securities, insufficient regulation and a downturn in U.S. real estate spread across financial markets around the world, resulting in government bailouts and the failure of several banking institutions, among other issues. U.S. debt downgrade (2011) – Ratings agencies lowered the U.S. government’s credit rating below AAA status for the first time following the U.S. Congress vote to increase the debt ceiling. Oil price collapse (2015 to 2016) – Increased oil supply combined with a decrease in demand resulted in the price of crude oil declining. COVID-19 (2020) – The COVID-19 pandemic forced lockdowns and travel restrictions that caused shifts from existing societal and economic norms.

iii For more information, accredited investors can read more on our website.

iv High yield debt represents about 30% of the fixed income portfolio of the EdgePoint Global Growth & Income and Canadian Growth & Income Portfolios.vSource: Bloomberg LP. Decade-low: 3.01% (December 12, 2021). June 2023 high: 4.65% (June 1, 2023). March 2023 high: 5.22% (March 24, 2023). The credit spread uses the ICE BofA US High Yield Option-Adjusted Spread (OAS). It's the difference between the ICE BofA US High Yield Index and a spot U.S. Treasury curve.

vi The S&P 500 Index is a broad-based market-capitalization-weighted index of 500 of the largest and mostwidely held U.S. stocks.

vii Source: Bloomberg LP. Total returns in US$.

viii Source: Bloomberg LP. Total returns in US$.