Asking the right questions - 1st quarter, 2023

The market has often been described as manic depressive – wildly swinging from periods of exuberance into the depths of pessimism. We have a front row seat to this behaviour as we witness the volatility in bond prices and yields, watching investor sentiment change daily. Our conversations with our clients have given us even deeper insight into what market participants are worried about based on their questions. The number of inquiries we get about the short-term performance of a particular asset class or investment gives us a good indicator of how they’ve been doing recently. We believe that the most-informed clients are the ones most likely to reach their financial goals, and we strive to address their concerns and reinforce our investment approach.

Over the last 12 months, we’ve received many questions, but the most popular topics have been inflation and interest rates. At the start of 2022, it was consensus that rates would stay low forever and that the only way to earn any yield in fixed income was to extend your duration. We were unwilling to expose our portfolio to duration risk and welcomed questions challenging our fixed income portfolio’s low duration.

A few months later, the worry of runaway inflation was the hot topic and investors woke up to risks that they hadn’t thought about in decades. We were asked about the performance of bonds during the 1970s and other periods of tremendous inflation. Clients began questioning if they should even own bonds in a period of rising rates.

Rates peaked around Halloween, and the scariest thing in peoples’ minds was when the recession was coming and how we would position for it. Most think it’s obvious that rates will continue to fall and that “the pivot” is right around the corner.

These aren’t bad questions. Clients have been shaken awake from decades of complacency in the fixed income market. They’re now struggling to reposition investments and update their thinking on what a fixed income sleeve adds to their overall portfolio.

Why are investors being forced to make macro calls?

The industry has done a disservice to clients by creating focused funds that require investors to make a market call before investing. There are long-duration funds that do well when rates are falling and short-term funds that protect you when rates are rising. There are government bond funds that reduce credit risk and funds that embrace it. There are simple-to-understand funds and even those that tackle more-complex investments.

We don’t think our clients want to guess what’s going to happen in the fixed income markets and then choose the appropriate fund. We think they want a portfolio that’s more robust and able to navigate periods of interest rate and credit volatility. Mistakes will happen but our 15-year track record shows that we have a skillset at protecting capital in different market environments and taking advantage of volatility when it inevitably rears its head. If the start of 2023 has taught us anything, it’s that volatility generally comes from the sources you least expect and a robust portfolio that can handle different market environments is essential.

So, are our fixed income Portfolios robust?

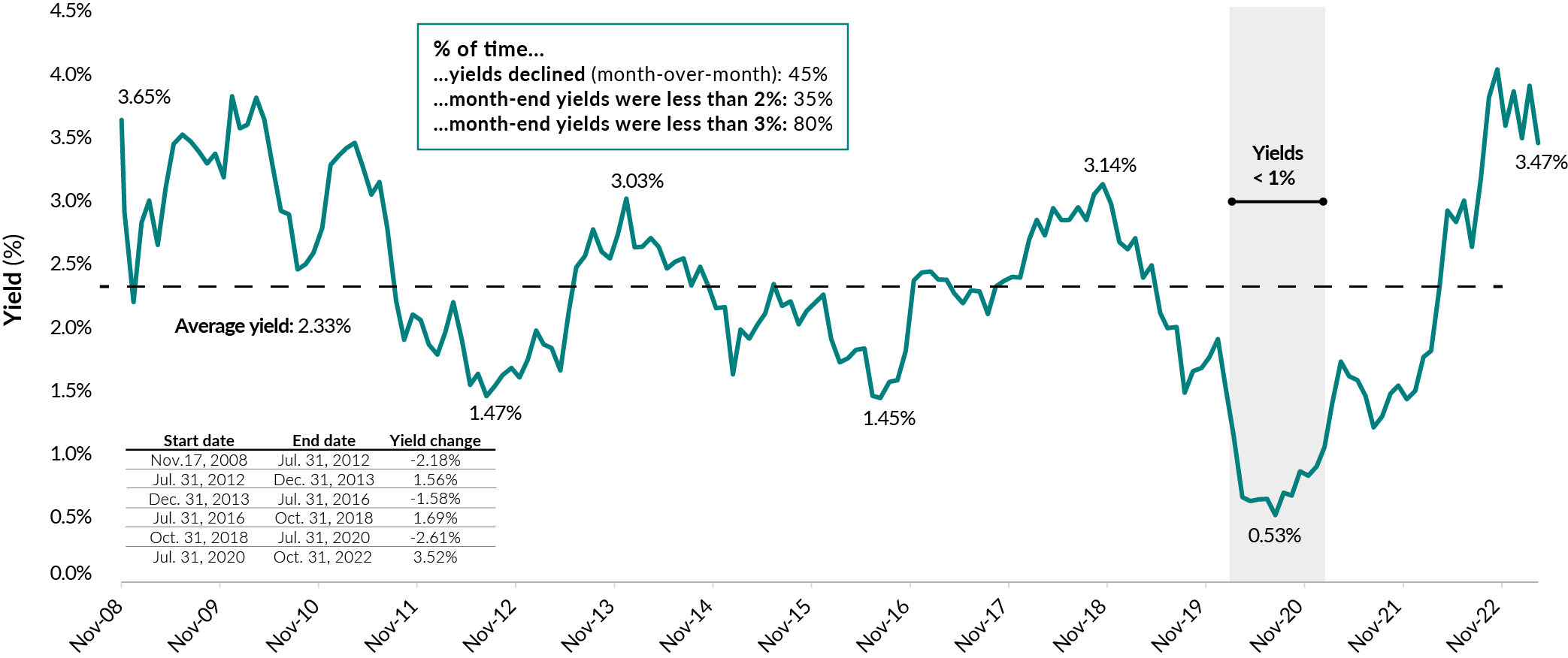

Let’s break down the environment that we have operated in since inception and see how our Portfolios performed. The following chart shows the yield of the U.S. 10-year government bond since EdgePoint’s inception. Most would generalize the last decade and a half as being a period of falling interest rates. The 10-year yield started at 3.65% and fell to a COVID-low of 0.53%. With the benefit of hindsight, our relatively low duration since inception acted as a drag to our performance. We weren’t positioned for the relentless decline of interest rates.

That said, the journey was anything but smooth. I was surprised to see that yields only declined 45% of the months – rates actually rose more month-to-month than they fell. There were 10 periods when rates increased or decreased by over 100 basis points, providing lots of surprises that could catch a portfolio off guard.i Despite the headwind of falling rates and the surprising volatility, our fixed income portfolios were able to outperform.ii

U.S. 10-year government bond yields (monthly)

Nov. 17, 2008 to Mar. 31, 2023

Source: Bloomberg LP. Yield-to-maturity is the total return anticipated on a bond if it’s held until it matures and coupon payments are reinvested at the yield-to-maturity. Yield-to-maturity is expressed as an annual rate of return. Statistics referenced above were calculated using month-end yields. November 17, 2008 was selected as a start date as this was the inception of EdgePoint Wealth Management Inc. Sub-1% yields were between March 3, 2020 and January 5, 2021.

Credit spreads are another crucial factor to our investment returns. EdgePoint started during a period of very wide credit spreads. Hindsight proved that it was a great time to start a portfolio of corporate bonds, but that tailwind was short lived. Soon after our inception, credit spreads tightened to their long-term averages. Since then, they have widened materially during three separate periods.

ICE BofA US High Yield Master II Index option-adjusted spread (OAS)

Nov. 17, 2008 to Mar. 31, 2023

Source: Federal Reserve Economic Data (FRED), St. Louis, “ICE BofA US High Yield Index Option-Adjusted Spread”. https://fred.stlouisfed.org/series/BAMLH0A0HYM2. The ICE BofA US High Yield Master II Option-Adjusted Spread is the calculated market capitalization-weighted spread between US$-denominated debt rated lower than investment grade (based on an average rating by Moody’s Investor Service, Standard & Poor’s and Fitch Ratings) and the spot U.S. Treasury curve. The index is not investible.

Most would say rapid spread widening would be a challenging time for a portfolio of predominantly corporate bonds. While that can be the case in the short term, we welcome it. It’s during these periods that we have historically added the most value. Finding bonds whose price has dropped but whose fundamentals haven’t is a recipe for success. Distinguishing between the two is the hard part. The following table shows that our return after these time periods has been pleasing and investors should join us in welcoming credit spread volatility.

EdgePoint Canadian Growth & Income Portfolio fixed income vs. ICE BofA Canada Broad Market Index

Total returns from OAS peak date Net of fees (excluding advisory fees), in local currency*

*Hypothetical returns for EdgePoint Canadian Growth & Income Portfolio fixed income security performance. These returns aren’t investible. They’re a best estimate of EdgePoint Canadian Growth & Income Portfolio’s fixed income performance.

Annualized total return, net of fees (excluding advisory fees), in C$ as at March 31, 2023

EdgePoint Canadian Growth & Income Portfolio, Series F - YTD: 5.46%; 1-year: 6.47%; 3-year: 22.00%; 5-year: 8.96%; 10-year: 9.41%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 11.19%. ICE BofA Canada Broad Market Index - YTD: 3.04%; 1-year: -2.17%; 3-year: -1.74%; 5-year: 0.83%; 10-year: 1.87%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 3.38%.

See endnote iii for more information.

There may be periods of time where it’s difficult to find new ideas in the largest fixed income markets. Our flexible portfolios can opportunistically look elsewhere and try to find areas of the market that institutional managers tend to ignore. Convertible bonds have been investments that periodically get pushed aside by large investors. We think this provides a fertile hunting ground for finding ideas. Changes in the underlying stock price often cause volatility in convertible bond prices and we’re happy to sort through the rubble trying to find a business that we believe is creditworthy and could have potential optionality. Since inception we have invested in over 30 converts and we are pleased with how they have contributed to our Portfolios’ returns. Levered loans and preferred shares are also large parts of the market that provide opportunities periodically. Having the flexibility to invest in all fixed income markets gives us a broader pool to fish in and increases the odds we find interesting investment ideas.

How do we navigate the uncertainty?

Knowing how to make money in different interest rate and credit spread environments is only part of the equation to running a fixed income portfolio with pleasing long-term returns. Avoiding losses is a crucial ingredient of our approach. A few good stock picks can cover up losses in a portfolio but bonds rarely provide that outsized return potential. Consistently earning a return on each investment is of the utmost importance.

Our approach helps me sleep at night because we haven’t been blindsided by unexpected events. The beauty of our investment approach is that it’s hinged on lending money to a business. Fixed income investing is often thought to be complicated. We find serenity in the fact that behind most of our bonds is a business. We can value a business by analyzing its margins, free cash and the durability of its competitive advantage. It is certainly not without risk, but we have a skillset at analysing the credit risks that we take. A business’ creditworthiness could deteriorate faster than we would have anticipated, but we have avoided many instances that resulted in permanent loss of capital.

The shutdowns that occurred globally in 2020 were one of the largest shocks that investors have experienced. Shutting down a leveraged business isn’t something that we had contemplated. If you or your customers aren’t open for business then you can’t possibly service your debt, which could quickly lead to an investment impairment. I think looking at our performance during this time period provides another example of the resiliency of our approach. Yet again, the actions that we took at the onset of COVID-19 helped position the portfolio for future success. We all hope that we don’t see a shock as unique as COVID-19 during the rest of our careers but rest assured that we will be prepared to act if we do.

EdgePoint fixed income returns vs. ICE BofA Canada Broad Market Index

Dec. 31, 2019 to Mar. 31, 2023

Annualized total return, net of fees (excluding advisory fees), in C$ as at March 31, 2023

EdgePoint Canadian Growth & Income Portfolio, Series F - YTD: 5.46%; 1-year: 6.47%; 3-year: 22.00%; 5-year: 8.96%; 10-year: 9.41%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 11.19%. ICE BofA Canada Broad Market Index - YTD: 3.04%; 1-year: -2.17%; 3-year: -1.74%; 5-year: 0.83%; 10-year: 1.87%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 3.38%.

See endnote iv for more information.

There are other managers that don’t think taking credit risk with a portfolio is prudent. They choose to take other forms of risk and the market is happy to provide opportunities for risk to the vast teams employed at many asset managers. Clients often ask us our opinion on asset-backed securities, emerging market debt and complex fixed income derivatives. Our answer often sounds like an interview with Charlie Munger, as we choose to say we have nothing to add rather than pontificate on markets that we chose not to participate in. We think the markets are challenging enough and do not want to introduce complexity risk into our investment portfolios.

There are many ways to make money in this world and we are of the firm belief that we can add value over time by focusing on what we do best. I rest well and so should our clients knowing that you won’t wake up one day and see losses from the latest emerging market default, G8 sanction activities or changes in inputs affecting derivative pricing models. Protecting capital starts with making sure we understand the risks that we’re taking and our approach has excelled at keeping it simple.

Since 2008, our fixed income portfolios have seen many different market environments. Interest rates and credit spreads provided many surprises, and we used our approach’s flexibility to take advantage of volatility and invest in areas of the market that were less followed by our peers. Our focus on risk management prevented any meaningful losses of capital that allowed us to achieve these returns:

EdgePoint Canadian Growth & Income Portfolio fixed income returns vs. Canada Broad Market Index

Annualized net of fees fixed income total returns since inception (local currency)

Annualized total return, net of fees (excluding advisory fees), in C$ as at March 31, 2023

EdgePoint Canadian Growth & Income Portfolio, Series F - YTD: 5.46%; 1-year: 6.47%; 3-year: 22.00%; 5-year: 8.96%; 10-year: 9.41%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 11.19%. ICE BofA Canada Broad Market Index - YTD: 3.04%; 1-year: -2.17%; 3-year: -1.74%; 5-year: 0.83%; 10-year: 1.87%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 3.38%.

See endnote v for more information.

That material outperformance didn’t come because we had boots on the ground in countless countries. Nor was it because our in-house economist was better at predicting the shape of the yield curve or from our AI-driven models. Our outperformance came from good old-fashioned credit work and our ability to generate proprietary insights about our businesses. It may not sound good on a TV commercial or glossy ad, but it sounds great where it counts – on your investment statement.

So…what’s next?

I suspect that clients will always want to know our thoughts on where the market is going. It’s a natural question to ask, but the answer is ultimately unknowable. The future is ultimately uncertain and investors need to embrace that. If there was true certainty, we would only ever be able to earn the risk-free rate and would fail in our goal to compound wealth. I sleep soundly at night knowing that we excel in uncertain environments. We have a robust investment approach that has worked in a variety of market environments. In the short term, there are bound to be periods of underperformance. Clients should be focused on our actions during those periods as that’s when we lay the foundation for our future performance. Our flexibility and focus on a singular investment approach will help us find ideas and our approach to risk management will keep us out of trouble.

Now is the time to look at your current fixed income portfolios. Have they lived up to your expectations? Are they robust or one-direction bets? I encourage all clients to look at our fixed income portfolios and join our team in getting a good night’s sleep.

EdgePoint Opportunistic Credit Portfolio, Series PF (Inception: Mar. 16, 2018): 7.05%

iShares US High Yield Bond Index ETF: 1.72%

EdgePoint Monthly Income Portfolio, Series F (Inception: Nov. 2, 2021): -2.31%

FTSE Canada Broad Market Index: -4.59%* Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. Excludes advisory fees.The following table contains hypothetical returns for the Growth & Income Portfolios’ fixed income performance. These returns aren’t investible. They’re a best-estimate of our Growth & Income Portfolios’ fixed income performance:Total annualized since-inception returns in C$ as at March 31, 2023

EdgePoint Global Growth & Income Portfolio – fixed income* (Inception: Nov. 17, 2008): 5.94%EdgePoint Canadian Growth & Income Portfolio – fixed income* (Inception: Nov. 17, 2008): 6.13%ICE BofA Canada Broad Market Index: 3.38%Annualized total return, net of fees (excluding advisory fees), in C$ as at March 31, 2023

EdgePoint Opportunistic Credit Portfolio, Series PF

YTD: 3.14%; 1-year: 6.30%; 3-year: 16.29%; 5-year: 7.10%; since inception (Mar. 16, 2018 to Mar. 31, 2023): 7.05%EdgePoint Monthly Income Portfolio, Series F

YTD: 2.38%; 1-year: 0.62%; since inception (Nov. 2, 2021 to Mar. 31, 2023): -2.31%EdgePoint Global Growth & Income Portfolio, Series F

YTD: 4.22%; 1-year: 5.79%; 3-year: 13.24%; 5-year: 4.86%; 10-year: 9.82%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 11.46%.EdgePoint Canadian Growth & Income Portfolio, Series F

YTD: 5.46%; 1-year: 6.47%; 3-year: 22.00%; 5-year: 8.96%; 10-year: 9.41%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 11.19%.iShares U.S. High Yield Bond Index ETF

YTD: 3.43%; 1-year: -3.73%; 3-year: 5.60%; 5-year: 1.83%; since inception (Mar. 16, 2018 to Mar. 31, 2023): 1.72%FTSE Canada Universe Bond Index

YTD: 3.22%; 1-year: -2.01%; since inception (Nov. 2, 2021 to Mar. 31, 2023): -4.59%ICE BofA Canada Broad Market Index

YTD: 3.04%; 1-year: -2.17%; 3-year: -1.74%; 5-year: 0.83%; 10-year: 1.87%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 3.38%.Source, ETF returns: Bloomberg LP. Total returns in C$. EdgePoint Opportunistic Credit Portfolio is only available by offering memorandum and as such, eligible investors must qualify before investing. Please see the Offering Memorandum (“OM”) for more details on EdgePoint Opportunistic Credit Portfolio. The iShares US High Yield Bond Index ETF is a market-capitalization-weighted ETF that provides exposure to a broad range of U.S. high yield, non-investment grade corporate bonds. The EdgePoint Opportunistic Credit Portfolio does not have an official benchmark. The ETF was chosen for comparison because it is representative of high yield corporate bonds consistent with the Portfolio’s mandate. The ETF is shown rather than the index it tracks because it is an investible product available to investors. The ETF returns are net of fees and based on market prices. As at March 31, 2023 the management expense ratio for the ETF is: 0.66%. ETFs are subject to tracking error relative to the underlying indexes they seek to track, this may cause performance to deviate from the underlying index. The ICE Canada Broad Market Index tracks the performance of publicly traded investment-grade debt denominated in Canadian dollars and issued in the Canadian domestic market. The indexes are not investible. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed-income comparability from the index.iii Source: FactSet Research Systems Inc. EdgePoint Canadian Growth & Income Portfolios fixed income holdings performance figures shown for illustrative purposes only and aren’t indicative of future performance. They aren’t intended to represent returns of an actual fixed income fund as they weren’t investible. EdgePoint Canadian Growth & Income Portfolio fixed income performance figures are net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). A hypothetical management expense ratio (MER) of 0.62% was applied to the EdgePoint Canadian Growth & Income Portfolios fixed income returns and prorated daily. The fixed income MER was calculated based on the average MER for EdgePoint Global and Canadian Growth & Income Portfolios (0.84% and 0.86%, respectively), relative to the EdgePoint Global and Canadian Portfolios’ MER (0.97%), then scaled to reflect the average fixed income weight of the Growth & Income Portfolios (35%). The ICE BofA Canada Broad Market Index tracks the performance of investment-grade debt publicly issued in the Canadian domestic market. The index is not investible. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed income comparability from the index.iv Source: FactSet Research Systems Inc. As at March 31, 2023. ICE BofA Canada Broad Market Index returns in C$ and EdgePoint returns in local currency. Both returns are total returns. The ICE BofA Canada Broad Market Index hit its lowest point following the COVID-19-related decline on March 26, 2020. EdgePoint Canadian Growth & Income Portfolio fixed income performance figures shown for illustrative purposes only and aren’t indicative of future performance. They aren’t intended to represent returns of an actual fixed-income fund as they weren’t investible. EdgePoint Growth & Income Portfolio fixed income performance figures are net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). A hypothetical management expense ratio (MER) of 0.62% was applied to the EdgePoint Growth & Income Portfolios fixed income returns and prorated daily. The fixed income MER was calculated based on the average MER for EdgePoint Global and Canadian Growth & Income Portfolios (0.84% and 0.86%, respectively), relative to the EdgePoint Global and Canadian Portfolios’ MER (0.97%), then scaled to reflect the average fixed income weight of the Growth & Income Portfolios (35%). The ICE BofA Canada Broad Market Index tracks the performance of investment-grade debt publicly issued in the Canadian domestic market. The index is not investible. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed income comparability from the index. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers.v Source, EdgePoint: FactSet Research Systems Inc. EdgePoint Canadian Growth & Income Portfolio fixed income holdings performance figures shown for illustrative purposes only and aren’t indicative of future performance. They aren’t intended to represent returns of an actual fixed income fund as they weren’t investible. EdgePoint Canadian Growth & Income Portfolio fixed income performance figures are net of fees and approximations calculated based on end-of-day holdings data (actual trading prices not captured). A hypothetical management expense ratio (MER) of 0.62% was applied to the EdgePoint Canadian Growth & Income Portfolio fixed income returns and prorated daily. The fixed income MER was calculated based on the average MER for EdgePoint Global and Canadian Growth & Income Portfolios (0.84% and 0.86%, respectively), relative to the EdgePoint Global and Canadian Portfolios’ MER (0.97%), then scaled to reflect the average fixed income weight of the Growth & Income Portfolios (35%). Source, index: FactSet Research Systems Inc. The ICE BofA Canada Broad Market Index tracks the performance of investment grade debt publicly issued in the Canadian domestic market. The index is not investible. Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed income comparability from the index.