A mea culpa to some Obvious Growers - 1st quarter, 2023

Many advisors consider a fund’s performance over a three-year period as an integral part of their investment decision-making process. This time frame is often used as a benchmark for evaluating a fund’s consistency and long-term performance. Obviously, we prefer our performance to be evaluated on a much longer time horizon, but nonetheless understand the importance of this figure. Fortunately, our three-year results across all of our prospectus Portfolios look quite pleasing on both an absolute and relative basis.i

Our absolute performance is driven by the capital appreciation and investment income of the businesses that we own. We think owning a collection of businesses is the best way to safeguard your hard-earned money from inflation and achieve your long-term financial goals. The problem with owning businesses, especially publicly traded ones, is that often their outlook and prospects can appear challenged. The ease of being able to sell a publicly traded business often leads to selling at inopportune times. At EdgePoint, we attempt to avoid these situations by taking a longer-term approach and capitalizing on this mistake that others frequently commit. This is no different than what any rational businessperson would do.

Three of a kind

Three years ago, which is the starting reference point for when many people are evaluating our investment performance, was one of these challenging periods – the physical economy was shutting down and in-person commerce and services ground to a halt. If our time horizon was within the immediate future, we would have been selling businesses and going to cash as fast as possible. Fortunately, our time horizon is much longer and three years is typically only the starting point for how far into the future we evaluate a business’s prospects. When you cast your gaze to the longer term, occasionally you can see how a business is going to look materially bigger in the future than it does today.

I want to take some time during this commentary to provide context and highlight some of the businesses over the last three years that were material contributors to EdgePoint Global Portfolio’s performance. While the results have been pleasing, I think what’s just as important is assessing the underlying ideas that gave us conviction to own these businesses during a challenging economic environment. In addition, now that we have the benefit of hindsight, we can evaluate if we were actually able to buy growth and not pay for it by comparing the current earnings power of the business to the prices we paid in early 2020.

Berry Global, Inc.ii

Berry is one of the largest packaging companies in the world. The business has proven its ability to grow through all points in the cycle as trends like convenience, health, safety and ecommerce propel the materials it produces to be consumed year-in and year-out. Even though certain products may have some cyclicality, the actual cash generation at Berry tends to be more counter cyclical. During slower economic periods, the prices of underlying raw materials that Berry purchases tend to fall faster than their selling prices, which leads to higher margins. The result is an incredibly stable and resilient cash flow profile through all points of the cycle that Berry can allocate to value-creating uses like opportunistic acquisitions or share repurchases.

Berry entered the COVID-19 period with a stretched balance sheet due to the fully debt-financed acquisition of one of its largest European competitors, RPC Group Plc. While Berry’s leverage level was optically high, we saw things a bit differently and used the pullback to make Berry a top-10 position. We had conviction in Berry’s ability to produce record amounts of free cash flow that would allow it to get to a more sustainable leverage level. More importantly, we saw the integration of RPC creating tremendous value, no different than Berry’s other 40+ acquisitions. We believed Berry would be able to increase share of wallet with both Berry and RPC’s legacy customers through scale benefits and innovation. In addition, we understood that combined cost structure of the consolidated entity, largely through procurement benefits, would materially increase Berry’s earnings power.

Over the past three-year period, Berry has been able to increase its earnings per share (EPS) by 60%, as it earned US$7.40 in adjusted EPS during the most recent fiscal year. Three years ago, Berry could have been purchased in the low-US$30s. This means purchases made during the end of March 2020 and beginning April 2020 were done at approximately 25% earnings yield on today’s business profitability. This is not bad (facetiously) considering Berry has proven an ability to grow at pleasing rates year-in and year-out!

CSX Corp.iii

CSX is one of the two largest railroads in the eastern United States. Given limited cost-competitive alternatives to shipping large products such as bulk commodities, railroads have proven to be very good businesses with pricing power typically exceeding inflation. Moreover, most railroads in North America have undergone an operating model shift. Historically, a train would run only when it was fully utilized. Under a railroading method pioneered by Hunter Harrison, CSX’s former CEO, the railroad operating model transitioned to one where trains run on a scheduled time. By operating on a set schedule, a railroad can decrease its operating costs. Scheduled railroading allows for greater predictability and less unproductive idling, which ultimately decreases labour, fuel and maintenance expenditures.

Entering the COVID-19 pandemic, CSX was towards the end of a multi-year transition to a scheduling railroad model and was set to benefit from the ensuing operating leverage. However, as a result of the cyclical nature of the underlying products CSX transports, the market had concerns on the near-term profitability of its rail network. Fortunately, given our ability to look out several years as opposed to quarters, we took advantage of the volatility and were able to buy CSX shares at about US$19/share. From the end of 2019 to the end of 2022, CSX was able to grow its EPS by 40%. Today, CSX’s earnings power is about US$1.90/share, meaning shares purchased three years ago were done at an attractive 10% earnings yield based on today’s business profitability. Unlike Berry, CSX doesn’t require significant capital to grow as the rail network has already been built out. This means shareholders get to benefit from both the earnings yield of the business and the underlying growth in earnings driven by pricing power above inflation.

Restaurant Brands International, Inc.iv

Restaurant Brands was a business that we opportunistically added to EdgePoint Global Portfolio during the onset of the pandemic after being a cornerstone position in EdgePoint Canadian Portfolio for many years. Restaurant Brands is one of our favourite business models – it’s a royalty company. As a royalty company, Restaurant Brands primarily makes money by earning a percentage of the sales from the underlying Tim Hortons, Burger King and Popeyes restaurants its franchisees operate. Just as importantly, Restaurant Brands doesn’t need to spend capital to grow as its underlying franchisees put up all the money for the privilege to manage a Restaurant Brands banner.

Three years ago, obvious market concerns allowed us to begin purchasing shares of Restaurant Brands in the low-US$30s. In 2022, Restaurant Brands earned over US$3 in EPS, implying our initial purchases in the EdgePoint Global and Global Growth & Income Portfolios three years ago were done at a 10% earnings yield based on today’s profitability. Despite the quick service restaurant industry being very mature, we see years of runway remaining in unit-growth opportunities at all of Restaurant Brand’s banners along with significant menu whitespace that can drive same-store growth.

Everything is obvious...in retrospect

Berry, CSX and Restaurant Brands all contributed to pleasing absolute returns for unitholders over the recent three-year time horizon. While all three underlying businesses were very different, they had an important similarity – each had non-obvious growth. Each business would be negatively impacted in the short-term by the stay-at-home trends that transpired, providing for an opportunity to buy growth and not pay for it.

In comparison, over the course of 2020, we became quite vocal on a swath of the market where valuations were not quite making sense to us. The characteristics underlying these businesses were exactly the opposite of where we were identifying investment opportunities – their growth was very obvious and the market was paying ever-increasing valuations for this growth. Given a lack of creativity on our part, you may have heard us refer to these businesses as the “Obvious Growers” such as in commentaries here, here and here.

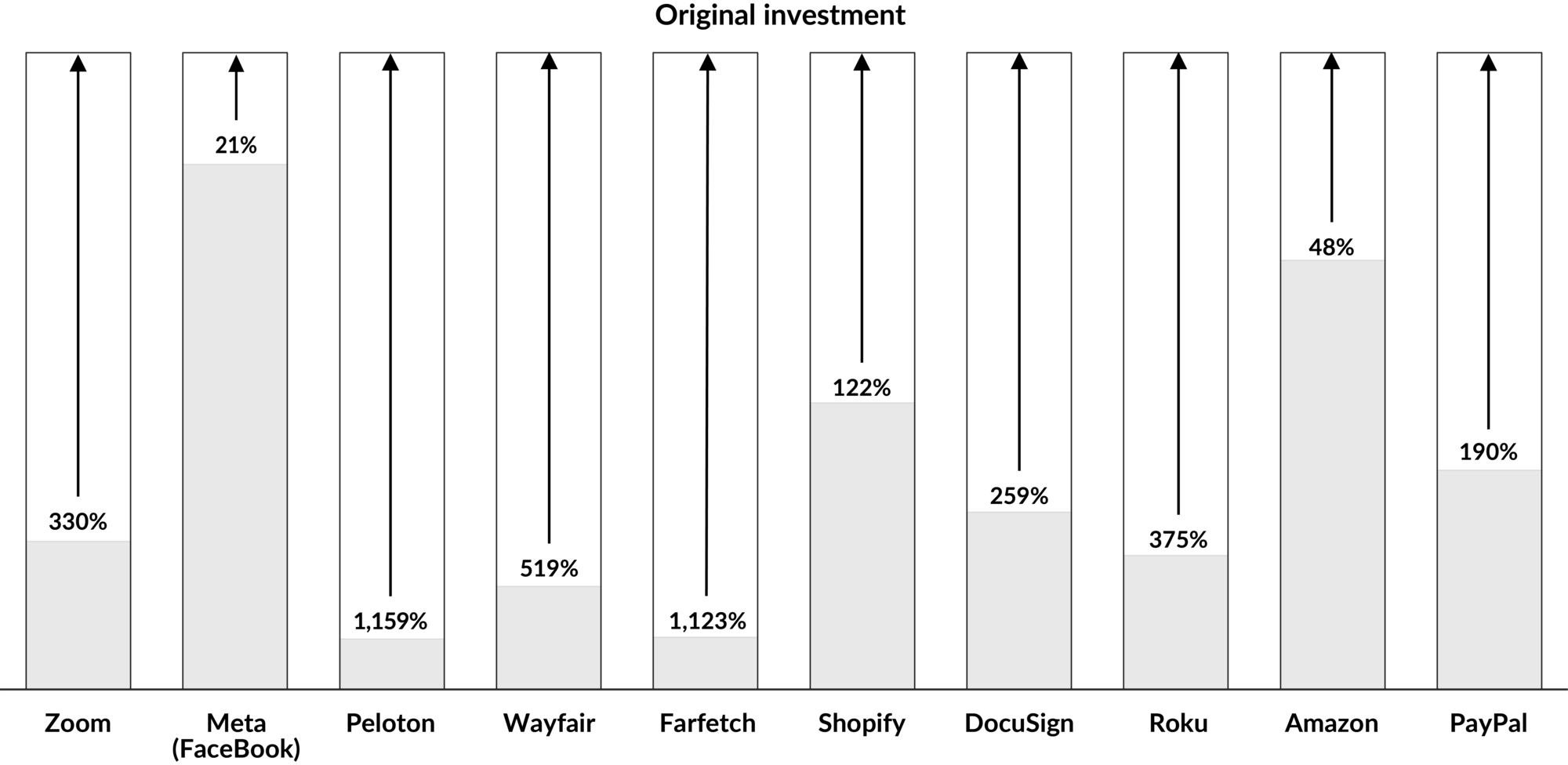

For the most part, an investment in the Obvious Growers didn’t work out well for investors. To illustrate, the following is a select list of Obvious Growers popular amongst investors in 2020. Throughout that year, these businesses could do no wrong as their growth appeared everlasting and they were on the right side of near-term trends. But unfortunately, the value of these businesses was negatively impacted by the culmination of underlying trends that proved to be more cyclical than structural, emerging competition and elevated valuations normalizing. The following chart illustrates the return required for an investment made into these businesses on December 31, 2020 to regain their original investment value based on the closing value on March 31, 2023.

Percentage return required for investments made into select Obvious Growers names on Dec. 31, 2020 to regain their original value

Dec. 31, 2020 to Mar. 31, 2023

Source: FactSet Research Systems Inc. In C$. Full names are Zoom Video Communications, Inc. Cl. A; Meta Platforms Inc., Cl. A; Peloton Interactive, Inc., Cl. A; Wayfair, Inc., Cl. A; Farfetch Ltd., Cl. A; Shopify, Inc., Cl. A; DocuSign, Inc.; Roku, Inc., Cl. A; Amazon.com, Inc.; and PayPal Holdings, Inc. The businesses were selected based on the popularity of their products during the work-from-home environment among general consumers and the positive effect that this popularity had on their respective stocks in 2020.

By avoiding this segment of the market, we were able to generate pleasing relative returns for our unitholders over the past three years. Unlike absolute returns, our relative returns are also a function of what we don’t own. To that extent, despite being very painful on a relative basis not owning these businesses in 2020, we feel vindicated. However, by no means consider this a victory lap. In fact, the commentary’s purpose is the opposite. Consider it a mea culpa of sorts…a mea culpa to certain Obvious Growers.

Looking back on the past three years, we missed some opportunities. And when we say missed, we don’t mean their share prices are significantly higher today than some time over recent history. There are many businesses that have seen their share price multiples rise despite little underlying progress on delivering core fundamental value for shareholders. Those companies shall remain nameless. What we want to profile are the businesses that have delivered phenomenal results while exceeding incredibly high expectations.

Tesla, Inc.

Tesla is a business that needs no introduction. You’re also probably rubbing your eyes right now as this is an EdgePoint commentary which is going to talk positively about Tesla, the poster child of Obvious Growth. However, we keep an open mind and give credit where it’s due. What Tesla achieved over recent years has been nothing short of remarkable. While growth appeared obvious given underlying electric vehicle demand, producing over a million electric vehicles profitably was far from obvious. Elon Musk and team have been able to successfully leverage scale economics without being encumbered by legacy costs and distribution. Tesla has capacity for nearly two million cars per year across only a handful of production facilities. About 95% of the vehicles produced are on the same platform (Model 3/Y) and there’s very little vehicle customization. This allows for the leveraging of fixed costs across high volumes and low operational volatility. In turn, over the last three years Tesla has not only achieved profitability but earns some the highest operating margins in the industry. It’s estimated that Tesla has a $10k per vehicle cost advantage versus traditional OEMs across battery, bill-of-material, distribution and advertising costs. Tesla earned US$3.60 in 2022 EPS with a net cash balance sheet. Three years ago, Tesla was trading for a split-adjusted price in the low-US$30s. This means Tesla shares could have been purchased at over a 10% earnings yield based on the business current profitability. Tesla is guiding for higher profitability in the near future as it has highlighted a number of cost-saving initiatives, along with improvements in its fixed-cost absorption from increased vehicle production at its new facilities in Germany and Texas. Further, these cost advantages are expected to support lower prices and grow Tesla’s addressable market.

LVMH Moët Hennessy Louis Vuitton

LVMH owns some of the most renowned brands in the world across leather goods (i.e., purses), jewelry, cosmetics, perfumes, champagnes and spirits. Replicating the prestige of these brands is very difficult as many have at least a century’s worth of history. As living standards increase, generally so does demand for luxury goods. In addition, the exclusivity of LVMH’s luxury portfolio allows it to raise prices. The combination of the above translates into LVMH being a very attractive business that grows and earns high returns on capital. During the onset of COVID, LVMH was facing considerable uncertainty. Just prior to the pandemic, the business approached luxury jewellery house Tiffany & Co. in a primarily debt-financed acquisition. While LVMH’s growth over the cycle appeared obvious, introducing peak leverage going into potentially one of the worst downturns on a highly discretionary luxury portfolio didn’t appear like a great opportunity. Now looking back, the business has really performed with the earnings power punctuated by the Tiffany acquisition. Over the past three years, the earnings power of LVMH doubled, and in 2022 it reported €28 in EPS. LVMH’s stock could have been purchased three years ago for the low-€300s, which based on today’s earnings power, appears very attractive.

Deere & Co.

Deere is what we consider a cyclical grower. Its main customers are industrial farmers whose spending habits on new equipment shift from year to year. However, Deere’s industry-leading install base of equipment coupled with a large service business and third-party distribution network, ensures that it generates free cash flow through all points in the cycle. Deere has historically reinvested a significant portion of its operating cash flow into R&D. Today, its R&D budget is more than twice its closest competitor, CNH Industrial N.V. This outsized investment spending has provided Deere with a large technological advantage that currently enables greater productivity for end farmers with Deere equipment versus its closest direct competitors, CNH and AGCO Corp. The productivity and efficiency gains enabled by Deere equipment provides it with pricing power. A strong agricultural cycle has incented farmers to spend on capital equipment, leading to Deere experiencing both pricing and volume growth in recent years. In turn, Deere earned slightly more than US$23 in EPS in 2022. This is more than double what the business earned three years prior. At that time, Deere shares could have been purchased in the low-US$130s, or 17% earnings yield. As we look towards the future, we see that Deere is in the process of meaningfully adjusting its business model and evolving into a higher-margin, less-cyclical company. It’s building a new revenue stream where precision farming equipment (automated and autonomous machines) will be sold through a subscription model (similar to streaming services), with farmers paying on a per-acre basis. The net effect is expected to be higher-margins, further pricing power and, since planted acres usually don’t change much from year to year, a more-stable revenue and earnings base.

Our promise to continue looking beyond the obvious

Tesla, LVMH and Deere are a non-exhaustive list. We have little variant view from here on these businesses, but we do believe it’s worth highlighting some of these companies as it keeps us motivated and inspired to identify the next ones.

Thank you for your trusted partnership. We hope from our frequent communications that you gain greater insight into our investment approach. Ultimately, we apply rational businessperson thinking day in and day out to ensure our portfolios are reflective of the best ideas amongst our 15-person Investment team. As you can see, we’re not going to get every idea and we will even make some mistakes along the way. However, we’re committed to our approach of having proprietary insights in the businesses we own and invest in and not paying for their growth. We have our money right along side yours. History suggests that over longer periods of time, aggregate results should be pleasing on both an absolute and relative basis.

EdgePoint Global Portfolio, Series F*: 15.76%

MSCI World Index: 14.46%EdgePoint Canadian Portfolio, Series F*: 31.72%

S&P/TSX Composite Index: 18.02%EdgePoint Global Growth & Income Portfolio, Series F*: 13.24%

60% MSCI World Index / 40% Canada Broad Market Index: 7.86%EdgePoint Canadian Growth & Income Portfolio, Series F*: 22.00%

60% S&P/TSX Composite Index / 40% Canada Broad Market Index: 9.91%

* Series F is available to investors in a fee-based/advisory fee arrangement and doesn’t require EdgePoint to incur distribution costs in the form of trailing commissions to dealers. Excludes advisory fees.Annualized total return, net of fees (excluding advisory fees), in C$ as at March 31, 2023EdgePoint Global Portfolio, Series F

YTD: 4.09%; 1-year: 5.05%; 3-year: 15.76%; 5-year: 4.74%; 10-year: 11.93%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 13.68%EdgePoint Canadian Portfolio, Series F

YTD: 7.36%; 1-year: 8.36%; 3-year: 31.72%; 5-year: 11.23%; 10-year: 11.16%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 13.21%.EdgePoint Global Growth & Income Portfolio, Series F

YTD: 4.22%; 1-year: 5.79%; 3-year: 13.24%; 5-year: 4.86%; 10-year: 9.82%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 11.46%.EdgePoint Canadian Growth & Income Portfolio, Series F

YTD: 5.46%; 1-year: 6.47%; 3-year: 22.00%; 5-year: 8.96%; 10-year: 9.41%; since inception (Nov. 17, 2008 to Mar. 31, 2023): 11.19%.The MSCI World Index is a broad-based, market-capitalization-weighted index comprising equity securities available in developed markets globally. The S&P/TSX Composite Index is a market-capitalization-weighted index comprising the largest and most widely held stocks traded on the Toronto Stock Exchange. The ICE Canada Broad Market Index tracks the performance of publicly traded investment-grade debt denominated in Canadian dollars and issued in the Canadian domestic market. The indexes are not investible. We manage our Portfolios independently of the indexes we use as long-term performance comparisons. Differences including security holdings and geographic/sector allocations may impact comparability and could result in periods when our performance differs materially from the index. Additional factors such as credit quality, issuer type and yield may impact fixed-income comparability from the index. ii As at March 31, 2023, EdgePoint Global Portfolio, EdgePoint Canadian Portfolio, EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Growth & Income Portfolio and Cymbria hold Berry Global, Inc. equity. iii As at March 31, 2023, no EdgePoint Portfolios or Cymbria hold any CSX Corp. equity or debt.iv As at March 31, 2023, EdgePoint Global Portfolio, EdgePoint Canadian Portfolio, EdgePoint Global Growth & Income Portfolio, EdgePoint Canadian Growth & Income Portfolio, EdgePoint Opportunistic Credit Portfolio and Cymbria hold Restaurant Brands International, Inc. equity.